Merchant Account Holds & Freezes – Everything You Need To Know

Last Updated on July 7, 2023 by Corepay

Merchant account holds and freezes are seldomly discussed in the credit card processing world; however, they are essential topics to understand as a merchant. Most of the time, merchants don’t find out what a merchant account freeze, hold, or termination is until they find themselves dealing with them first-hand.

One of the most financially troubling things for a merchant to experience is a hold or freeze. This article will break down everything merchants need to know about merchant account freezes, holds, and terminations.

If your merchant account was recently frozen or held, you have come to the right place, and you will leave with an understanding of why it occurred and what you need to do next.

So, what is a merchant account hold?

Merchant Account Holds

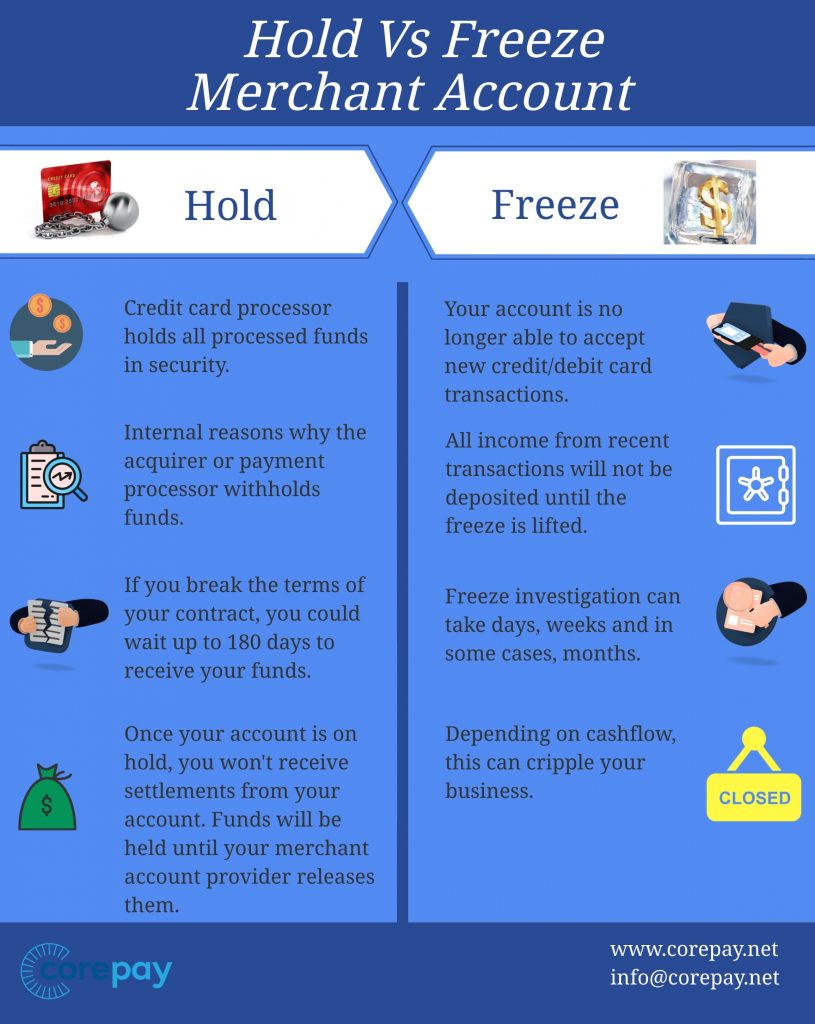

A merchant account hold is when a credit card processor pauses settlements and instead holds all processed funds in security rather than depositing the money into your account. This is also known as a “funds hold.”

Merchant account holds differ from ACH delays and rolling reserves in the sense that there is an internal reason at the acquirer or payment processor level as to why they are withholding your funds.

There are many reasons your service provider could withhold your funds, and should your provider notice that you broke the terms of your contract, you could wait up to 180 days before receiving your funds.

Once your funds have been put on hold, you won’t be able to receive settlements from your account, and your funds will be held until your merchant account provider releases them to you.

Merchant Account Freezes

While a freeze and hold are similar, they do differ. A merchant account freeze is a worst-case scenario for a merchant.

During a freeze, you will no longer be able to accept new credit/debit card transactions, and all of the income from recent transactions will not be deposited until the freeze is lifted.

When this happens, it can be a death knell for businesses depending on how established they are and what their cashflow situation is.

Avoiding Merchant Account Holds/Freezes

Transparency and communication are absolutes when it comes to your merchant account. Always refer to the terms and conditions in your merchant processing agreement before setting up your merchant account to avoid a freeze.

Terms and conditions will vary from provider to provider, so upon starting processing on your merchant account, be sure to review the T&C of your provider.

Merchants should avoid behavior that can trigger fraud alerts. When trying to prevent suspicious/abnormal processing behavior, merchants should:

Can Your Processing Provider Legally Hold Your Money?

Your processor can legally hold your funds as you signed a contract that allows them to do so. Always be sure to review the terms and conditions in your merchant processing agreement before partnering with a payment processing provider.

While merchants are usually able to negotiate specific provisions when signing a contract, you won’t be able to negotiate fundholding or reserve provisions out of your arrangements.

A hold for specific activities deemed “out of the ordinary” is standard in the processing industry. This is because your acquiring bank is essentially fronting you the money based on credit card transactions. Thus, the credit check during the time of application. Risk comes into play as the banks want to be sure that they will be able to recoup the money that was fronted originally.

Chargebacks, refunds, and fraud are the common culprits for banks not being able to recoup on specific transactions.

Should you review your contract with your merchant account provider, the holding of funds and reserve accounts will always be listed, and is always favorable to the bank.

What Causes Merchant Holds/Freezes?

Credit card processing companies can hold your funds for a variety of reasons. Here are the main reasons in which a payment processor will hold your funds:

As terms will vary from company to company, you will need to view the contract you have with your payment processor.

You can potentially break the terms of your contract without even knowing it, and this is something that sadly occurs more often than you would think.

Breaking Account Terms

Before opening a merchant account, you will need to sign a merchant processing agreement (MPA) You will find rules, limitations, and fees regarding your ticket size and monthly volume capacities for your account in this agreement.

Should you violate this, your processing bank can hold, freeze, or even terminate your account at their discretion. Once your funds are held, you will need to wait until the processing bank determines whether or not they wish to reinstate your account.

Excessive Chargebacks

Chargebacks are the main culprit for merchant account terminations. What can make chargebacks devastating for merchants is that, even if you win the chargeback, it still counts against your chargeback ratio.

Working with a suitable processor can significantly aid in reducing chargebacks. Below are some chargeback prevention tools.

Suspected Fraud

Suspicious behavior often results in the processor putting a hold on a merchant account. In most cases, the payment processor can act as another line of defense against fraud.

During suspected fraud holds, the funds will be held until the processing company carries out their investigation into the fraud.

Sometimes completely legitimate transactions can be looked at as potential fraud. An example of this is a significant spike in sales in a short period of time. Payment processors can see this with businesses that operate in seasonal niches such as fishing, summerwear, or travel.

Can Personal Credit Affect Merchant Holds?

While personal credit certainly can be problematic when applying for a merchant account, your personal credit will no longer be a factor once you’ve begun processing.

Should you have poor personal credit, your credit card processing company may enforce a reserve account instead of allowing you to operate and then hold a reasonable portion of your processed funds. They may also require a co-signor in order to approve the merchant account.

What To Do If A Merchant Account Is Frozen?

Unfortunately, once a processor freezes a merchant account, you have to let the process run its course. This timeline can vary greatly, depending on why your account was frozen in the first place.

The best thing you can do is determine what caused the account to be frozen and then immediately plan the recovery.

Should your account be frozen, you can speak with Corepay today, to see what we can do for your business. Once you fill out an application with us, we will swiftly respond and let you know the following steps to take.

Frozen accounts occur all too often, and the main reason is usually that the merchant is processing sales that are against terms of service for that provider.

Let’s take Paypal or Stripe, for example. These are two extremely popular and great processors; however, they don’t process all industries.

Anything considered high-risk by Paypal will result in your account being frozen/terminated/funds held.

Because Paypal doesn’t do its underwriting at the time of your application, your business may have been processing transactions efficiently until an underwriter audited your account.

You will want to speak with Paypal immediately to determine the reason and stay in the loop with them as they will let you know what the process will be in your case.

While this is ongoing, it is wise to quickly find a new payment processor to avoid any lost sales and damage to your brand. Should your account be frozen because you are operating in an industry that Paypal doesn’t process, you will want to apply for a merchant account with a provider specializing in high-risk accounts.

In severe cases, legal action can be taken; however, this is a very daunting and costly task.

Merchant Account Termination

An account termination with your provider is the end of the road for that specific relationship. Account terminations typically happen when a merchant breaks the terms of service or if their account wasn’t audited upon submitting their application. The account is later audited and deemed to be against the terms of service, resulting in termination.

When reviewing most processing contracts, account termination is usually at the processor’s discretion. It is common to see language such as, “We may terminate your account at any time for any reason.” Because of this, it is usually in the merchant’s best interest to determine what happened, learn from it, and find a new provider.

What Can Corepay Do For You?

Should your account have been terminated, Corepay can quickly review your business/operation and get you back to processing transactions, provided that your business is processing legal transactions in the operating jurisdictions. At Corepay, we strongly encourage merchants to process with more than one merchant account. While this aids greatly in risk mitigation should unforeseen circumstances occur with one acquirer/payment processor; it also can provide benefits in terms of approval ratios.

Corepay works with all legal businesses including:

When it comes to merchant holds and freezes, it is always better to be proactive. Should you ever have any questions or concerns regarding upcoming transactions, reach out to Corepay and see what we can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].