Online Dating Merchant Accounts: Complete Guide To Finding Your Match

If you’re looking for the most reliable online dating merchant accounts for the USA and Europe, you’ve come to the right place. At Corepay, we have been working with dating merchants for nearly two decades and understand the intricacies of the industry in every way.

Since you are considered as operating in a high-risk category, this means that you will be under increased scrutiny from acquirers and payment processors.

Applying

Applying for a dating merchant account is exciting, as it means you are anticipating sales in the immediate future. That said, not all payment providers are created equally, and it is imperative to do thorough research before choosing your processor.

Fortunately, deciding on a payment service provider does not have to be a monumental task, as you can easily compare providers online before applying.

If you choose to use Corepay, we make the process as seamless as possible. Once you submit your application and are internally pre-approved for your high-risk merchant account, you will be assigned an account manager at Corepay.

Below is a list of some of the dating industry subtypes that Corepay services, all of these fall under the merchant category code(MCC) 7273.

Corepay is proud to offer the following for online dating merchant accounts:

When applying you will need the following:

Corepay is an online dating payment service provider that has over two decades of experience in high-risk payments with many clients in the industry.

Why Are Online Dating Merchant Accounts Considered High-Risk?

Being considered high-risk is not the end of the world.

However banks may view dating merchants as having adult-industry content and therefore automatically decline the merchant. This is usually due to the potential of having nudity on the dating site, which is typically the defining characteristic of an adult-coded merchant.

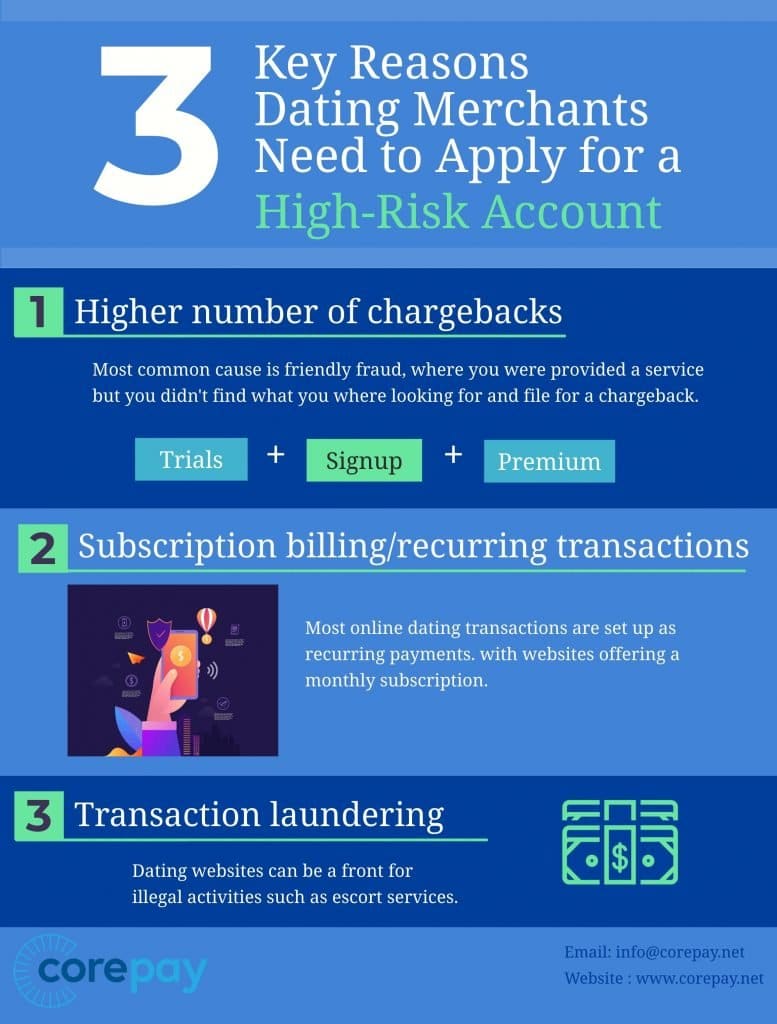

The main reasons that dating merchants will need to apply for high-risk merchant accounts are the following:

Online Dating Chargebacks

Chargebacks in the dating industry happen frequently. While there are several reasons why chargebacks occur, the most common cause is when a member of a site doesn’t like the services for which they are paying. This can cause an element of buyer’s remorse, and rather than seek a refund, they instead immediately file a dispute with their issuer, triggering a chargeback.

Corepay offers chargeback mitigation and dispute management services to reduce the impact of chargebacks on your online dating business with our partner product, CB-ALERT.

Subscription Billing/Recurring Transactions

Most online dating transactions are going to be CNP transactions. These transactions notoriously have a higher number of chargebacks than card-present (CP) transactions simply because you can not as easily prove that the cardholder actually authorized the use of the card.

Recurring payments frequently occur in the dating niche as most websites offer a monthly subscription amongst their offerings.

Transaction Laundering

Dating websites can be used as fronts for different industries. Some of these other industries can either be illegal or not accepted by the given acquirer. An example of this would be someone using a dating website as a coverup for escort services.

Transaction laundering can be a form of money laundering used by criminals secretly to process their credit card payments.

So, how is this done? Transactions are laundered when a merchant submits credit card charges for a business other than the one that was approved by the acquirer. The “front” can, of course be a website rather than a classic brick and mortar store.

Credit Card Processing For Dating Accounts

Over 40% of the U.S. population is currently using online dating services, so having a full spectrum of payment options that are fast and secure is an absolute must.

Corepay offers credit card processing for all major credit cards, including Mastercard, Visa, Discover, American Express, JCB, and the ever-growing Alipay and Wechat for your online dating business.

Over 70% of the United States currently owns and uses a credit card, with the average person carrying at least 3 cards. Outside of the United States, Canada currently leads the charge with over 82.5% using credit cards for transactions. Expect this number to continue to grow, as more countries shift towards going completely cashless.

Being able to process credit cards for your dating app or website is absolutely vital and there is simply no way around this.

Competitive Fees

When opening up a high-risk merchant account, fees will vary. Since dating is considered high-risk, it is likely you will pay more than a typical brick-and-mortar account. However, you will also be able to safely process more transactions with less fear of account closure and then having funds held.

Corepay waives application/setup fees and excessive early termination fees to maintain transparency.

Why Corepay Is Your Perfect Match

Corepay knows the online dating industry exceptionally well, having many years of experience in high-risk merchant accounts. This means we understand the risks associated with the inndustry, while always offering bespoke service and security for our clients.

At Corepay, we want to help you get approved, stay approved, and grow your dating business into everything you dreamed.