Firearms Merchant Accounts – Gun Clubs/Dealers

Last Updated on February 13, 2024 by Corepay

When it comes to high-risk industries, firearms is one of the most challenging industries to find reliable credit card processing. Therefore, a firearms merchant account with the correct payment service provider is a must for your business, be it e-commerce or brick and mortar.

At Corepay, we specialize in high-risk credit card processing, and we have a deep understanding of the firearms industry – whether it be for FFL dealers or gun shops.

Financial institutions and regulators/lawmakers have tightened restrictions for firearms merchant accounts/processing over the years while consumer demand has steadily grown.

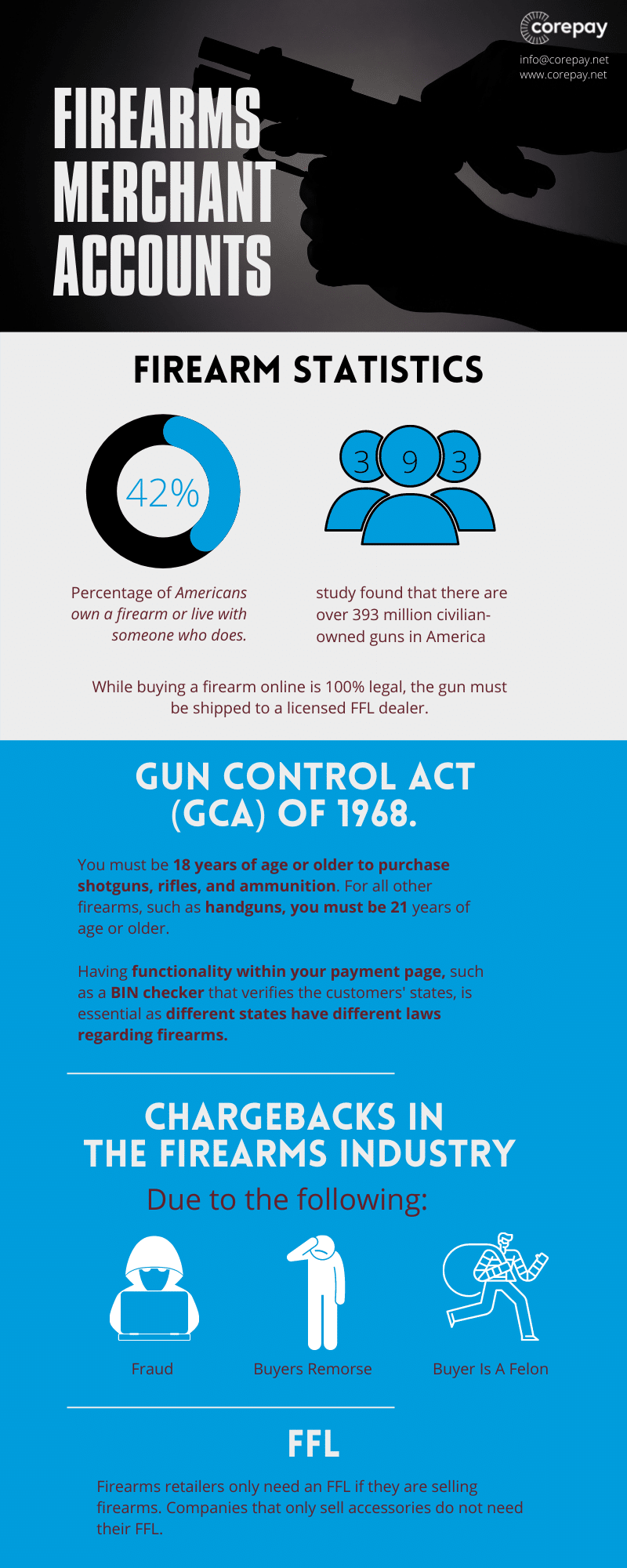

It is estimated that over 42% of Americans own a firearm or live with someone who does. Another study found that there are over 393 million civilian-owned guns in America. On top of this, the sales of ammo and firearms accessories are also heavily on the rise.

Like retail clothing, firearms sales are rapidly increasing through online platforms. While it is 100% legal to buy a firearm online, the gun must be shipped to a licensed FFL dealer.

If you’re in the business of firearms and looking to grow your online business, you’ve come to the right place. You will need to find reliable high-risk payment processing from a processor that understands the ins and outs of your industry.

Let’s look below at the different businesses we provide services for in the firearms industry: It’s important to note that Corepay offers payment processing for all licensed firearms businesses legally selling products.

Corepay Provides Payment Processing For The Following Not Limited To:

Applying For A Gun/Firearms Merchant Account

Since the firearms industry is high-risk and is always under the public eye, it is more challenging to get approved for your merchant account. However, with that said, the right high-risk payment processing provider will be able to get you approved.

Applying for your firearms merchant account is different in the sense that you will also need a Federal Firearms License.

When applying for your merchant account for gun clubs/firearms, you will need the following:

Why Choose Corepay For Your Firearms Merchant Account

We believe that payment processing for high-risk merchants is often overlooked, or not researched enough by business owners.

At Corepay, we understand the firearms industry, and we also have a great understanding of regulations, as well as chargebacks/fraud related to the industry.

We pride ourselves in always providing 100% transparency regarding fees and offering competitive rates and dependable service.

At Corepay, we truly care about your firearms business and understand the importance of reliable payment processing. Therefore, to keep pricing as low as possible, we waive application fees, annual fees, and set up fees.

With Corepay, you can expect the following for your firearms-related business:

Why Are Firearms Merchant Accounts Considered High-Risk?

The firearms industry is one of the more challenging industries to find reliable credit card processing. Firearms merchant accounts are deemed high-risk by acquiring banks and credit card processors for many reasons.

Over the years, the firearms industry has faced many criticisms regarding gun laws, restrictions, and the second amendment in general. This makes it risky for acquiring banks and processors when determining if they want to work with firearms-related businesses.

Below are some of the main reasons why firearms merchant accounts are deemed high-risk:

Regulations

Guns are heavily regulated federally, and the laws vary statewide as well. This makes the purchasing and selling of firearms online a little bit more challenging.

Due to the Gun Control Act (GCA) of 1968, you must be 18 years of age or older to purchase shotguns, rifles, and ammunition. For all other firearms, such as handguns, you must be 21 years of age or older.

The tricky part here is that firearms dealers must have a reliable way of verifying customer’s age before selling to them.

Having functionality within your payment page such as a BIN checker that verifies the states in which the customers are from is essential as different states have different laws regarding firearms.

For example, semi-automatic weapons are heavily restricted but are legal in most states.

Since there are federal restrictions regarding firearms, payment processors must undergo serious underwriting at the time of the application. This may result in a longer approval time, but that’s not always the case.

Firearms Are Heavily Politicized

Firearms can be a topic that many people aren’t interested in talking about due to politics. With the rise of events such as Columbine, many have pushed to have guns restricted even more than they already are.

Banks and processors typically do not want to have their names tied to political organizations to maintain complete transparency. Some banks have also taken an anti-second amendment stance in which they refuse to do business with legal firearms companies.

This makes it all the more challenging to find reliable payment processing, muchness processing at an affordable cost.

Reputational Risks

As mentioned above, firearms dealers have long been under the public eye and are often attacked in the aftermath of any shootings.

Securing a firearms merchant account is challenging as banks do not want to lose customers due to being tied to firearms companies.

Chargebacks In The Firearms Industry

While many high-risk industries face similar reasons for chargebacks including, fraud, and buyer’s remorse, firearms come with another important factor. Chargebacks can occur in the firearms industry if the person who is purchasing the gun is a felon.

It is illegal to sell to a felon and what typically happens is the customer will obtain someone else’s credit card and place the order. The charge will go through, and then it will get investigated, ultimately leading to a chargeback in which the processor and the bank lose money.

To avoid chargebacks, firearms merchants should do the following:

At Corepay, we are partnered with CB-ALERT to bring to you some of the best solutions to fighting chargebacks.

When it comes to firearms chargebacks, having 24/7 customer service is critical for companies. The faster you can speak with the customer and answer their questions, the better your chance of mitigating a chargeback and saving money.

Displaying all of the correct information on where to pick up their purchase and assuring your customer their package will be arriving on time is also crucial in fighting chargebacks.

Firearms Are Typically High-Ticket Items

When you are processing transactions typically over $50 per purchase, you will often be considered high-risk. Keeping chargebacks at a minimum will help lower your level of risk.

Fees

It is of utmost importance to understand what you are looking at when viewing your credit card processing statement.

Firearms businesses will notice that their MCC or Merchant Category Code is 5999, and this will include any company related to the sale of firearms/accessories.

Corepay promises to consistently deliver payment processing with highly competitive rates and bespoke customer service for all of our clients.

Choosing The Right Payment Processing For Your Firearms Business

Choosing the right processing solutions for your firearms business is no easy task. The most important thing when deciding on payment processing for the firearms industry is that you choose a high-risk payment processing provider.

Another thing to keep in mind is that different processors will offer drastically different rates and expertise with specific industries. With the firearms industry, you will need a payment processor who can help you with chargeback solutions and provide you with acquiring banks who understand your industry.

At Corepay, not only are we familiar with the industry, but we also have partners who solely work with firearms businesses.

Comparing rates is a must when deciding on your merchant account for guns/accessories. We are 100% confident that we can provide you with highly competitive rates and reliable payment processing.

Another thing to remember when choosing a provider is the approval time is not always the most important thing when choosing. Just because a provider can begin processing payments faster does not mean you get dependable payment processing and high-risk processing. The example that we see often is when a firearms/high-risk business begins processing payments with a low-risk processor such as Paypal.

Can Merchants Use Paypal, Square, Or Stripe For Firearms Payment Processing?

When searching for your payment processing partner for the firearms industry, it’s important to note that low-risk solutions such as Paypal, Square, and Stripe are not viable options as they do not work with high-risk industries.

While Paypal, Square, and Stripe are all great for their purpose, they only work with low-risk industries. While you might be able to begin processing firearms-related transactions with Paypal, Square, or Stripe, you will end up having your merchant account frozen or terminated in the following six months.

If you’re wondering why one of these processors shut down your account, it is because high-risk industries are against their terms of service. Should they deem your business risky, they can choose to terminate your account.

Companies such as Paypal also do not perform their underwriting at the time of the application. This means you can begin processing firearms transactions only to have your account terminated and funds held for up to 180 days.

Firearms Industry Overview

While many citizens negatively view the firearms industry, the number of firearms globally is steadily increasing annually.

It is estimated that 72 million people own a gun(s) in the United States. In 2021, the United States firearms market has eclipsed over 15 billion dollars, and it’s expected to grow another 7.2% in the next year.

For online retailers, the top 10 countries that own firearms are as followed:

- United States

- Falkland Islands

- Yemen

- New Caledonia

- Serbia

- Montenegro

- Uruguay

- Canada

- Cyprus

- Finland

On top of this, sales in accessories to guns are also rising, such as holsters, sights, grips, muzzles.

What Is A Firearms Merchant/Gun Club Account?

A firearms merchant account is essentially the financial product that allows firearms/FFL businesses to be tied into banks/major credit card companies such as Visa, Mastercard, Discover, and American Express.

Your payment processor manages the merchant account on behalf of your business and provides support/monthly reporting.

Do You Need An FFL To Sell Accessories?

Firearms retailers only need an FFL if they are selling firearms. Companies that only sell accessories do not need their FFL.

Wrapping Up

Boasting over two decades of reliable credit card processing experience, Corepay is certain we can get your firearms business approved, stay approved and help you grow throughout the years to come.

As online shopping continues to grow, having reliable payment processing that understands the firearms industry and how acquiring banks view them is something that can’t be ignored.

Fill out an application below and find out what Corepay can do for your firearms business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].