CBD Merchant Account Service Specialists

To say the CBD industry is blazing would be an understatement. U.S. consumer sales of cannabidiol (CBD) will surpass3.5 billion by 2024, according to Statista. If you are the owner of a CBD business, you must be working with a payment service provider who specializes in CBD payment processing/merchant accounts.

The CBD industry is considered high-risk as it is currently not regulated by the FDA as a dietary supplement. Payment processors and banks understand this, making it hard for CBD merchants to acquire a merchant account for CBD.

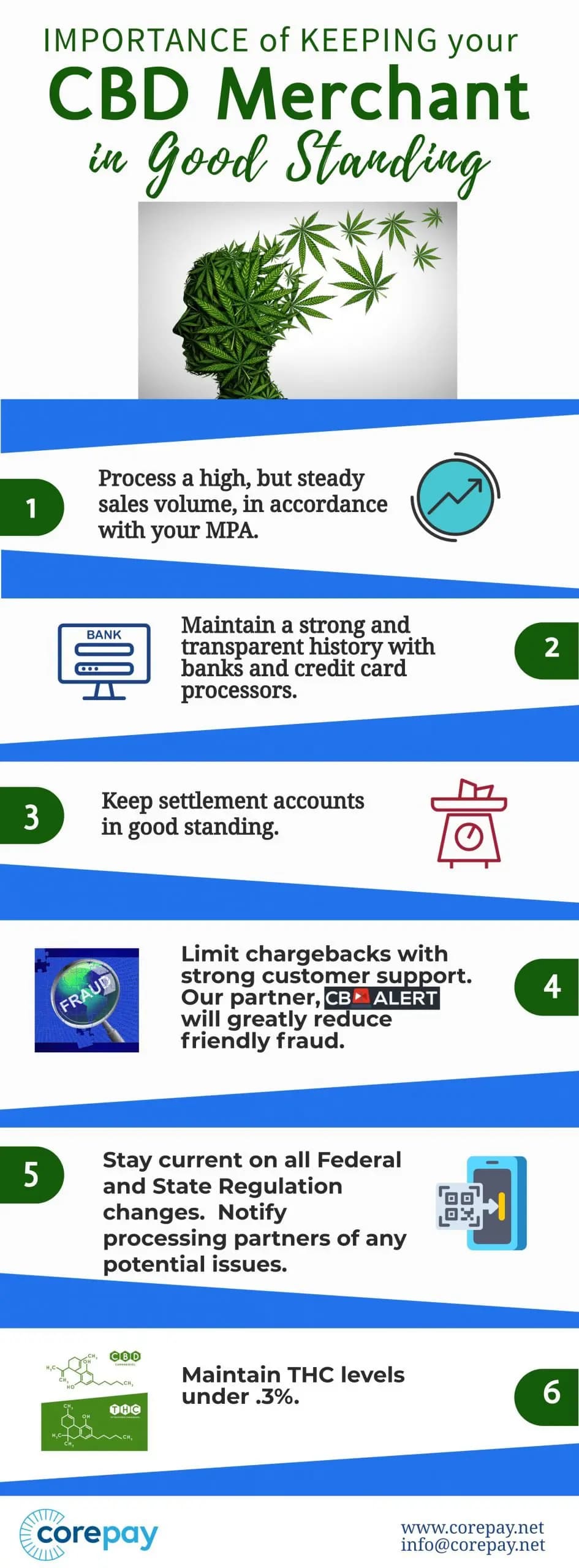

At Corepay, we understand how frustrating it can be when applying for a CBD payment processing solution. Not only do we boast two decades of high-risk credit card experience, but we also specialize in the CBD industry. Corepay’s top priority is to get your business approved and make sure you stay approved.

We provide CBD merchant accounts for the following:

As the CBD industry expands and encompasses new products, Corepay works diligently to maintain proper service and provide exceptional service to our clients.

Corepay offers the following for CBD merchants:

How To Apply For A High-Risk CBD Merchant Account

When looking for CBD credit card processing, you must ensure compliance with all regulations. CBD merchants who are selling CBD/hemp-derived products with THC levels of .3 percent can apply for their merchant account.

It is important to note that Corepay cannot provide a merchant account for any cannabis products containing cannabidiol, cannabinoid, THC over .3 percent.

By filling out an application with Corepay, we can quickly get you approved and processing CBD transactions in no time.

You will need the following information when applying:

*While we cannot guarantee your approval at Corepay, we can promise that we will do our best to get you approved and processing transactions swiftly.

Why Are The Best CBD Merchant Accounts Considered High-Risk?

Since CBD is used for medical reasons and has not been approved by the FDA, this automatically implies banks and payment processing providers are taking on additional risk.

CBD is often used as an alternative to treating epilepsy, cancer, sleep deprivation, and anxiety. With this being said, there has been insufficient medical evidence to back up these claims.

According to Healthline, there is some evidence that cannabinoids can decrease the size of tumors. However, Healthline also states that it is far too soon to say that CBD is a safe and effective treatment for cancer in humans.

CBD merchant accounts are deemed high-risk by banks and payment processors for the following reasons:

Lack Of FDA Approval

This is a major concern for CBD merchants when processing credit card transactions for CBD purchases. The only FDA-approved drug that includes CBD is Epidiolex. Epidiolex does not contain any THC.

Epidiolex contains a highly purified form of the drug substance CBD for the treatment of seizures.

The FDA has gone after several CBD companies for making statements regarding the medical benefits of CBD.

As THC levels in CBD can vary, this leads to a risky position for payment processing providers.

If a CBD company is caught selling CBD with higher levels of .3 percent THC, the payment service provider risks taking a significant financial hit and reputational hit as well.

CBD Legislation Issues

Contrary to popular belief, CBD is not yet legal in all 50 states, and this is a primary concern for banks/processing companies. Currently, CBD that contains any levels of THC is banned from Idaho completely.

CBD product possession in the following states requires patient registration:

Reputational Concerns

The fact that the FDA does not approve CBD makes it a significant risk for payment providers. A bank or payment processor’s reputation can be on the line when working with CBD companies, as there are still many unknowns.

Stories like Summit Labs, in which they sold a product that contained lead, cause a lot of uncertainty for payment service providers.

CBD is similar to the adult industry when it comes to reputational risks; however, CBD also introduces an element in which there are unknowns regarding health.

A CBD merchant that sells mostly CBD vapes or ingestible products may be viewed differently from a CBD merchant that deals mainly with external CBD oils, as vapes can introduce another dangerous element.

CBD Chargebacks

Chargebacks in the CBD industry differ from other high-risk industries such as online dating or adult content. Generally speaking, there aren’t as many chargebacks in the CBD industry, but they still exist, especially with online CBD stores.

To grab a quick understanding of chargebacks, a chargeback is a charge returned to a credit card after a customer successfully has disputed a transaction from their statement.

In the CBD industry, this is most prevalent with CBD subscription boxes. Chargebacks are commonly seen when subscription services are presented.

Here are some essential points to note with your merchant service provider:

*While we cannot guarantee your approval at Corepay, we can promise that we will do our best to get you approved and processing transactions swiftly.

Are CBD Credit Card Processing Solutions Expensive?

Generally speaking, merchants will pay more for CBD payment processing as they fall into a high-risk category.

At Corepay, we offer our CBD merchants highly competitive rates, and we also waive annual fees, setup fees, and application fees. We believe a good payment processor will earn your loyalty rather than extort it with hidden fees.

Why Choose Corepay

At Corepay, we specialize not only in CBD merchant accounts but in high-risk merchant accounts. We understand what it takes to get CBD merchant accounts up and running and how to keep them growing.

Corepay offers completely customizable credit card processing options, and we can also get you approved in as little as 24 hours upon submitting your application.

Your success is our success, and we can assure you that we can be your greenlight to CBD payment processing solutions.