eCommerce Merchant Accounts – Your Online Shopping Payment Processing Solution

An eCommerce merchant account is required in order to accept credit cards as payment for your online businesses. eCommerce merchants will continue to see exponential growth in the coming years as online shopping increases in popularity/convenience.

Working with a payment processing provider can significantly benefit your eCommerce business as you will need reliable payment processing solutions and secure platforms.

eCommerce merchants can be considered high-risk and will therefore need a high-risk merchant account. This may be surprising at first, as you might not think an online business should fall under a high-risk category.

Note* If you’re currently running your ecommerce business from Shopify, check out our Shopify high-risk merchant accounts.

Consumers are becoming reliant on using online shopping platforms, and a recent study conducted estimates that 95% of all purchases will be made online by the year 2040. Ecommerce provides endless possibilities for businesses, especially as we continue a shift towards online shopping from the standard brick and mortar retail approach.

Applying For An eCommerce Merchant Account

Regardless of you being relatively new to the eCommerce world and looking to start processing payments, or an established eCommerce merchant, Corepay offers highly competitive rates and exceptional payment processing solutions.

Applying for eCommerce payment processing solutions is as simple as filling out an application and speaking with the payment service provider you are looking to partner with.

At Corepay, we highly recommend comparing rates and services of several payment service providers to ensure you are making the correct decision for your eCommerce business.

Once you apply with Corepay and are pre-approved for your eCommerce merchant account, you will be assigned an account manager at Corepay who understands your business.

When applying, you will need the following:

Prior credit card processing history, including chargeback/fraud performance, helps establish which type of account you need and the solutions that make the most sense for your business.

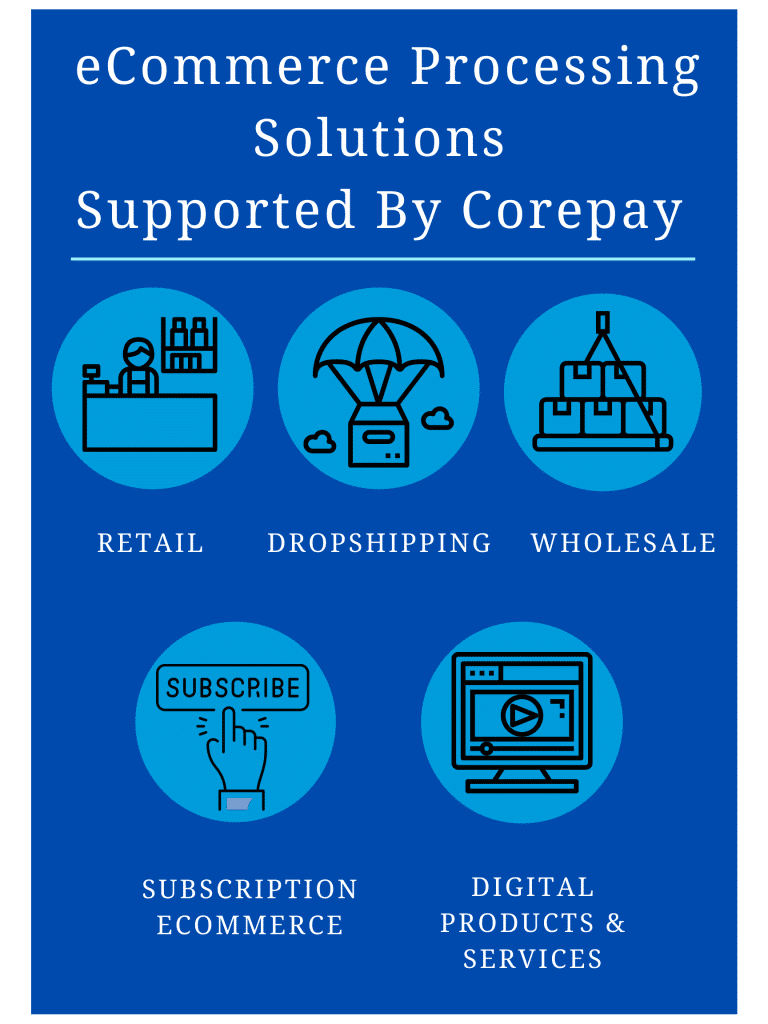

Corepay eCommerce Payment Processing Solutions

Corepay is proud to offer the following:

Corepay understands that digital payments are intrinsically tied to the success of eCommerce businesses. Having a variety of payment options with optimal security is a must for successful online companies.

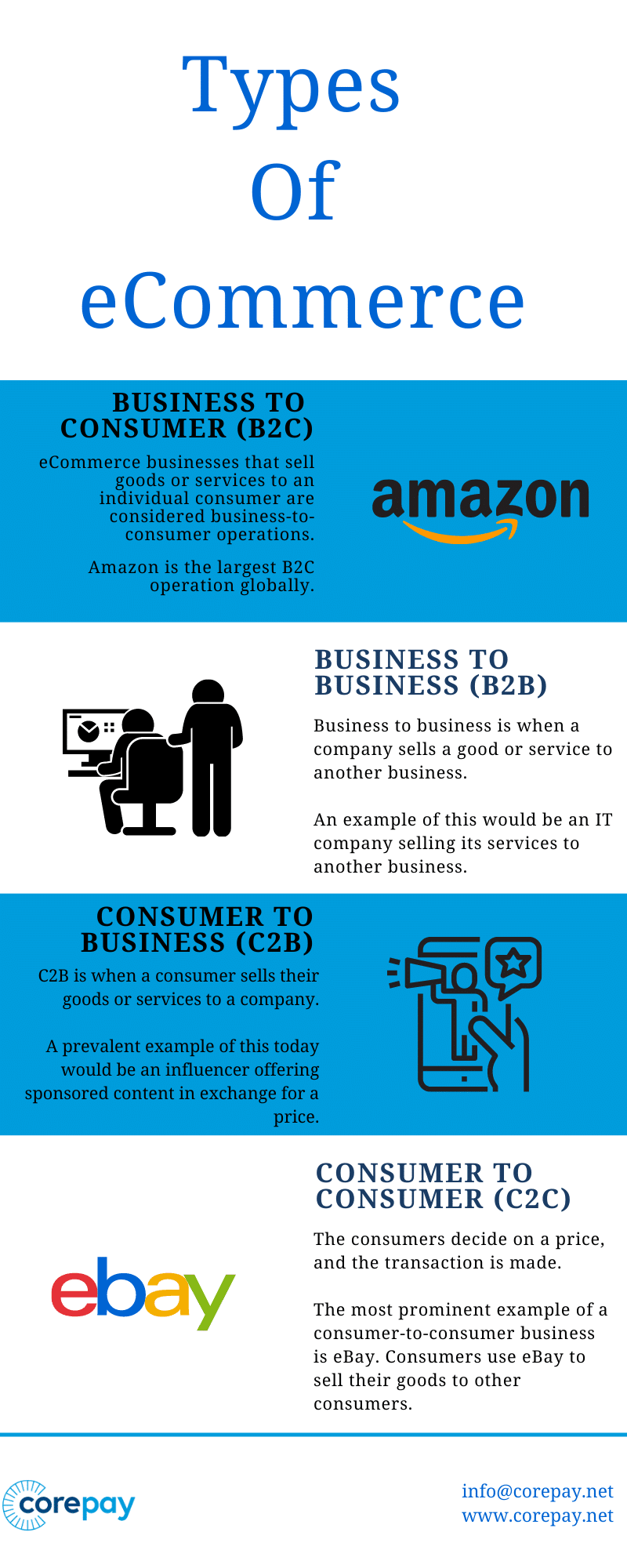

Different Types Of eCommerce Merchant Accounts

The sky’s the limit when it comes to eCommerce in today’s market. There are many different types of eCommerce businesses, leading to various options for eCommerce merchant accounts.

Below are the four different types of eCommerce businesses:

Business To Consumer (B2C)

eCommerce businesses that sell goods or services to an individual consumer are considered business-to-consumer operations.

An example of this is someone purchasing a guitar from an online retailer. They go online, find their guitar, and purchases it; therefore, this is a business-to-consumer relationship.

Amazon is the largest B2C operation globally, with over 150.6 million users on their mobile app in 2019.

Amazon currently has a market value of $1.4 trillion and is trailed by Walmart, with Walmart having a market value of over 340 Billion.

Business To Business (B2B)

Business to business is when a company sells a good or service to another business. An example of this would be an IT company selling its services to another business.

This type of business is prevalent and is rapidly growing in recent years. As eCommerce continues to grow, B2B will become more and more popular.

Payment processing providers are also considered B2B as they are selling services to other companies.

Consumer To Business (C2B)

Consumer to business is another popular eCommerce business model. C2B is when a consumer sells their goods or services to a company. A prevalent example of this today would be an influencer offering sponsored content in exchange for a price.

Companies will pay for exposure to their business, and the rate is dictated by the engagement and number of followers the influencer has.

If the consumer grows a large enough following, they can turn this into their full-time income and an actual marketing business.

Consumer To Consumer (C2C)

The most prominent example of a consumer-to-consumer business is eBay. Consumers use eBay to sell their goods to other consumers.

Another example would be consumers looking to sell their musical instruments on a used eCommerce marketplace. The consumers decide on a price, and the transaction is made.

The following are specific examples of eCommerce businesses that Corepay can provide payment processing solutions for:

eCommerce Merchant Account Fees

eCommerce merchant accounts fees can vary significantly between payment processing providers and the type of business you have.

For example, a company that is considered high-risk, such as a CBD online store, will pay higher fees than an online store selling books with minimal chargebacks.

High-Risk Vs. Low-Risk eCommerce Merchants

eCommerce merchant accounts can come with different risk factors. If you are deemed high-risk or low-risk by your acquiring banks and payment processing provider, you will be given differing fee schedules.

Low-risk eCommerce accounts are less expensive than high-risk accounts. Corepay offers extremely affordable eCommerce rates with no additional hidden fees, set up fees, or annual fees.

There are a few different factors that will determine whether your business is considered high-risk. The main reasons eCommerce accounts can be deemed high-risk are as follows:

While these are three primary reasons, there are also other deciding factors. If your online business sells high-ticket items frequently, you do more than 50k/month in processing volume without prior history, or your business unknowingly processes fraudulent transactions, you can be deemed high-risk.

eCommerce Chargebacks

In simple terms, a chargeback is a charge returned to a customer after they successfully dispute a transaction on their credit statement.

eCommerce chargebacks can prove highly detrimental to a merchant’s business as chargebacks are not taken lightly by banks.

Your payment service provider should be able to provide you with solutions to eliminate and fight eCommerce chargebacks/fraud.

Specific industries are going to be riddled with chargebacks. Subscription services, adult services, CBD, online dating, and the health and beauty industry are examples of industries with a higher number of chargebacks.

Chargebacks are seen frequently in CBD because of the nature of the industry. As research on CBD is still lacking, customers can claim that their product didn’t perform as promised and file a chargeback.

Reputational Risks

While eCommerce accounts may not always have reputational risk, it always comes down to the industry type of your business.

For example, the adult industry is typically viewed as taboo, and, for this reason, many banks refuse to work with adult content businesses.

If your marketplace frequently sells items such as adult toys or novelties, you will likely be deemed high-risk.

How To Reduce eCommerce Chargebacks

Merchants can reduce chargebacks by working with payment providers who are knowledgeable about their industry.

There are also chargeback tools such as Order Insight by Verifi and our partner product CB-ALERT will help your company identify and fight chargebacks by utilizing these offerings.

Speaking with your payment processing provider is also critical to understanding what your business is doing right and what it might be doing incorrectly.

There are often simple solutions that websites can take advantage of when it comes to eliminating chargebacks.

Why Was My eCommerce Merchant Account Closed?

There are several reasons why your eCommerce merchant account could’ve been closed. The main reason for this is probably that your company was working with a payment processing provider specializing in low-risk merchant accounts.

A great example of this is Paypal. While Paypal is not by any means a bad company, they don’t work with high-risk merchants. Should an underwriter deem your company to be “high-risk,” they can terminate your account and hold your funds for up to 180 days.

eCommerce Credit Card Processing Solutions

Corepay processes all major credit card brands and alternative payment methods like WeChat and Alipay. Having the ability to process all major credit card brands is vital in an eCommerce market.

As countries continue to adopt cryptocurrencies and move away from cash, eCommerce merchants should be in the know at all times and be ready to adapt to current payment trends.

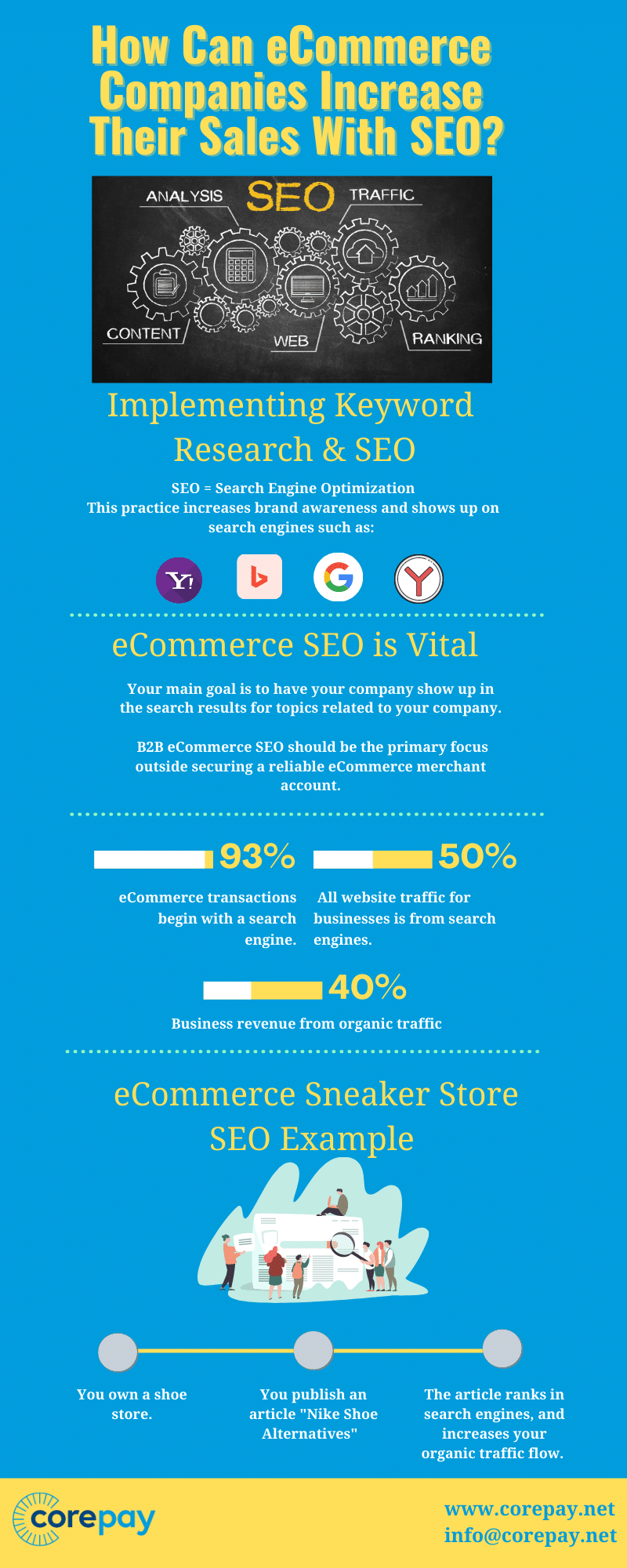

How Can eCommerce Companies Increase Their Sales?

Working with a payment processing provider who understands the eCommerce business model is essential. This will increase sales and help fight against chargebacks, ultimately saving your company money.

On top of this, eCommerce SEO is vital. If your business is operating entirely online, you need to take advantage of every opportunity there is.

So, what is SEO for eCommerce? SEO stands for “search engine optimization.” This means you are working to increase your brand awareness and show up on search engines such as Google, Bing, Yahoo, or Yandex.

Your main goal is to have your company show up in the search results for topics related to your company with eCommerce SEO.

For example, if you run an eCommerce sneaker store, you could rank one of your pages for “Nike shoe alternatives.” If you’re able to do this, your conversion rates will increase as you will be targeting consumers who are already in the buying funnel. This is an example of keyword research, as the main goal is to rank for keywords related to your business.

If your business is B2B, eCommerce SEO should be the primary focus outside securing a reliable eCommerce merchant account.

Why Choose Corepay For Your eCommerce Business?

Corepay can offer solutions for all eCommerce businesses, including high-risk merchants. Below are some of the high-risk industries that Corepay frequently works with.

If your online business was terminated or you’re not happy with your payment processing provider, fill out an application today and learn how Corepay can improve your eCommerce business solutions.