Travel Merchant Accounts – Payment Processing For Travel Businesses

Last Updated on July 7, 2023 by Corepay

Merchant accounts for the travel industry can sometimes be challenging to properly understand. Having reliable payment processing will be crucial moving as the world begins to reopen for travel after COVID-19.

In 2019, the travel industry had reached a market cap of an impressive 9.25 billion dollars globally. While COVID-19 severely impacted it in 2020, the travel industry is starting to come back alive, and it is expected to continue growing come 2022.

Payment processing for the travel industry is slightly different from other industries as many business models can be considered “travel.”

Travel merchants need to know that travel merchant accounts are often considered high-risk by banks and processors when searching for payment processing.

While the travel industry is worth trillions, it bleeds about $25 billion dollars annually due to frequent chargebacks and fraud. Chargebacks will occur more frequently in specific areas of the travel industry.

Because of this, you should find a high-risk credit card processor that understands the ins and outs of the travel industry.

This article will be taking an in-depth look at travel merchant accounts and offering our advice and why we at Corepay think we would be a perfect partner for your travel business.

Travel Merchant Accounts For All Businesses In The Travel Industry

At Corepay, we are proud to offer over two decades of high-risk credit card processing experience to your travel business.

The travel business has greatly benefited from technological advancements and the widespread use of electronic payments. Providing reliable payment processing to your customers is the cornerstone to successful travel businesses.

Having a high-risk travel merchant account makes it easy for customers to pay over the phone, online, or even in-person at a retail store. Should you choose a high-risk credit card processing solution such as Corepay, you will be able to accept payments globally as well.

At Corepay, we offering travel merchant accounts for the following:

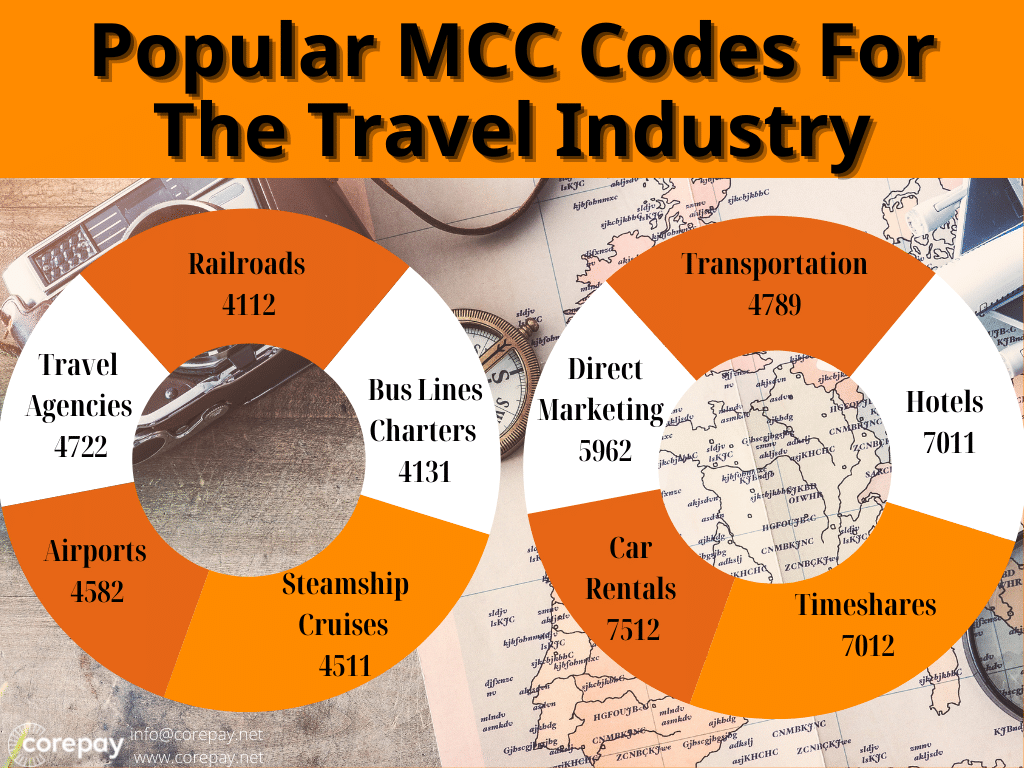

Some popular travel industry MCC codes include:

Now that we have established that travel merchant accounts are high-risk, let’s take a look at what makes them high-risk.

Most businesses in the travel industry listed above are dealing with high-ticket transactions frequently. A high-risk payment processing solution for these types of companies is vital.

Before we get into what exactly makes travel businesses deemed high-risk by banks and processors, let’s take a look at what we can offer you at Corepay.

Why Choose Corepay For Your Travel Merchant Account

Are you looking to boost your revenue for your travel business? You’ve come to the right place for your payment processing. Travel merchants in the US and worldwide can use our payment processing to boost their revenue, fight chargebacks, and grow their business to the next level.

At Corepay, we genuinely care about your travel business and understand the importance of reliable payment processing. To keep your fees as low as possible, we waive all application fees, annual fees, and set up fees.

The following are we offer all for all of our travel merchant accounts:

Applying For A Travel Merchant Account

Before accepting payments, you will need to apply for your merchant account. We make applying for travel payment processing as seamless as possible, and we will walk you through the entire process.

Upon filling out an application, a trained specialist will reach out to you and let you know the following steps to take to get your merchant account up and running.

When applying for a travel merchant account, the more information you can provide, the faster we can get you approved and processing transactions.

While good credit helps keep your fees at a lower price, getting approved for a merchant account with poor credit is possible.

We strongly urge you to compare rates with other high-risk processors when applying for your merchant account, and we are confident in our rates, service, and expertise.

Below you will find some tips and things you will need when applying for a merchant account.

Some tips that you can share when applying for a merchant account include:

When payment processors do their underwriting, they will determine the level of your risk based on all of the information you provide them. The more information you can provide, the better for your business.

Why Are Travel Merchant Accounts High-Risk?

They are considered high-risk for a few different reasons, but the biggest reason is that the industry is susceptible to many chargebacks. As mentioned above, the travel industry experiences roughly 25 billion dollars per year from fraud and chargebacks.

The following are reasons why you will need a high-risk merchant account:

Travel Industry Chargebacks

With businesses such as Air BnB’s and timeshares, chargebacks are expected. Most of these transactions occur via apps through computers or mobile devices, resulting in card-not-present transactions or CNP.

CNP transactions have a far better chance of resulting in chargebacks, especially in the travel industry when purchases can be rather large.

Travel businesses need to be aware of their audience and study how they navigate their website/apps. Having an understanding of what your customers are looking for from your business can help you keep your chargebacks to a minimum.

At Corepay, we will set you up with anti-chargeback tools and show you how to monitor your chargebacks, ultimately keeping your monthly fees as low as possible.

Our partner product, CB-ALERT, can be implemented easily in your business and will significantly help reduce chargebacks.

Should you be looking for ways to keep your chargebacks in the travel industry to a minimum, you should do the following:

High Ticket Transactions

The travel industry is expensive. This means that when a cardholder files a dispute, the bank and processor could be hit with a hefty chargeback.

If your business offers goods/services for over $50, you will likely be deemed high-risk, and it will be 100% in your best interest to keep your chargebacks at a minimum.

Purchases In Advance

Most travel purchases occur months in advance. The problem with this is that this leaves customers months to come across a problem that results in a dispute. With friendly fraud being rampant in the travel industry, a customer could end up having another event fall on the same date as a planned travel trip and file a dispute.

Stating company policies clearly can help mitigate some of the risks here, but finding yourself dealing with situations similar to this is inevitable.

During COVID-19, the travel industry was hit extremely hard as many planned trips were canceled, leaving customers looking to be fully reimbursed.

Bankruptcies

Banks and processors know that the travel industry can experience bankruptcies frequently, which ultimately leads to an added concern with potentially higher fees.

Providing a business growth plan at the time of an application can help ease the concerns of processors in this instance.

Travel Merchant Account Fees

As travel merchants are considered high-risk, they will usually have to pay more in fees to cover the additional risks related to the nature of their business.

With this being said, fees drastically vary from processor to processor, so be sure to do diligent research and compare.

Some of the fees that travel merchants will likely experience are:

Travel Industry Overview

The biggest earner in the travel industry in 2019 was Expedia by a landslide, with over $99 billion in sales.

While airlines are highly profitable, some travel agencies have earning potential that is unparalleled, especially moving forward with a growing demand for travel.

The top five earners in the travel industry are currently:

To put this in perspective, Delta Airlines was the most profitable airline in 2019, with $47 billion in profit.

Currently, the United States accounts for the largest share of the market, with over $2.9 trillion dollars in 2019.

Choosing The Best Payment Processing For The Travel Industry

Payment processing decisions are always difficult. When searching for payment processing, be sure to compare rates, chargeback solutions, and industry knowledge from each processor before making a decision.

Fees can vary greatly, and certain processors will specialize in specific industries.

At Corepay, we understand precisely what travel businesses should be focusing on, as well as what it takes to grow your business to the next level.

Choosing a payment processor with 24/7 customer service is vital for any travel business since you are operating in an industry prone to high chargebacks.

We also recommend picking a processing company that understands the specific needs of your travel business, as not all companies will need the same solution.

Paypal/Stripe/Square For Travel Merchant Accounts

All three of these payment processors offer excellent service; however, they don’t do high-risk accounts. Businesses in the travel industry are deemed high-risk and should find a high-risk processing solution.

The biggest problem with using Paypal is that they don’t do their underwriting at the time of the application. This means that you could have your Air BnB processing payments through Paypal for up to 6 months before they audit your account.

Upon the audit, they could deem your business high-risk and freeze/terminate your merchant account. Our best advice is to fill out an application and speak with other high-risk processors and us immediately if this happens to you.

Paypal can legally hold your funds for up to 180 days with no questions asked. Unfortunately, there isn’t much you can do once they put your account on hold, and you won’t be able to access your funds.

The most important thing to do in a situation like this is to quickly get another merchant account that is reliable up and running to mitigate the damage of having your funds frozen.

Wrapping Up

Whether you’re a business specializing in lodging, vacation packages, Air BnB’s, or cruises, Corepay is here for your payment processing needs. We understand what goes into getting your travel business approved, and we will also make sure you stay approved.

As the economy bounces back and travel begins to pick back up, having reliable payment processing will be essential. Fill out an application with Corepay today to see what we can provide for your travel business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].