Best Subscription Merchant Account In 2024

Last Updated on January 21, 2024 by Corepay

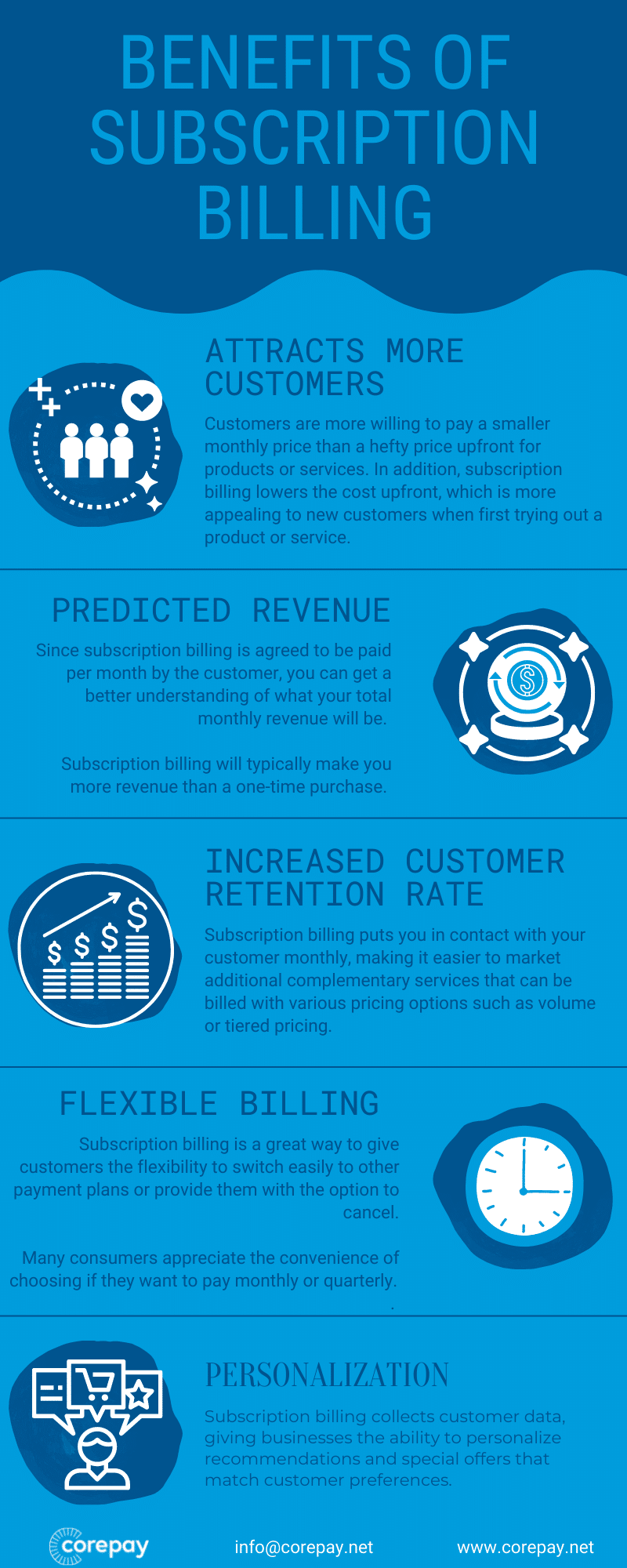

For years now, subscription services/recurring billing models have gained popularity with no signs of slowing down. As a result, subscription billing is prevalent in almost every industry as it is quick and convenient for customers.

If your business specializes or offers recurring/subscription billing, you will need a merchant account that is tailored to your subscription needs.

This article will break down subscription merchant accounts and why we believe we are an excellent fit for your payment processing needs.

Not all merchant accounts are created equally and we can provide you with everything your business needs to succeed. At Corepay, we are proud to offer over two decades of credit card processing experience to assist your business needs.

*If you’re an e-ecommerce store, we also provided top-notch e-commerce merchant accounts.

Some of the industries Corepay assists with subscription billing include the following:

- Adult

- Online dating

- Health and beauty

- Supplements

- CBD

- Vape products

- Meal boxes

- Car washes

- Clothing boxes

While the recurring billing model is highly profitable, it is typically deemed high-risk by processors/acquiring banks.

Why Are Subscription/Recurring Business Models Deemed High-Risk?

Since subscription services exist in most industries, you might be surprised to learn that they are all considered high-risk. The main reason they are deemed high-risk is due to chargebacks.

Subscription services see many chargebacks, which are usually higher in frequency than with other payment methods, such as a typical one-time payment.

So, why do recurring billing merchants see more chargebacks? There’s a number of reasons; however, the main reason is that customers often forget to cancel on time and request a chargeback due to their own forgetfulness.

Another reason why chargebacks are frequent is that most subscription services are card-not-present transactions which have a higher chance of chargebacks.

Distribution is another key reason for chargebacks. Certain companies aren’t in charge of their own fulfillment, such as a magazine subscription in which the magazine hires a third party to deliver the magazines.

The lack of control means that these types of companies cannot readily take care of fulfillment issues that come up.

Other merchants utilizing subscription billing could be operating in industries that are considered high-risk by banks and processors. Examples of this would be a CBD subscription service or an online dating subscription.

How To Apply For Your Recurring Billing Payment Processing

Before processing transactions, you will need to apply for your subscription merchant account. Our goal is to make the application process as easy as possible, ultimately allowing for quick approvals and seamless integration for all of our clients.

A trained specialist will reach out to you and provide you with the following steps to get your merchant account up and running.

The more information you can provide upon applying, the faster we can get your account approved.

When applying for your merchant account, it is imperative to note that good credit helps keep your fees at a lower price; however, you can still be approved with poor credit.

At Corepay, we strongly urge you to compare our rates with other high-risk processing rates upon applying with us.

Below is a list of what you need when applying for processing:

- Articles of incorporation

- Principal’s driver’s license

- Company EIN document

- Proof of operating address

- Financial statements – both personal and business

- Voided check to prove bank account

- Business plan to help us better understand your business

Below are a few other things you can share with your payment service provider:

- Information on how your business handles and fights chargebacks – Customer service

- Provide an understanding of the services your business provides

- Return policies

- Refund policies

When payment processors review your application, they will determine the level of your risk based on all information you can provide to them.

Why Choose Corepay

If you’re looking to boost your subscription-based revenue and grow your client base, look no further than Corepay for your payment processing. Subscription/recurring merchants in the US and worldwide can use our payment processing services to fight chargebacks and boost their revenue with 100% transparency.

At Corepay, we understand subscription/recurring merchant accounts and know exactly what you need to succeed on the payments front.

We offer the following for our travel merchant accounts:

- Exceptional 24/7 customer service

- Competitive rates: Our goal is to provide you with the lowest possible pricing to allow your business to grow with optimal profitability

- Swift approval times: Fast approvals maximize the time that recurring billing merchants can earn more sales

- High volume: We have a payment gateway, Solidgate, built for high-risk, high volume, recurring billing processing

- Multiple currencies: Having the ability to process multiple currencies can help your business take full advantage of global sales

- Security: We have a PCI-Level 1 secure payment gateway that is monitored around the clock and regularly tested for security issues

- Mobile payments: Accepting payments from mobile is vital for all business models

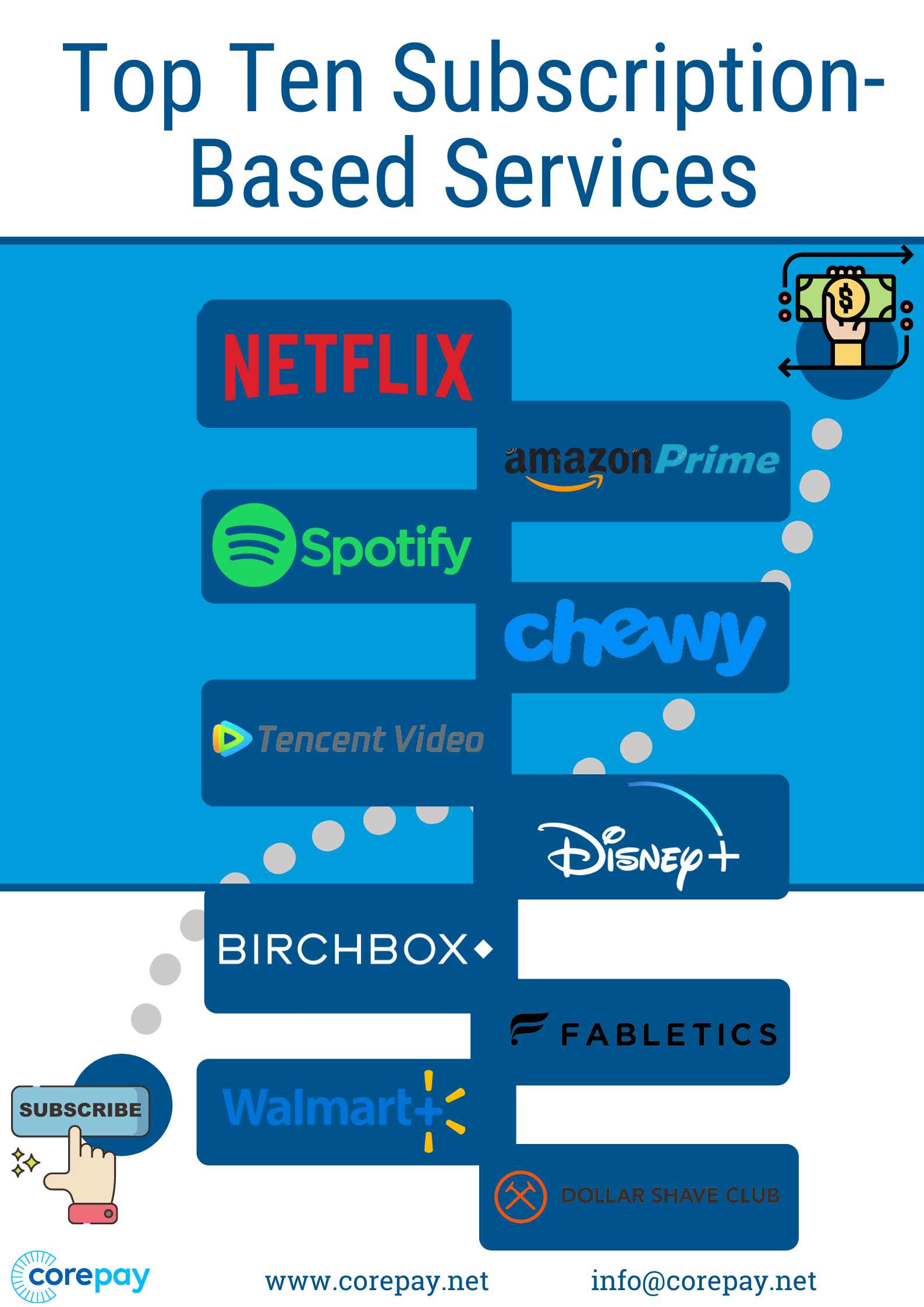

Subscription Services Overview

Subscription-based pricing has become one of the most popular forms of billing. Let’s take a look into the biggest subscription-based services in the world today.

- Netflix

- Amazon Prime

- Spotify

- Chewy

- Tencent Video

- Disney Plus

- Birch Box

- Fabletics

- Walmart Plus

- Dollar Shave Club

Subscription VS Recurring Billing Model

Subscription-based billing is the same thing as recurring with one difference. Recurring payment entirely depends on credit/debit card, while subscription services and be paid for in more than one form of payment.

With recurring billing, you will likely have to store a form of payment such as a credit or debit.

What To Do If Paypal/Stripe/Square Terminate Your Subscription Merchant Account

If your account was frozen or terminated with Paypal, you’ve come to the right place. While you can’t speed up the process of Paypal auditing your account, you can quickly find reliable payment processing.

Paypal can legally hold your funds for up to 180 days with no questions asked. Unfortunately, there isn’t much you can do once they put your account on hold, and you won’t be able to access your funds.

We are confident that we can get your account up and running swiftly.

Wrapping Up

Finding reliable payment processing for your subscription-based business can be challenging and confusing. However, we are confident that we can provide you with reliable and affordable payment processing, along with chargeback mitigation, which will allow you to maximize your profits.

Please fill out the application below to find out what we can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].