Coaching Merchant Accounts 2024

Last Updated on February 5, 2024 by Corepay

Online coaching has become a significant source of income for many individuals over the last year. You will need a coaching merchant account if you are making money through coaching and accepting credit/debit cards. Our merchant accounts for coaching are tailored explicitly towards whatever you need, whether a secure payment gateway or an online shopping cart – Corepay has you covered.

If you operate your business primarily on Instagram or through a website, we are confident Corepay can help take your business to the next level with our payment processing for coaching.

If you’re a business that charges high-ticket prices and offers coaching/consulting, you will find it exceptionally difficult to find a merchant account with affordable rates. At Corepay, we specialize in payment processing for high-risk businesses such as coaching or consulting.

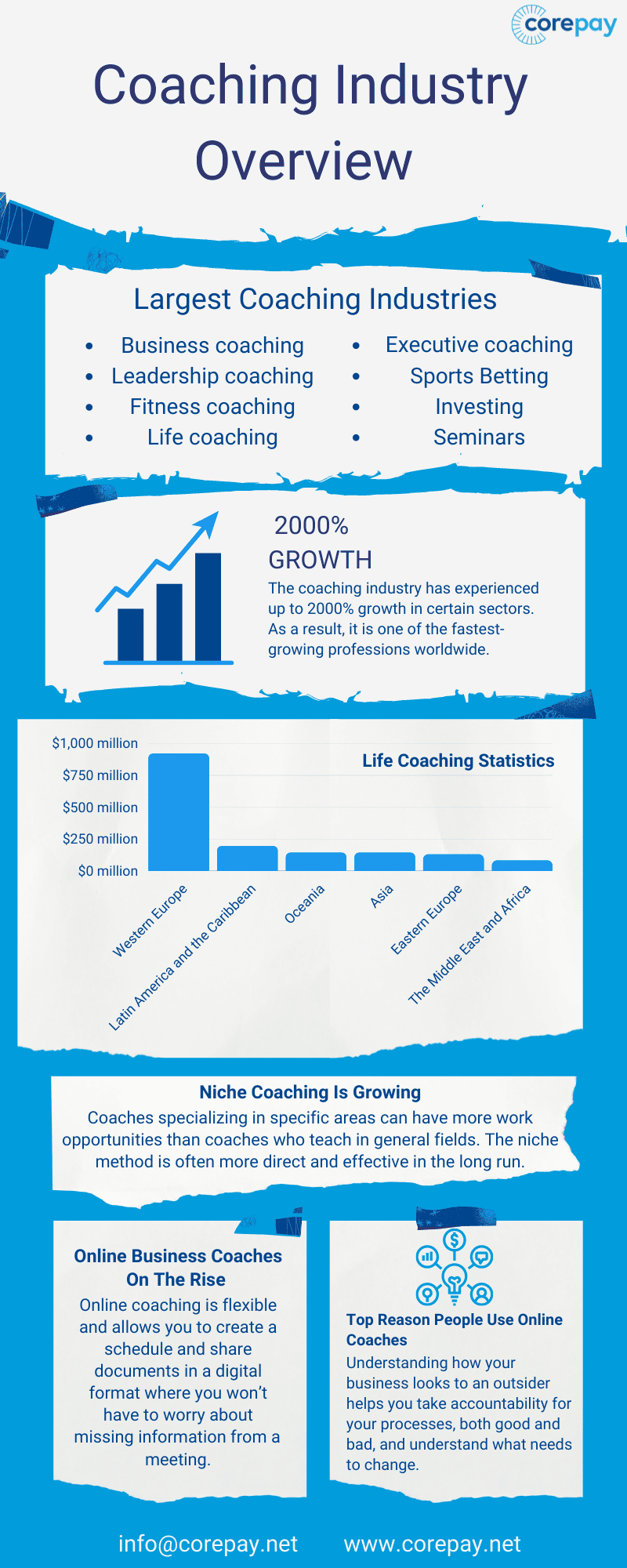

We frequently see coaches in the following industries:

- Business coaching

- Leadership coaching

- Fitness coaching

- Life coaching

- Executive coaching

- Sports Betting

- Investing

- Seminars

If you’re a legal business that offers coaching, we can aid in the grow of your business with our payment processing solutions.

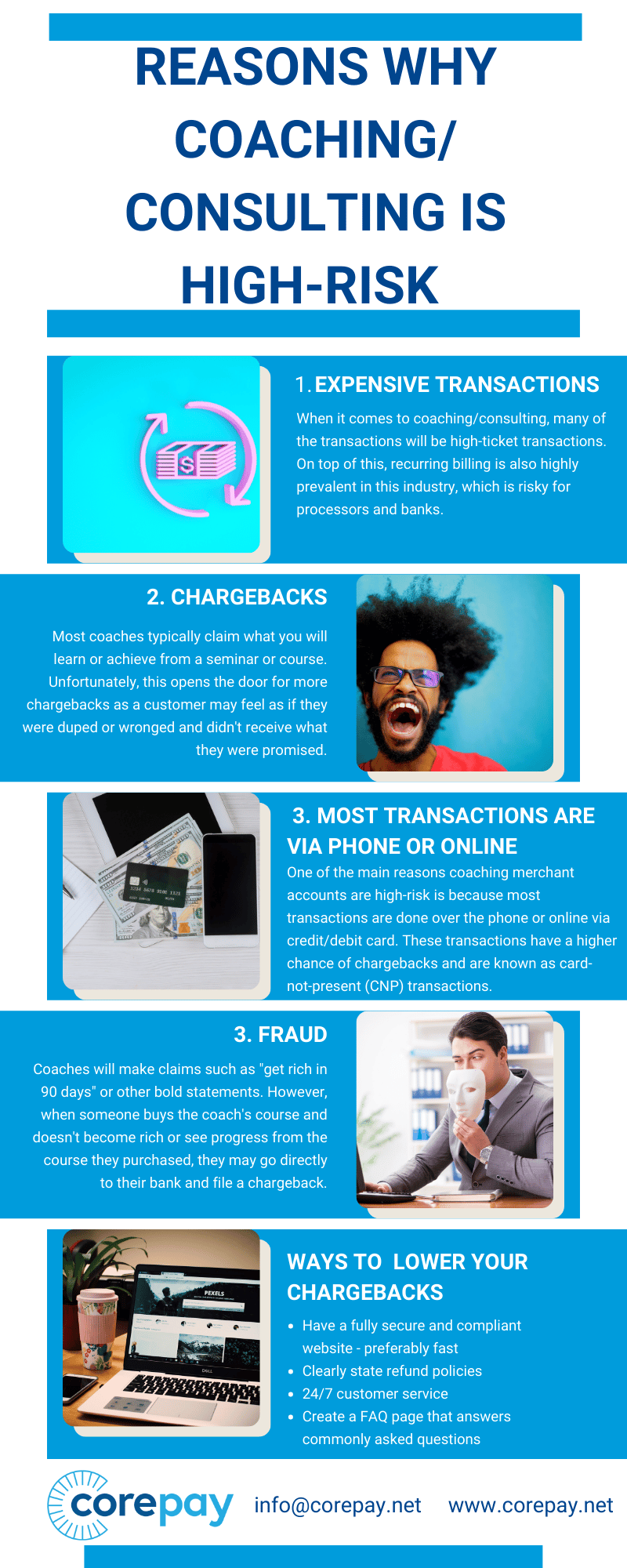

Why Is Coaching/Consulting Viewed As High-Risk?

Coaching and consulting are considered high-risk by banks and processors for many reasons. Banks typically won’t process for coaching/consulting as the situation can quickly arise in which it’s the merchant vs. customer.

- Expensive transactions

- Chargebacks

- Most transactions are via phone or online

- Fraud

While there are more reasons consulting is considered high-risk, it’s important to note that customers can often misinterpret advice from a coach and use that as a means to file a chargeback.

Expensive Transactions

When it comes to coaching/consulting, many of the transactions are going to be high-ticket transactions. On top of this, recurring billing is also highly prevalent in this industry, which is risky for processors and banks.

High-ticket transactions are risky by banks and processors as they can have higher chargebacks than lower transactions. Purchases for this industry are typically made in advance, which can also be a red flag to banks and processors as these can result in higher chargebacks.

Chargebacks

Chargebacks are quite frequent in the coaching industry for a number of reasons. If a customer feels as if they were duped or wronged during coaching or a seminar, they can file a chargeback.

Most coaches typically make claims regarding what you will learn or achieve from a seminar or course. This opens the door up for more chargebacks as the claims are usually hard to prove one way or another.

Online/Phone Transactions

One of the main reasons coaching merchant accounts are high-risk is because most transactions are done over the phone or online via credit/debit card. These transactions have a higher chance of chargebacks and are known as card-not-present (CNP) transactions.

Being able to accept these types of transactions is vital to coaching/consulting merchants.

Coaching merchants generally accept many CNP transactions before a seminar, which results in inconsistent transactional patterns that are hard to anticipate for processors/acquiring banks.

Fraud

In this industry, fraud is rampant regarding payment processing for seminars/coaching. Fraud typically leads to chargebacks, which makes it even harder for merchants to find payment processing.

The type of fraud in coaching is slightly different as we’re not talking about specifically about money laundering in this case.

Commonly, coaches will make claims such as, “get rich in 90 days” or other bold statements. When someone then buys the course and doesn’t become rich or is somewhat unsatisfied, they may go directly to their bank and file a chargeback.

How To Lower Your Chargebacks As A Coach

Lowering chargebacks is one of the most important items to address as a merchant. Fortunately, we have vast experience when it comes to doing so.

We offer chargeback solutions through our product, CB-ALERT.

Some of the other things you can do to lower your chargebacks include the following:

- Have a fully secure and compliant website – preferably fast

- Clearly state refund policies

- 24/7 customer service

- Create a FAQ page that answers commonly asked questions

The more information you can provide to your clients, the better when it comes to preventing chargebacks.

Applying For A Coaching Merchant Account

Applying for your coaching/online course merchant account is quick and easy. Our goal is to streamline the application process and get you approved as fast as possible.

Most approvals come with 24-72 hours of completing your application.

When applying, you will need the following to speed up the process:

- Company EIN document

- Financial statements, including personal and business

- Proof of operating address

- Principal’s driver’s license

- Articles of incorporation

- Business plan

- Voided check

The more information that you can provide us showing that you run a legitimate coaching business, the faster Corepay can get you approved with an acquiring bank.

Why Choose Corepay For Your Seminar/Coaching Merchant Account?

If you offer coaching, consulting, seminars, or developmental training, you may find it hard to find reliable credit card processing. We understand the coaching industry profoundly and know what it takes to take your business to the next level.

At Corepay, we have extensive relationships with acquiring banks, know how to lower your chargebacks, and offer highly competitive rates for high-risk industries.

We offer the following for all of our coaching merchant accounts:

- Fast Approvals: You can expect approvals averaging between 24-72 hours

- Highly competitive rates: We understand the importance of competitive rates for our clients

- High-volume processing: Our payment gateway, Solidgate, was built specifically for high-risk industries processing high volumes

- Multiple currencies: We understand the importance of being able to process as many currencies as possible

- Security: We have a PCI-Level 1 secure payment gateway that is monitored around the clock and regularly tested

- Accept mobile payments: We make it easy to accept payments from customers paying with their mobile devices

- 24/7 exceptional customer service: If you are having trouble, we offer 24/7 bespoke customer service that is dedicated to making sure your business never experiences downtime related to credit card processing

- Waived fees: In efforts to maintain 100% transparency, we waive annual, set up, and application fees

We are highly confident that we can provide you with exceptional payment processing for your coaching business.

Not only do we specialize in high-risk, we also have a great understanding of your industry.

Did PayPal Freeze Your Coaching Merchant Account?

If your coaching merchant account was terminated or frozen by Paypal or another low-risk processor, you would need to find a new processor as soon as possible.

While having this happen is incredibly frustrating, there’s usually little you can do outside of following the instructions from the company that has frozen your account.

Once frozen, your funds could be held for up to 180 days or until the processor has finished its audit of your account.

Is Corepay Compatible With CRM Software?

Yes. We can plug into most major payment gateways and eCommerce solutions such as Woocommerce.

At the time of your application, be sure to let us know which systems you already have in place; we may be able to streamline a more efficient solution for processing.

Two of the more common payment gateways we plug into are Authorize.net and NMI. Should you be using a different payment gateway, let us know during the application; we will advise whether you should use our payment gateway or continue using the one you are.

How Does Applying For A Coaching Merchant Account Work And How Long Does It Take To Get Approved?

The application process is as follows:

- Fill out the application to its fullest and submit the form

- Await an email from us letting you know the following steps

- We will perform our underwriting

- Bank will perform underwriting

- Start accepting payments

Once we are done with our underwriting, the acquiring bank will underwrite your coaching merchant account. Once approved, you can then begin accepting payments hassle-free.

Coaching Industry Overview

The coaching industry has exploded over the last 3-4 years with apps such as Instagram and Tic Tok, making it easier than ever to reach large numbers of potential customers.

The coaching industry is expected to hit $20 billion by the end of 2022, and it is well on its way.

The rapid growth of this industry is exciting in terms of finding credit card processing as it shows the potential to acquiring banks and processors.

Wrapping Up

A coaching merchant account is essential when launching your business or reworking your payment structure to maximize growth.

Whether you need a virtual terminal/payment gateway or simply looking for reliable credit card processing, we are confident Corepay can help you.

Fill out an application below, and one of our team members will reach out to you within minutes of the application.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].