Telemedicine Merchant Accounts – Get Yours Today

Last Updated on April 5, 2024 by Corepay

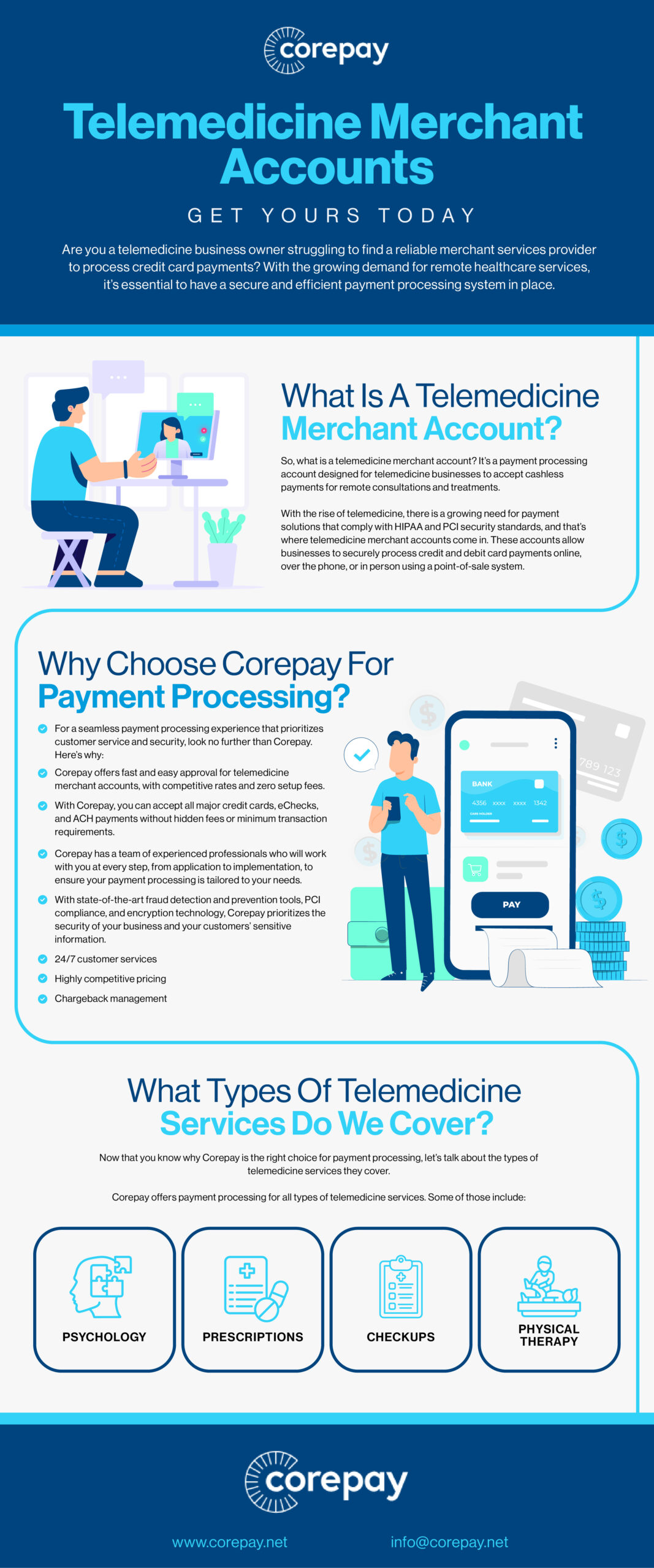

Are you a telemedicine business owner struggling to find a reliable merchant services provider to process credit card payments? With the growing demand for remote healthcare services, it’s essential to have a secure and efficient payment processing system in place.

Key Takeaways

- Corepay offers credit card processing solutions for telemedicine businesses, leveraging relationships with credit card processors and sponsor banks and integrating chargeback and fraud prevention software through our partner product, CB-ALERT.

- VIPPS Certification or proof of registration with Legit Script is required to approve a merchant account for selling medicine or similar services online.

- Telemedicine is a fast-growing market with benefits such as reduced travel costs and waiting room time for patients, reduced overhead costs for healthcare providers, and the ability to offer consultations, diagnose and treat patients without the constraints of practicing in a traditional office or hospital.

*Corepay offers full medical merchant accounts as well.

Applying For A Telemedicine Merchant Account

To apply with Corepay, merchants will need the following:

- Proof of business bank account

- Prior processing history

- Compliant website

- VIPPS Certification or proof of registration with Legit Script

- Chargeback history

What Is A Telemedicine Merchant Account?

A telemedicine merchant account is essential for any business in the telemedicine industry. It enables the company to accept payments quickly and efficiently while complying with security standards.

With the right merchant services provider, businesses can receive personalized support and integrations with various website platforms for efficient credit card processing.

Telemedicine Industry Growth

You may have noticed that the healthcare industry is constantly evolving. With the rise of remote treatment options, it’s no surprise that virtual aftercare and consultations are becoming increasingly popular.

The Telehealth industry has seen significant growth in recent years, particularly in North America, the most substantial and fastest-growing market globally. With the ability to reduce travel costs, waiting room time for patients, and overhead costs for healthcare providers, telemedicine is quickly making a dent in the market.

Specialists can quickly view results from health-tracking devices used at home and exchange medical records with other specialists, making diagnosis and treatment more efficient. Telemedicine is revolutionizing the availability of clinical healthcare in rural areas with a shortage of healthcare providers.

Additionally, telemedicine is changing how doctors do business by allowing them to provide care without delay from any location with reliable internet.

With the growth of telemedicine, the need for telemedicine merchant accounts to accept cashless payments has become essential for healthcare providers looking to expand their services and reach more patients.

Telemedicine Chargebacks

Chargebacks can be a significant problem for any business accepting card-not-present transactions.

Chargebacks occur when a customer disputes a transaction, and the funds are returned to their account. This can happen for various reasons, such as fraud, service dissatisfaction, or simply misunderstanding the charge.

For telemedicine businesses, chargebacks can be especially problematic due to the high-risk nature of the industry and the potential for fraudulent activity. To prevent chargebacks, it’s essential to thoroughly understand the chargeback process and implement strategies to mitigate them.

This includes offering clear and concise descriptions of services, having a reliable payment gateway, and providing top-notch customer service.

Working with a reputable merchant services company with experience in the telemedicine industry can also be beneficial, as they will have chargeback prevention tools in place and can offer guidance on handling disputes.

Taking proactive measures to prevent chargebacks can protect your business and ensure your customers remain satisfied with your services.

Confidential Information

A security breach for telemedicine businesses can spell trouble quickly.

Securing your confidential information in the telemedicine industry is crucial, especially with the increasing use of technology and electronic health records.

With telemedicine merchant accounts, you’ll be handling sensitive patient information, and ensuring it’s kept confidential is paramount. This includes personal information such as names, addresses, and social security numbers, as well as medical information such as diagnoses, treatment plans, and medication lists.

Telemedicine merchant account providers use various security measures such as encryption, tokenization, and fraud prevention tools to protect confidential information. They also comply with HIPAA and PCI security standards to protect patient information during transactions.

High-Ticket

High-ticket billing is typically considered high-risk by banks and processors as there is more risk when the tickets are costly.

Why Choose Corepay For Payment Processing?

For a seamless payment processing experience that prioritizes customer service and security, look no further than Corepay. Here’s why:

- Corepay offers fast and easy approval for telemedicine merchant accounts, with competitive rates and zero setup fees.

- With Corepay, you can accept all major credit cards, eChecks, and ACH payments without hidden fees or minimum transaction requirements.

- Corepay has a team of experienced professionals who will work with you at every step, from application to implementation, to ensure your payment processing is tailored to your needs.

- With state-of-the-art fraud detection and prevention tools, PCI compliance, and encryption technology, Corepay prioritizes the security of your business and your customers’ sensitive information.

- 24/7 customer services

- Highly competitive pricing

- Chargeback management

Choose Corepay for a payment processing partner that understands the unique needs of telemedicine businesses and is committed to helping you succeed.

What Types Of Telemedicine Services Do We Cover?

Now that you know why Corepay is the right choice for payment processing, let’s talk about the types of telemedicine services they cover.

Corepay offers payment processing for all types of telemedicine services. Some of those include:

- Psychology

- Prescriptions

- Checkups

- Physical therapy

Telemedicine Payment Processing Experts

If you want to grow your business and accept online payments without a headache, look no further than Corepay. We are confident that we can take your business to the next level and save you money on processing fees.

Please fill out the application below to find out what Corepay can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].