Order Insight – Everything Merchants Need To Know

Last Updated on July 7, 2023 by Corepay

For some merchants, chargebacks can be the bane of your merchant account’s existence. Chargebacks can, in some cases, get your account shut down or raise your cost per transaction (CTP) immensely.

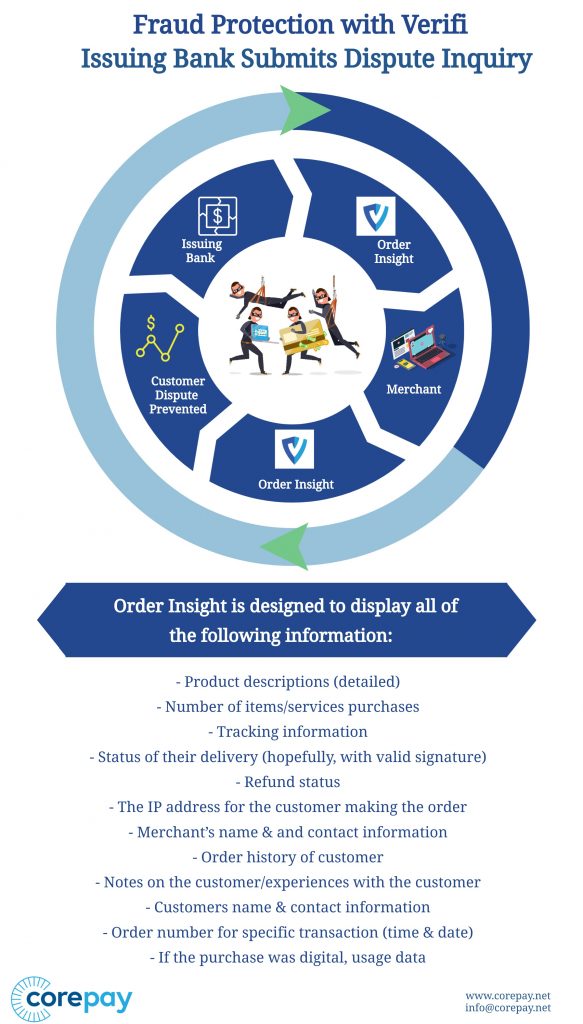

Initially launched in 2017 by VISA and formerly known as VMPI (Visa Merchant Purchase Inquiry), Verifi’s Order Insight offers merchants an impeccable tool to prevent chargebacks before they are even submitted to the bank.

Visa has estimated that their cardholders initiate over 3 million disputes per year because they can’t recognize the specific transaction in question. Order Insight could eliminate most or even all of those disputes.

Order Insight is designed to combat fraud in a more streamlined manner than traditional chargeback alerts. At Corepay, we are proud to offer direct Order Insight facilitation, including integration via API in less than 48 hours, through our partner CB-ALERT.

Order Insight by Verifi allows the bank’s customer service representatives to access information from a specific merchant’s CRM systems in real-time, ultimately enabling them to provide complete details for the transaction in question.

Cardholders can recall older transactions and discuss whether their dispute should escalate to a chargeback or if they need to resolve their transactional issue directly with their merchant, hopefully preventing the chargeback.

An example of this would be that a cardholder doesn’t remember making a specific purchase. They look at their statement and notice a purchase occurred, not realizing their spouse had made the purchase. Order Insight acts as a decision clearing house in cases like this, preventing a dispute from turning into a real chargeback.

What Information Should Be Shared With Order Insight?

Merchants/payment processing companies have a plethora of options regarding which information they choose to share with Order Insight.

Typically, the more information that you can provide, the better the tool will perform. That is, the more data that can be provided to the cardholder, the better your chances are of avoiding a chargeback.

Order Insight is designed to display all of the following information:

Merchant Information

This information is anything that could help the customer recognize the purchase/ your business.

- Address of the business

- Business name

- Business website URL

- Customer service number

Customer Information

- Cardholder name

- Their email address

- Phone number

- Notes about the customer

Details Of The Order

In this section, merchants can share details that are stored in their CRMs that relate to the dispute.

- Order number

- Type of payment

- Price of purchase

- Tax included

- Date of the purchase

- IP address of the customer

- Number of items

- Location of purchase

- Name of device

- AVS, CVV, and 3D Secure response codes

Details Of Product

- Name of product

- Product description

- Price

- Images

Anything that can be included about specific products can be of help, especially images, as an image could remind the customer of their purchase.

Order Insight Overview And Its Importance

Whether you’re a merchant and considered low-risk or high-risk by your bank or payment processor, Order Insight will be of assistance to your business.

VISA was initially launched as VMPI in 2017 after a study in 2015 showed that 14% of chargebacks were prevented in Hong Kong and New Zealand.

After VISA acquired Verifi, the product was rebranded to Order Insight, and one major upgrade was introduced. When comparing Order Insight with VMPI, the most significant difference is that Order Insight allows for integrations with web and mobile applications, whereas VMPI could only be used via phone.

According to VISA, over 20% of chargebacks issued were for digital goods or services in which the customer claimed they didn’t purchase. All of these chargebacks typically end up costing more money than the actual service in question.

If you currently have a high-risk merchant account, you likely understand the importance of reducing chargebacks.

Key Features

- Cost Reduction: Order Insight empowers cardholders to answer their questions related to a particular transaction/purchase. This allows merchants to optimize their customer support teams as it dramatically reduces low-value calls from cardholders.

- Provides Self-Customer Service: As previously stated, low-value digital disputes are usually a lose-lose situation. Order Insight aims to eliminate as many of these low-value disputes as possible.

- Prevents brand damage and loss of customers: Order Insight helps prevent brand damage as they can take care of their dispute before a chargeback is filed.

- Prevent the loss of shipped product: If a customer is inquiring about a specific transaction involving a tangible product shipment, merchants can prevent products from being shipped when necessary. Rather than attempt to recoup an already-shipped product that a customer claims they did not purchase, the product will never leave the fulfillment center.

How Order Insight Works

While you have an understanding of what Order Insight is, let’s take a look at exactly how it works below:

- The cardholder is reviewing bank transactions and requests additional transaction details with a customer representative on the phone.

- The issuer sends an API request to Verifi for additional information.

- Verifi sends a real-time request to the merchant.

- The merchant looks for the purchase information.

- The merchant sends a detailed regarding the purchase/data.

- Verifi validates this message and sends it back to the issuer.

- Issuer presents this data to their cardholder on the phone, or through their online bank portal.

It is important to note that all of this information happens within a second of the issuing bank inquiring about the specific transaction.

Should Merchants Use Order Insight?

The short answer is, yes, merchants should use Order Insight. Let’s take a look at why below.

Running a business is expensive. When companies get hit with chargebacks, it usually results in losses for the chargeback. It also results in companies being affected negatively should they have too many chargebacks.

Rather than dealing with chargeback requests yourself, the responses can be handled automatically. Using API technology, issuers can integrate VCPI data directly into their mobile or online banking portal.

By providing this data to cardholders, you are minimizing chargebacks by solving their basic questions such as:

Order Insight is ideal for any merchants who get a high number of disputes, have recurring transactions, sell digital products, ship physical products, or have free trial periods with automatic renewals.

Of course, there may be a slight downside. Verifi needs access to each merchant’s transactional data within a second of the inquiry for the system to work. Sharing and matching this data can be fairly complex, so you’ll want to work with a merchant provider who understands the technology and can ensure that you seamlessly plug it into the system. Corepay, through our partner, CB-ALERT, is proud to offer direct Order Insight facilitation, including integration via API in less than 48 hours, along with real-time reporting of all associated data through its portal.

Second, you share certain aspects of your transactional data with Verifi, allowing them to mine it for their own benefits by saying that the technology is so effective.

Overall, our opinion is that Order Insight is a boon for many merchants because it can help you reduce the number of chargebacks, especially those instigated by customers who just forgot what they purchased or can’t recognize the transaction.

The transformation from VMPI to Order Insight

The most significant transformation from VMPI to Order Insight is that Order Insight allows for web and mobile integrations.

Order Insight has significantly improved on VMPI’s inquiry response features as it allows for integrations to both mobile and web applications. An issuer could only use VMPI if the cardholders were calling them on the phone.

With VMPI, they could share either the transaction information or indicate the intent of whether they will be issuing a refund. With Order Insight, you are given transaction information only.

With Order Insight, the purpose is to address a specific point in the transaction dispute process: cardholders informing their bank that they are disputing a purchase.

- Order Insight allows for mobile and web integrations, whereas VMPI was via phone only.

- Order Insight provides transactional information only.

Mastercard’s Consumer Clarity VS Visa’s Order Insight

Mastercard’s Consumer Clarity is a very similar product to Order Insight.

Both Consumer Clarity and Order Insight are used during the same period in a dispute. As soon as the individual disputes a transaction, Consumer Clarity and Order Insight come into play.

Overall, they do the same thing, which is an attempt to stop a chargeback from occurring.

The main difference between the two is that they are designed for different platforms. Order Insight and Consumer Clarity work to solve brand-specific disputes.

Order Insight works with Visa, and Consumer Clarity works for Mastercard. It is important to note that Consumer Clarity recently rebranded from “Eliminator.”

Rapid Dispute Resolution

Rapid Dispute Resolution (RDR) is another tool by Verifi that helps fight against chargebacks. When used effectively, RDR goes hand in hand with Order Insight and enters the dispute process after the initial inquiry is processed by Order Insight.

The way Visa Rapid Dispute Resolution works is that the merchant will provide a specific set of rules/policies for what type of chargebacks they would like to automatically always refund.

Once a dispute is received and matches the merchant’s set criteria, RDR will communicate with the acquiring bank and automatically tell the merchant’s account to issue the refund.

By doing this, RDR mitigates the damage since the dispute can’t progress any further. Additionally, it fully prevents the dispute from progressing into a chargeback, and therefore eliminating cumbersome paperwork from being processed by both the issuer and the acquirer.

What makes RDR effective when used in tandem with Order Insight is that, while the merchant account issues a refund to the customer, you avoid a chargeback, which could cost you double the price of a refund.

By issuing the refund and negating the chargeback, you not only save money from that specific chargeback, but you also save money in the future as every chargeback increases your chargeback rate, and could jeopardize your merchant account.

As time progresses, more and more acquirers will be under a mandate to support RDR functionality. All acquirers/processors are required to make the following system and processing changes by the April 2021 release to support RDR.

How Can Merchants Start Using Order Insight?

The most effective way to use Order Insight is by having it integrated with their CRM to provide automatic responses in real-time. This should be done through a partner with an up-to-date, simple-to-use API and a rock-solid support team that ensures that your transactional data matches the requests.

If you have a merchant account with Corepay, we will take care of this for you, allowing you to take full advantage of Order Insight.

Pricing For Order Insight

Order Insight is often more cost-effective than traditional alerts as it is designed to avoid alerts/chargebacks. If Order Insight does not prevent the dispute from progressing, the worst-case scenario should be that the merchant receives a conventional CDRN alert.

Order Insight is designed to work in tandem with alerts, ultimately saving the merchant money.

Price Per Inquiry

The price per proven deflection takes up to 90 days, which is a percentage of the transaction amount having a chargeback deflected. The cost per inquiry can often vary, but it is typically only a few cents.

Analyzing Your Data

Once you have Order Insight integrated, you must analyze your data on an ongoing basis.

You will want to ensure that your CRM is capable of matching the respective fields within the allowable timeframe of one second. Then, you will need to ensure that useful criteria is being passed back to the customer such that they gain additional confidence regarding their orders, or can get refunds more quickly.

Thus, your chargeback and fraud ratios should improve within the first few months of integrating Order Insight if being utilized correctly.

Does Order Insight Violate Privacy Laws?

Order Insight does not violate any privacy laws. All transactional data is encrypted and only shared between the merchant and the actual customer.

Wrapping Up

Order Insight is an incredible tool that can be used with other tools, including RDR and traditional chargeback alerts to help prevent customer disputes.

When used correctly and with the correct partner who facilitates the product with easy-to-use technology and excellent service, Order Insight is highly effective at fighting chargebacks/fraud.

CB-ALERT is an authorized facilitator of Verifi’s Order Insight and has among the highest OI matching rates of any facilitator. The integration for OI with CB-ALERT via API is seamless and can be achieved within a few hours. Once integrated, CB-ALERT contains full reporting for OI within its cutting-edge portal, along with many other products designed to stamp out chargebacks and fraud.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].