High-Risk Merchant Account Service Specialists

Last Updated on January 3, 2024 by Corepay

The term high-risk merchant account refers to a merchant account or (MID) for businesses that accept credit cards but are considered risky by banks and credit card processors. If you’re looking to to find a high-risk merchant account or simply learn more about them, we’ve got you covered.

Getting Started:

- High-risk merchant accounts are for businesses that are risky for traditional banks and processors

- Corepay offers over two decades of high-risk payment processing experience with extremely competitive pricing

- Maximizing approval rates is a must for high-risk merchants

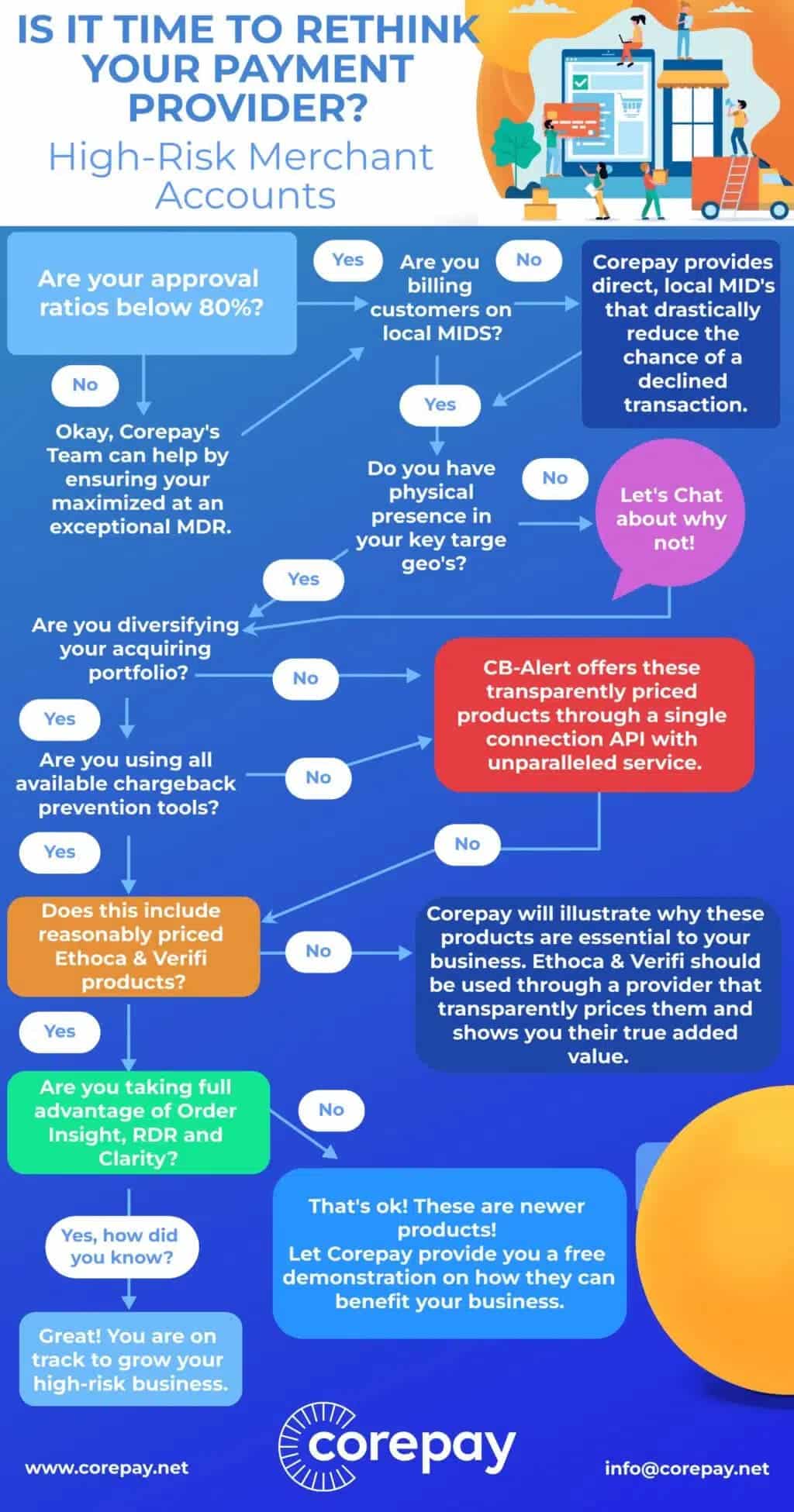

Looking for a high-risk merchant account? Below is an infographic to make sure you’re getting the most out of your payment provider in 2024, as a lot has changed over the years.

So, why are high risk merchant accounts considered risky? High risk merchant accounts are considered risky for the following reasons:

- Chargebacks

- Reputational issues

- Legal regulations

- The industry you operate within is risky for banks and processors

Get Your Pre-Approved High-Risk Merchant Account Today

Corepay is dedicated to serving many different high risk industries, with most of our clients coming from:

- Adult entertainment

- Online dating

- Ecommerce

- CBD

- Vaping

- Medical

- Crypto

- Fantasy

- Subscription

- Pharmacy

- Health and beauty

Corepay offers the following for its highrisk businesses:

Applying For Your High-Risk Merchant Account Services

At Corepay, we make the application process a breeze. Below are the following things you will need when applying:

- Certificate of incorporation

- A voided check, or other proof of bank accounts such as a signed bank letter or barring that, your bank’s routing number and your bank account number

- Personal and business financial history

- Organizational chart

- Any licensing numbers and the name of the organization that granted the license

- Six months of processing statements, if applicable

- A compliant website, (stipulating terms and conditions, including refund policy)

What Are High-Risk Merchant Accounts?

A high risk merchant account is a business bank account in which a merchant can access their funds. They are difficult to obtain due to the risks banks and processors take with each account.

Your business may need a high risk MID merchant account if any of the following are true:

- Your bank thinks they’ll take a loss on your account due to your personal credit or your company’s financials. They don’t want to spend more time and money dealing with your account than they’re going to make.

- You have gotten, or will get, a high number of chargebacks – You should try to avoid chargebacks, to begin with, but if you’re a low-risk merchant who suddenly gets a lot of chargebacks, you can get bumped to a high risk account.

- Your industry regularly has a high number of chargebacks. For example, subscription services, especially those with free trials, get a lot of chargebacks. When a free-trial user forgets to cancel their membership before the trial ends and gets charged for the first month, they’ll often issue a chargeback rather than admit they were negligent.

- Your business or industry has a reputation of being risky and could damage the bank’s reputation. Things like gambling, adult entertainment, or CBD all make banks a little nervous about how their customers will see them.

- You sell “future deliverable” products. Hotel rooms, plane tickets, event tickets, and other reservation-based items.

- Your product or service has a long chargeback liability period. For example, if you sell annual memberships, your customers can issue a chargeback up to six months after the end of the service date. You may charge them on January 1, 2021, for an annual membership, but they have until July 1, 2022, to issue the chargeback.

- You have a poor past history with other merchant accounts in general. because you’ve been dropped, labeled high risk, or generally had problems with your processor.

- You have been on the Terminated Merchant File (TMF) or Mastercard Alert to Control High risk Merchants (MATCH) list. If you previously owned a business that made one of these lists, your next business is considered high risk.

Countries We Service

We are a registered ISO in Europe and in the United States, giving us access to servicing the following countries:

- Albania

- Andorra

- Armenia

- Austria

- Azerbaijan

- Belarus

- Belgium

- Bosnia and Herzegovina

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kazakhstan

- Kosovo

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Moldova

- Monaco

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

- United States Of America

- Vatican City

How Does Having A High-Risk Merchant Account Affect You?

Being labeled high risk doesn’t mean you can’t accept payments. It just means you have to meet certain requirements, and or pay extra in terms of fees in order to keep the processors and banks happy.

You may pay a higher percentage in processing fees. (Be sure to factor this into your ROI.) Or you may have to keep extra money in a reserve account in case of chargebacks.

A reserve account is a sub-account attached to your own merchant account where a portion of your credit card sales are kept in order to cover any chargebacks and credit card disputes you might be hit with.

For example, some industries are more prone to identity thieves using credit cards to make purchases, like e-commerce electronics sites or electronics retail stores, especially if they offer “buy online, pick up in-store” (BOPIS) options — they’re prone to return fraud.

Credit Needed For A High-Risk Merchant Account

On average, you will need over a 550 credit score to obtain a high risk merchant account. With this being said, you can still get approved should you have a cosigner that has better credit involved in your business.

High Risk VS Low-Risk Merchant Accounts

Below you will find the differences between low-risk merchants and high risk merchants.

Pros Of Going High-Risk

While it may cost more to have a high risk merchant account, there are some serious perks as well:

- Companies that have financial difficulties or bad credit can still process credit cards and accept payments, which can help them recover and get back to being profitable.

- Low-risk merchant processors won’t touch certain kinds of businesses at all.

- There’s increased protection from fraud and chargebacks. Since high risk businesses are labeled as such because of the risk of chargebacks, their payment processor and issuing bank take extra precautions to protect themselves against chargebacks.

- When hit with a lot of chargebacks, you’re less likely to lose your merchant account over it. (Still, try and avoid a lot of chargebacks.)

- You can earn more money because high risk accounts may mean you are in an industry that involves high-profit margins.

- A reserve account will protect you against surprise chargebacks. It may be a pain to have one, especially if you have to wait for as long as 180 days after account closure before you get your money, but at least the funds are there as the last line of defense, and the bank understands this.

- You have global coverage, which means you can sell your products and services almost anywhere in the world. High risk payments service providers are used to a global outlook on payments and have the technology in place to help you grow.

Cons Of High Risk Merchant Accounts

- You’ll pay more for merchant fees and services. You can expect to pay fees that are higher than traditional processing fees.

- You have a rolling reserve account which can be as much as a cap of 50% of the approved monthly volume. Depending on your issuing bank and your payment processor, your rolling reserve can be held up to 180 days post merchant account closure.

Do Paypal Stripe And Square Deal With High-Risk Businesses?

No, they do not. If Paypal determines at any point that your account is high risk, such as CBD or Online Dating they can choose to terminate your account.

It may be easy to get one of these accounts up and running, but they also usually end quickly, with funds held for at least 180 days post account closure.

Corepay specifically works with high risk businesses and understands the risks associated with these industry types.

High-Risk Merchant Account Fees

While rates vary from one provider to the next, it is important to note that high risk merchant accounts are often significantly more expensive than low-risk merchant accounts.

Generally speaking, should you be deemed high risk, you will typically pay more than those who are low-risk for similar services.

At Corepay, we understand this and truly aim to do our part when it comes to costs; such as waiving setup fees/application fees, and early termination fees.

Below are the merchant accounts fees you can expect to see when applying for a high risk account:

Setup Fees

Regardless of whether you’re a high risk or low-risk merchant, you may have to pay to set up your merchant account.

But high risk merchants need to pay more than regular merchants. Corepay does not charge application or setup fees.

Early Termination Fee

You pay this fee when you’re setting up your account, but it’s the payment made if you end your contract early. It’s sort of like a cell phone termination fee, but you pay it up front.

This fee can be waived by your processor. You shouldn’t be extorted into loyalty; a good processor will earn it.

Discount Rates

This is typically done as a flat rate/blended merchant discount rate (MDR) or as a pass-through mechanism referred to as Interchange Plus (ICC+) pricing.

The former model, MDR is the easiest pricing method to forecast expected processing costs as a simple percentage of turnover.

However, some “less honest” processors hide costs, or pad interchange fees, making it difficult to determine what you are paying for.

On the other hand, the Interchange Plus pricing model, is a truly transparent pricing model, which shows just how much the processor is making off you as profit.

This assumes that the majority of the processor’s costs are related to interchange (card scheme hard fees to banks/processors) and then adds value to create profitability.

Longer Contracts

This is typically a point of negotiation, however, it’s not uncommon for providers to require at minimum, 3 years of service.

Authorization Fees

When you attempt to process a transaction, there is an authorization (auth) fee to first confirm the validity of the transaction.

If the cardholder information is valid, and the issuer allows the transaction to process, the transaction then enters the “settlement” phase.

If the transaction fails due to any number of reasons (maximize your conversions), this fee is still charged, even as a declined transaction.

Again, the key for merchants is in understanding the many different interchange rates and how to reduce their processing costs as much as possible for their industry type.

Settlement Transaction Fees

This is charged for approved transactions, in addition to the previously discussed transaction fee. Some banks may not impose a separate authorization and settlement fee, instead bundling them.

However, it is often advantageous for high risk merchants to separate the costs and not pay exorbitant processing fees for declined transactions.

Chargeback Fees

You get hit with chargeback fees (and refunds) when you get hit with chargebacks. And you get charged with them as soon as a dispute chargeback is filed.

You still get to defend yourself and prove that you’re in the right, to recover the lost revenue but you’re you’re still stuck with the chargeback fee that will not be reimbursed to you.

So it’s best to prevent the dispute from happening in the first place, and if it does arise, fight your chargebacks and recover your lost revenue

Non-compliance/Penalty Fees

These are the fees assessed if you violate your payment processing contract.

For example, if you don’t follow PCI compliance standards or use an EMV compliant processing machine you could be hit with non-compliance fees for failing to follow the payment processor’s contract.

This could even get you blacklisted by your processor, which makes it harder to get an account with another processor.

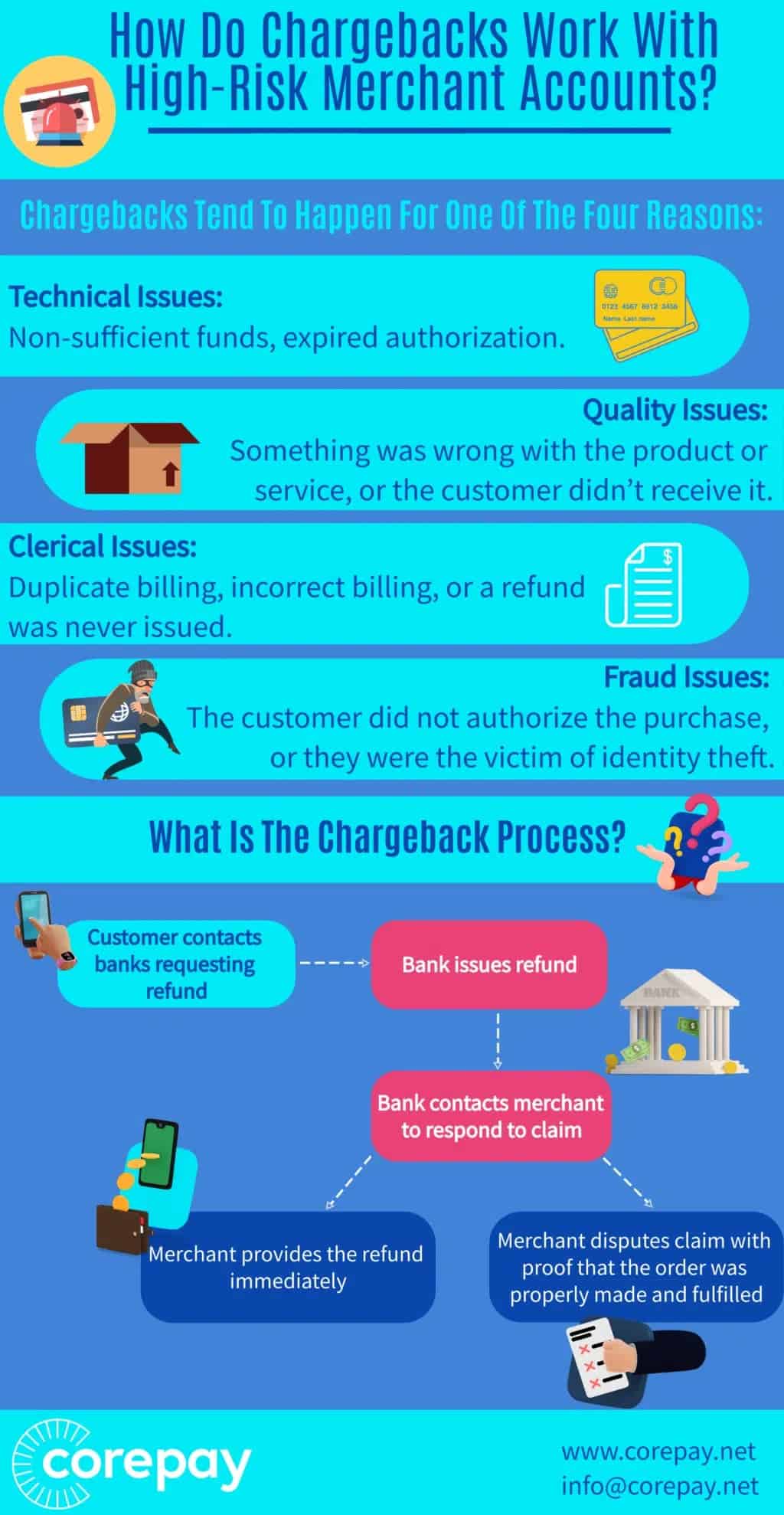

How Do Chargebacks Work With High Risk Merchant Accounts?

Chargebacks tend to happen for one of four reasons:

- Technical Issues: Non-sufficient funds, expired authorization

- Quality Issues: Something was wrong with the product or service, or the customer didn’t receive it.

- Clerical Issues: Duplicate billing, incorrect billing, or a refund was never issued

- Fraud Issues: The customer did not authorize the purchase, or they were the victim of identity theft. Also called “malicious fraud.” The customer committed friendly fraud, and lied about quality issues or clerical issues. Says they didn’t receive a shipment or it was damaged.

When a chargeback happens, the customer calls the bank, gives a reason for wanting a refund, and the bank issues the refund.

The bank then contacts the merchant and gives them a very small window of opportunity to respond to the claim.

The merchant can either give a refund immediately or if they believe the chargeback was made in error or as a result of fraud, they can dispute the chargeback and show the bank that the purchase was correctly made and properly fulfilled.

Both Visa and MasterCard now have programs that help merchants fight friendly fraud and unknown errors.

A customer can call their bank, and order Insight by Verifi (a Visa company), or Mastercard’s Ethoca will provide transaction information in real-time.

The customer service representative can confirm a purchase, which may remind the customer that they did in fact buy the item in question.

Or they can require that the customer contact the merchant directly, which helps certain businesses, like restaurants that made a quality error on the delivery order.

Corepay Is Here For You

Finally, Corepay can help businesses get approved for your high risk merchant account where other processors simply cannot.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].