Visa Integrity Risk Program April 1 – VIRP

Last Updated on April 26, 2024 by Corepay

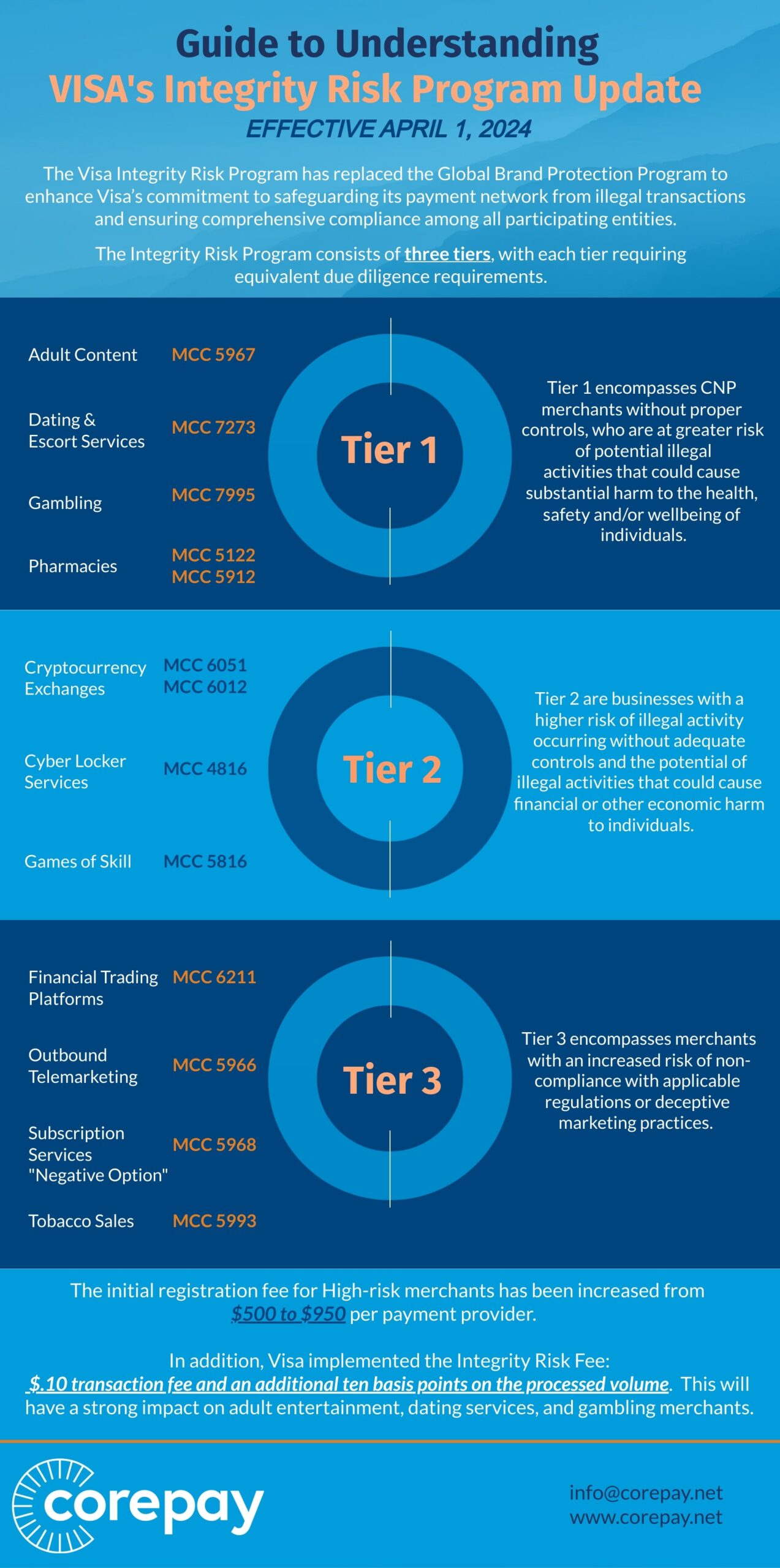

The updated Visa Integrity Risk Program went into effect on April 1, 2024, completely changing the high-risk payments landscape for many merchants. While this was announced in April 2023 as the replacement to the Visa Global Brand Protection Program, high-risk merchants need to be aware of the changes made on April 1, 2024.

In a nutshell, these changes crack down heavier than ever on the bad actors in the high-risk space while also making things a bit tougher for those who are playing the game fairly.

If you operate in the following industries, you can expect additional scrutiny from your payment processor/acquiring bank, as the VIRP has cracked down significantly in both the US and Europe:

- Adult, online dating/escort, pharmaceuticals including weight loss/peptides, CBD, vape, and online gambling.

What High-Risk Merchants Need To Know About The Visa Integrity Risk Program

- High-risk merchants are classified as High Integrity Risk Merchants and are categorized into three tiers based on business type and risk level.

- Acquirers sponsoring high-integrity risk merchants must undergo control assessments to ensure proper oversight and control processes. To cover the risk associated with these types of merchants, acquirers may charge considerably higher fees than previously.

- Adult, dating/escort, gambling, and pharmaceutical merchants face the most scrutiny and are classified as tier 1 under the VIRP.

- Visa and Mastercard require all pharmacies and telemedicine providers that process card-not-present transactions to be certified and monitored by an approved certification organization, such as LegitScript.

- VIRP imposes higher registration fees for high-risk merchants, increasing from $500 to $950.

- The VIRP program includes registration fees, transaction fees, and adjustments to cover operational costs and prevent illegal transactions in specific merchant categories.

- VIRP replaces the GBPP and focuses on integrity risk rather than brand risk.

- Getting approved as a High Integrity Risk Merchant has never been more challenging, and merchants must show they run a legitimate business.

VIRP VS Visa Global Brand Protection Program

VIRP ensures that Acquirers and their designated agents uphold stringent controls and oversight mechanisms to reduce the number of illicit transactions in the Visa Payment System.

One major change is that the VIRP imposes higher registration fees for high-risk merchants, increasing from $500 to $950. This shift reflects Visa’s commitment to maintaining a secure and trustworthy payment ecosystem.

Three Tier Levels for High-Integrity Risk Merchants (VIRP)

Under the Visa Integrity Risk Program, there are three distinct tiers for High Integrity Risk Merchants.

Each tier mandates specific control measures to mitigate potential illegal activities.

Tier 1

Let’s look at the changes and additional requirements for each industry that’s landed in tier 1. Below is not a complete list of the requirements, as we’ve trimmed it to make it easier to digest. When applying for processing, we will provide you with the extensive requirements.

As you would assume, Tier 1 labeled businesses face the most scrutiny. These businesses are companies that could harm individuals’ health, safety, and well-being.

The industries that are deemed tier 1 are:

- Adult, dating/escort services, online gambling/sports betting, and pharmaceuticals/weight loss.

Adult: MCC 5967

- Acquirers must regularly review their Merchants’ website content to ensure compliance with the law, Visa Rules, and VIRP guide.

- Merchants are prohibited from promoting or allowing search terms that suggest child exploitation or non-consensual activities on their websites.

- Merchants must establish a complaint process for reporting illegal or rule-violating content, resolving complaints within seven business days, and promptly removing illegal content while notifying their Acquirers.

- Merchants must offer an appeals process for individuals depicted in content to contest lack of consent claims, ensuring consent was obtained appropriately or removing content if consent cannot be verified.

- Merchants must provide monthly reports to their Acquirers detailing flagged content, complaints, and takedown requests, which Acquirers must share with Visa upon request.

- Merchants must not attract website users using illegal adult content or violating Visa Rules.

- Merchants must comply with age verification laws and ensure viewers meet age requirements before accessing content.

- Merchants must implement effective policies prohibiting website use that promotes or facilitates human trafficking, sex trafficking, or abuse and are encouraged to participate in anti-trafficking organizations.

- Acquirers must be capable of providing the necessary documentation to demonstrate compliance with VIRP requirements.

Dating/Escort Services: MCC 7273

Acquirers engaging with dating and escort service providers and related advertising services are entrusted with ensuring the legality and regulatory compliance of such merchants’ operations. To fulfill this responsibility, acquirers soliciting activity from dating and escort services must adhere to the following:

- Conduct Website Analysis: Acquirers must thoroughly scrutinize the Merchant’s websites to ascertain that the services described and rendered are lawful.

- Validate Jurisdictional Compliance: Merchants can only operate within jurisdictions where such services are legally permissible and conducted in adherence to all relevant regulatory and licensing stipulations.

- Combat Human Trafficking: Acquirers are obligated to ensure that the Merchant has \measures in place to combat sex trafficking.

- Prevent Underage or Non-Consensual Participation: Acquirers must assess the Merchant’s controls to deter any involvement of underage individuals or individuals who have not consented to participate in the services offered.

- Prohibit Illegal Advertising: Acquirers must verify that the Merchant refrains from advertising services that contravene the law or are inherently illegal.

Gambling: MCC 7995

While gambling operations are legal in certain regions, they face regulations or outright bans in others, necessitating careful adherence to legal and ethical standards. To ensure compliance with Visa Rules and associated requirements, gambling transactions must satisfy the following criteria:

- The Merchant must possess a valid license or appropriate authority as mandated by the jurisdictions in which they operate. Acquirers must retain documentation of this authorization and furnish it to Visa upon request.

- Transactions must comply with all pertinent laws and regulations, including age restrictions, location-based regulations, self-exclusion protocols, and anti-money laundering statutes.

- Card-absent gambling transactions must be categorized with MCC 7995, irrespective of whether gambling constitutes the Merchant’s primary business.

- The homepage or payment page of card-absent gambling merchants must prominently display specific information in line with Visa Rule ID#0008635, including:

- A disclaimer regarding the potential illegality of internet gambling in the user’s jurisdiction.

- Acknowledgment of the cardholder’s responsibility to understand relevant laws.

- Prohibition of participation by individuals below the legal age.

- Comprehensive rules of play, cancellation, and payout policies.

- Recommendation for cardholders to retain transaction records and merchant policies.

- Inclusion of an Acquirer numeric identifier.

Pharmaceuticals/Weight loss: MCC 5122, 5912 (These merchants must be Legit Script certified.

Online pharmaceuticals and weight loss merchants are on the rise, and with them have come many bad actors. VIRP aims to put a halt by implementing the following:

Payment processors ensuring:

- The Pharmacy holds required licenses in all operating jurisdictions.

- It ensures the distribution of prescription drugs only where legally allowed.

- It prevents exporting prescription drugs across jurisdictions where prohibited.

Tier 2

Tier 2 is for businesses that could cause financial harm. While tier 2 doesn’t face as much scrutiny as tier 1, these industries are still extremely risky from a payment processor/acquiring bank perspective.

The following are considered tier 2:

- Crypto trading platforms: MCC 6051, 6012

- Online storage services: MCC 4816

- Skill-based gaming: MCC 5816

Tier 3

- Tier 3 is for companies at a higher risk of non-compliance, such as trading platforms, telemarketing, negative option billing, and even tobacco sales.

Registration Fees

Initial registration fees have increased from $500 to $950, a substantial rise that reflects additional operational costs for merchant review and registration.

Furthermore, Visa has introduced an Integrity Risk Fee. This new fee includes a fixed charge of 10 cents per transaction and an additional ten basis points added to the volume of transactions processed. This fee applies specifically to merchants in specific category codes.

Transaction Fees

Below is a quick look at what you can expect for fees under the Visa Integrity Risk Program.

1. Visa Integrity Risk Fee: This fee is a new addition targeting specific high-risk merchants. It consists of a fixed charge of 10 cents per transaction and ten basis points applied to your processed volume.

2. Application to Specific MCCs: These fees apply to specific Merchant Category Codes (MCCs), such as adult entertainment, online gambling, and dating services.

3. Passing on Fees: Acquirers usually pass these fees onto merchants. So, expect your costs to increase if your business falls under the targeted MCCs.

Role of Payment Processors

Payment processors are instrumental in managing high-risk fees, serving as intermediaries between merchants and payment networks. We meticulously assess high-risk merchants for legal compliance and industry standards while aiding in implementing advanced fraud prevention measures to minimize chargeback rates.

Fees pose significant challenges for merchants, notably smaller businesses. Collaborating with an experienced and dependable payment processor is essential for comprehending the expenses associated with your company and leveraging their expertise to mitigate costs effectively.

Choosing a payment provider that understands the new regulations is crucial. While you may see your payment processor as the enemy, it’s important to note that they are taking on a lot of risk by boarding your business, especially under the VIRP.

At Corepay, we aim to help you grow your business to the next level, regardless of your industry. For the last two decades, we have been taking on risk and working with high-risk merchants, and nobody understands the high-risk field quite like us.

Closing Thoughts

While the game is changing, it remains highly profitable for those willing to do it correctly. If you’re considered a High Integrity Risk Merchant, you must take every measure to ensure your business is fully compliant and you will need to find a payment processor who has the appetite to still board your industry during this turbulent time.

At Corepay, we can assist and take your company to the next level, provided you operate under the latest VIRP guidelines.

Please fill out the application below and find out what Corepay can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].