Medical Merchant Accounts – Specialized Payment Processing

Last Updated on April 5, 2024 by Corepay

Payment processing for the healthcare/medical industry is often complex. With the internet evolving and technology creating various ways to pay for services, your healthcare business needs to have a medical merchant account tailor-made for your business.

Businesses operating in the healthcare industry are regularly considered high-risk by credit card processors and acquiring banks. Finding reliable payment processing can be extremely difficult for many healthcare-related businesses.

There are many unique needs that healthcare businesses will need with their merchant account. Thus, healthcare providers will need a reliable way to accept credit card payments in person, online, and over the phone.

At Corepay, we understand exactly what healthcare merchants need when it comes to payment processing, and we also are confident that we can get your business approved, while ensuring it stays approved.

We are proud to offer medical payment processing for the following:

Why Medical Merchant Accounts Are High-Risk

Medical Chargebacks

Chargebacks are often the bane of a merchant’s existence. Medical chargebacks are expensive and can also result in you paying more in fees with your payment processor.

A chargeback occurs when a customer makes a complaint with their bank, claiming that a charge was not authorized, is for an incorrect amount, or that the goods or services paid for were not delivered.

Keeping chargebacks at a minimum is key to keeping your healthcare merchant account in good standing and avoid additional/higher fees, or closure.

Clearly stating refund policies on your company website and have 24/7 customer service can significantly reduce your chargebacks.

In efforts to help your business fight against fraud, Corepay offers chargeback mitigation and dispute management services to reduce chargebacks and their impact on your medical business through our partner product, CB-ALERT.

Fraud/Security

Since HIPPA regulates all medical-related business, security is a huge concern. Data breaches can prove to be devastating for acquiring banks and medical businesses.

At Corepay, we have a PCI-Level 1 secure payment gateway that is monitored around the clock and regularly tested for security issues.

High Ticket Transactions

Medical-related purchases are often expensive and over $50 per transaction. Large transactions are riskier due to chargebacks and fraud. A lot of banks will simply avoid working with medical merchants for this very reason.

Health Risks

Certain businesses provide services/goods that could prove to be harmful to their patients. Should a service injure a patient or offer a service that is frowned upon, it puts acquiring banks at greater risk.

Medical MCC

The merchant category code that will be assigned to your business is 5047.

Application Process For Medical Merchants

Applying for payment processing for your medical business is exciting. Our goal at Corepay is to get you approved and processing as quickly as possible.

Before applying for your medical merchant account, you should have the following:

The more information that you can give when applying for your medical merchant account, the faster you can get approved.

You may need additional information depending on the type of medical bussiness.

Why Choose Corepay For Your Medical Payment Processing?

Those looking to increase their revenue for their medical businesses have come to the right place. Medical businesses globally can benefit from our payment processing/chargeback mitigation services to boost their revenue.

At Corepay, we care about all of our clients and understand the importance of reliable payment processing.

We are proud to offer the following for our medical merchant accounts:

How To Choose The Best Payment Processor For Healthcare

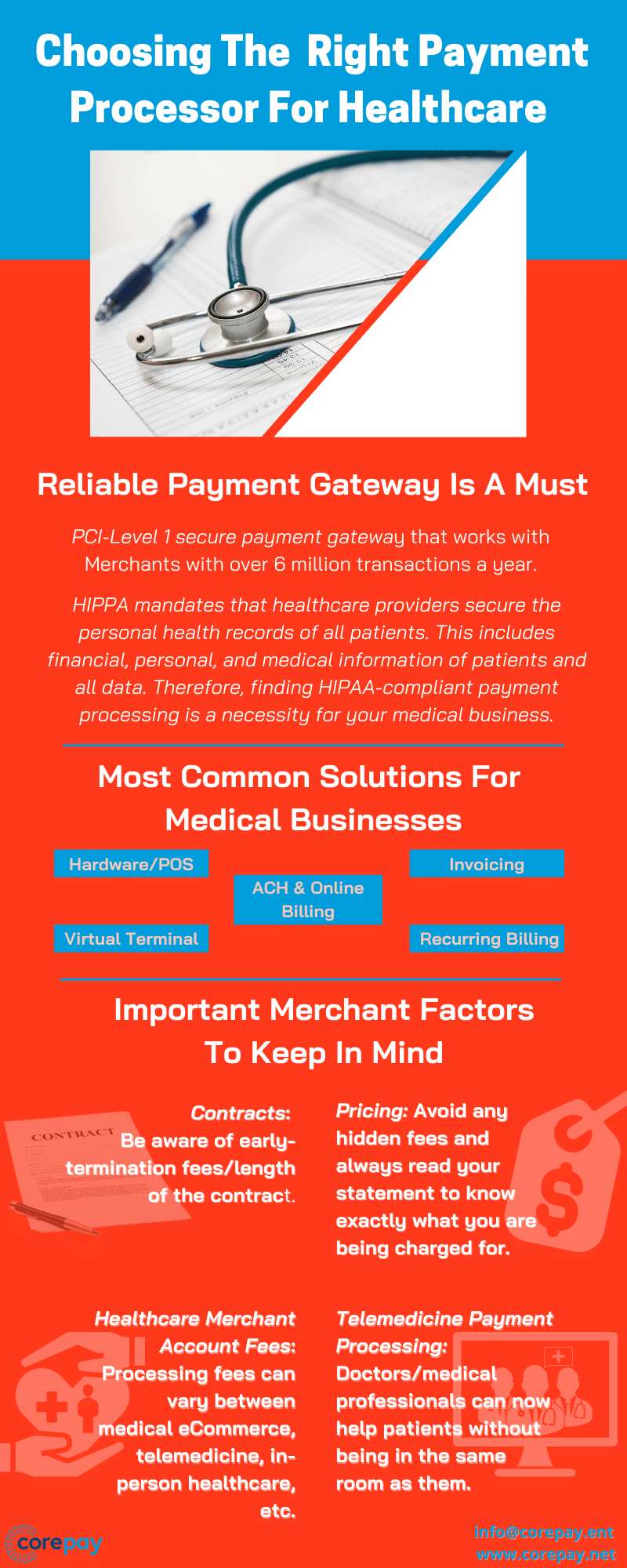

Choosing the best payment processing solution for healthcare is not an easy task. Whether you’re an established business or just getting started, there are many things you will have to consider when choosing a provider.

First and foremost, choosing a provider specializing in high-risk processing and having experience in the medical industry is critical. It is essential that you do not select a low-risk processor, as you could end up having your merchant account terminated.

When speaking with your payment processor, be sure to inquire about other services they may offer. For example, at Corepay, we specialize in saving our clients money on fees by optimizing their chargeback ratios through our partner product CB-ALERT.

Choosing a payment processor with a reliable payment gateway is also very important. At Corepay, we have a PCI-Level 1 secure payment gateway that’s monitored around the clock and regularly tested for security issues.

HIPPA mandates that healthcare providers secure the personal health records of all patients. This includes financial, personal, and medical information of patients and all data. Finding HIPAA-compliant payment processing is a necessity for your medical business.

Let’s take an even deeper look at what you should keep in mind when choosing a medical merchant account.

Number Of Payment Channels

Choosing a payment processing provider that is able to provide you with multiple payment channels is essential. Since there are many different types of businesses in the medical industry, you will need to have payment processing specifically tailored to your business.

At Corepay, we understand that medical businesses need to have as many different viable payment processing solutions.

The following are the most common solutions for medical businesses:

Customer Support

When finding a payment processing provider for your medical business, you will want to choose one that has 24/7 customer service. When something goes wrong with credit card processing, it’s often time-sensitive, so being able to diagnose and fix an issue quickly is of utmost importance.

Contracts

The length of payment processing contracts can vary from processor to processor. Be sure to read the agreement and ask any questions you may have regarding early-termination fees/length of the contract.

Pricing

While pricing varies depending on which company you choose, transparency is key. Unfortunately, not all payment processing providers are transparent when it comes to pricing. You want to avoid any hidden fees and always read your statement to know exactly what you are being charged for.

Be sure to speak with your payment processor immediately should you ever have any questions regarding your statement.

Telemedicine Payment Processing Solutions

With the advent of Covid-19, telemedicine services exploded, the doctors/medical professionals could help patients without being in the same room as them.

It was estimated that Teladoc, a private healthcare company, was averaging over 15,000 patients per day in 2020.

This is a 350% increase from the following year, and telemedicine is expected to continue growing in the coming years.

At Corepay, we understand the needs of telemedicine payment processing as well as security. We are proud to offer merchant accounts for all businesses related to telemedicine.

We also offer MOTO merchant accounts, allowing businesses to accept credit/debit card payments by manually entering them into the payment gateway when the customer/client is not present. This is beneficial for payments the phone or mail.

Healthcare Merchant Account Fees

Medical merchant account fees can vary depending on a few different factors. You will notice that processing fees will vary from processor to processor.

The total fees that you pay can also be influenced by the following:

As the medical field is vast, there are many different business models payment processors frequently come across. Processing fees can vary between medical eCommerce, telemedicine, in-person healthcare, etc.

Should you choose Corepay for your healthcare payment processing, we will waive unnecessary setup fees, application fees, and annual fees. You will also find that we offer highly competitive rates, dedicated customer service, and reliable payment processing you can always count on.

Dental Solutions

Run a local dental office and looking for bespoke payment processing? Look no further than Corepay for all of your payment processing needs. We are confident we can help dentists grow their business by saving money on processing fees and reducing their chargebacks.

Did Paypal, Square, Or Stripe terminate your Medical Merchant Account?

Being slapped with a medical merchant account hold, freeze, or termination can be terrifying for merchants. But, unfortunately, this is something that frequently happens in the healthcare industry.

While Paypal, Square, and Stripe are all great options for low-risk merchants, they specifically do not work with high-risk merchants. Because of this, medical merchants can run the risk of having their accounts terminated.

Once your account is put on hold, you will have to wait until the payment processor completes their audit and instructs you on what to do next. While you will have to wait until your funds are unfrozen, finding a high-risk processing solution is crucial so that you are able to continue to accept payments.

If you are confused about why your account was put on hold by Paypal, the simple answer is that Paypal doesn’t perform their underwriting at the time of your application. This is problematic because businesses can be making transactions for up to 6 months before finding out that their account has been frozen/terminated.

At Corepay, we have a team of professionals who review your application and audit your account at the time of the application. Our goal is to provide 100% transparency with our clients so that you don’t end up with any surprises in fees/holds down the road.

Largest Medical Merchants

The following are the most prominent medical merchants in the country:

- Mckesson – A wholesale medical distributor based in Texas

- AmerisourceBergen – Healthcare solutions

- Henry Schein – Medical supply distributor

- Cardinal Health – Medical supply distributor

- Medline Industries

The following specializes in eCommerce medical supplies:

- Discount medical supplies

- Medical Supply Group

- Medical Supply Depot

- USA Medical Surgical Supplies

- Vitality Medical Supplies

Wrapping Up

Medical merchant accounts/payment processing are unique require a payment processor who is familiar with the industry.

At Corepay, we are confident that we can help grow your business, reduce your chargebacks, and set you up with payment solutions specifically tailored to your business needs.

Fill out an application below and find out what Corepay can do for your healthcare business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].