Visa’s Rapid Dispute Resolution – RDR

Last Updated on March 4, 2024 by Corepay

Looking to stop bleeding revenue to chargebacks? Meet Visa’s Rapid Dispute Resolution.

Refunding sales is difficult for merchants, whether you are established or just getting started. However, issuing a refund to a customer is always better than facing a chargeback. Once a customer decides they are filing a chargeback dispute, they are typically cutting out the merchant at this point. With Visa’s Rapid Dispute Resolution (RDR), merchants now have one final opportunity to refund the customer rather than deal with a dreadful chargeback. This article will cover everything merchants need to know about Rapid Dispute Resolution and explain why it’s such a helpful tool.

What Is Visa’s Rapid Dispute Resolution, And How Does It Help Merchants?

Visa’s Rapid Dispute Resolution is the newest Verifi product that upgrades Visa’s Chargeback Dispute Resolution Network. RDR is all the rage in 2023 and will be critical to the success for merchants moving forward.

Visa has updated several products in the last year, one of those being Order Insight – formerly known as Verifi.

RDR allows merchants to enter a set of rules for types of disputes that they prefer always to accept and refund. When a dispute is received that matches the merchant’s set of rules, RDR will alert the acquiring bank to issue a refund, mitigating a potential chargeback automatically. Before we go into great detail about RDR, let’s highlight the main points right away.

- What is RDR? RDR is one of the best chargeback prevention tools currently available. Verifi created it, and it is packed and sold by various resellers, such as CB-ALERT.

- Why Use RDR? To lower your Visa disputes and show your processor/acquiring bank you are serious about maintaining your company’s healthy chargeback ratio.

- When? Merchants should take advantage of RDR as quickly as possible, if they not already using it.

- How Does It Work? RDR allows the acquirer to refund the customer automatically before it becomes a chargeback.

*We recommend our sister company CB-ALERT for your Visa RDR services.

Why Should Merchants Use RDR?

RDR benefits both merchants and the consumer. Since the consumer is looking for a refund, they can get their refund while the merchant avoids a chargeback from an irate customer.

By giving the customer a better user experience, they are more likely to return for another purchase.

RDR can benefit your business in several different ways. Below you will find the main reasons why you should be using RDR:

- Reduce Chargebacks

- Improve User Experience

- Save Money On Chargeback Fees

- Avoid Having Your Merchant Account Frozen/Terminated

- Inform Merchants Of Disputes Quickly

Reducing Chargebacks

RDR works to resolve customers’ complaints before they file a chargeback. Not only does this save your company chargeback fees, but it will also help you negotiate lower processing fees.

When running an online business, one of the most powerful things merchants can do is lower their chargebacks.

Improve User/Customer Experience

RDR alerts merchants so that they can quickly respond to angry customers. In addition, merchants can significantly improve customer service by using RDR to refund customers instantaneously.

Save Money On Chargeback Fees

While some merchants may be hesitant to issue a refund, they need to remember that once fees and overhead are included, the cost of a chargeback can be double the original purchase price. So, yes, issuing a refund might not be the greatest feeling in the world, but giving a refund is always better than a chargeback.

Avoid Having Your Merchant Account Frozen/Terminated

Once merchants reach a certain number of chargebacks, their processor may freeze or terminate their account, leaving the merchant with frozen funds.

RDR works as a highly effective tool for decreasing chargebacks and should be integrated into your current chargeback prevention system.

Be Alerted Early On In The Customers Negative Experience

When merchants are alerted early in a customer’s negative experience, they are given the opportunity to fix the situation. Having the ability to resolve a customer’s problem early can improve the customer experience and help you avoid a chargeback.

How Does Visa Rapid Dispute Resolution Work?

The first thing you need to do as a merchant is enroll in RDR. To register, you will need the following:

- Merchant ID -MID

- List of billing descriptors used for your MID

RDR works by taking liability for disputes and refunding the cardholder before becoming a chargeback. Merchants are given the freedom to set the rules however they choose.

When issuing banks see a merchant is enrolled in RDR, they will process disputes differently. Instead of the dispute becoming a chargeback, it will now be handled based on the following:

- Non-Visa dispute

- Visa dispute

If the dispute is a non-visa dispute, it will be paused, and the merchant will be alerted. The merchant now has 72 hours to respond. RDR will alert the merchant and give them the option also automatically to refund the customer.

Should RDR receive a Visa dispute, it will automatically refer to the merchant’s ruleset. Every merchant is responsible for their own rules that are based on the following:

- Transaction amount

- Date of transaction

- Specific product

- Dispute category

- Currency

- Purchase date and time

- Issuer’s bank ID

- Chargeback reason code

Note: If the merchant sends an “accept” response for any of the above results, the customer will be refunded immediately. Should the merchant mark it as “decline,” they will go through the next steps in a chargeback.

Merchants are protected by Visa’s guarantee that the dispute is resolved and that no chargeback will occur.

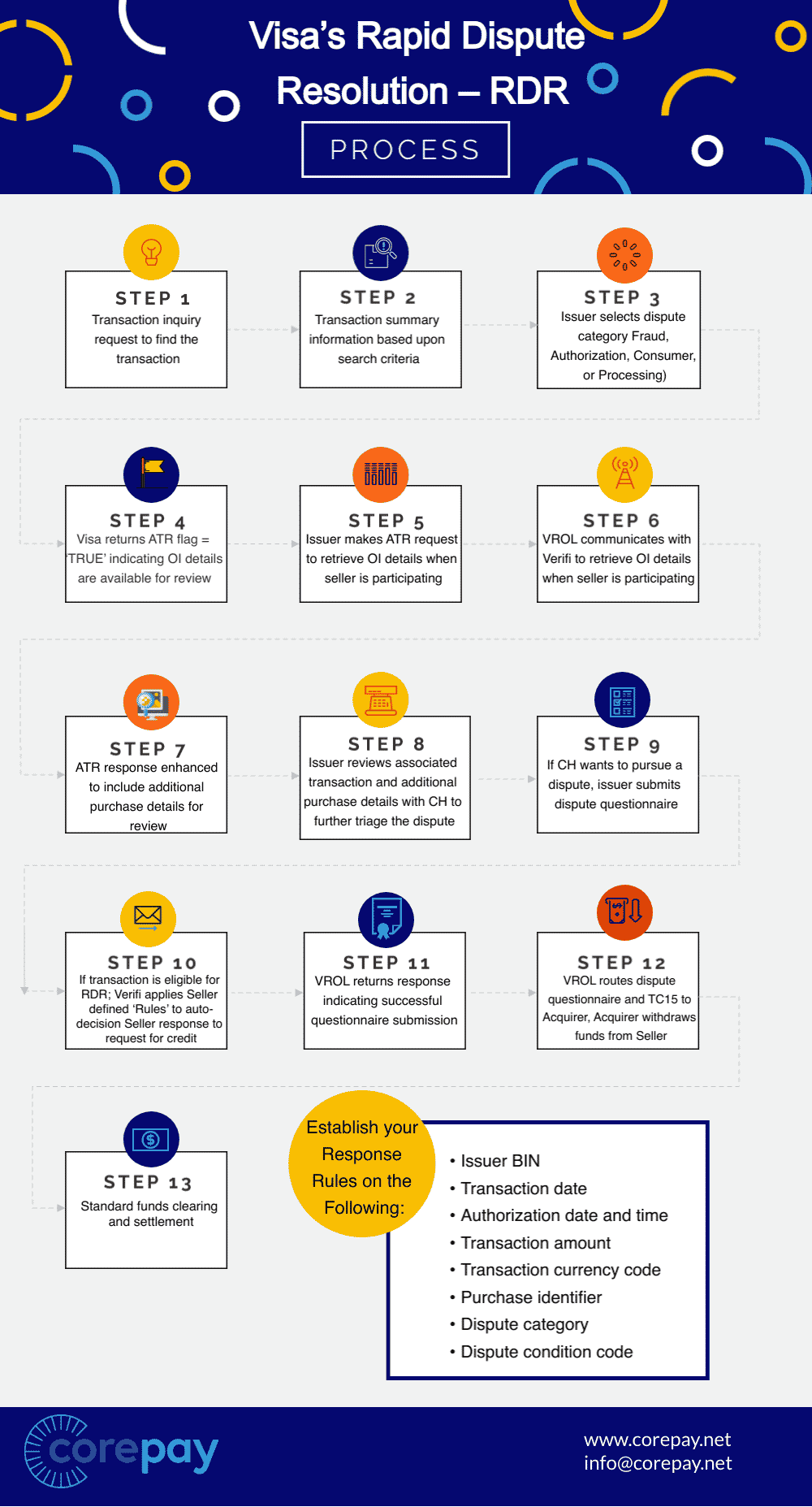

Here is the full process of RDR:

- Transaction Inquiry request with search criteria to find the transaction

- Transaction summary information based upon search criteria

- Issuer selects dispute category (Fraud, Authorization, Consumer, or Processing)

- Visa returns ATR flag = ‘TRUE’ indicating OI details are available for review

- Issuer makes ATR request to retrieve OI details when seller is participating

- VROL communicates with Verifi to retrieve OI details when seller is participating

- ATR response enhanced to include additional purchase details for review

- Issuer reviews associated transaction and additional purchase details with CH to further triage the dispute

- If CH wants to pursue a dispute, issuer submits dispute questionnaire

- If transaction is eligible for RDR; Verifi applies Seller defined ‘Rules’ to auto-decision Seller response to request for credit

- VROL returns response indicating successful questionnaire submission

- VROL routes dispute questionnaire and TC15 to Acquirer, Acquirer withdraws funds from Seller

- Standard Funds clearing and settlement

Make The Changes On Your CRM

While you are refunding the amount to the customer, you will still need to change the sale inside of your CRM.

You will want to do the following:

- Check and see that the transaction was refunded

- Make sure it was initiated through RDR

- Update your customer blacklist

- Cancel subscriptions and block access to any other platforms you have

What Is The Best Way To Use RDR?

- Analyze customer data as well as your chargeback ratio

- Set your rules

- Analyze data after 30-60 days

- Tweak your rules

- Analyze data

- Make tweaks if needed

Merchants will decide which types of chargebacks to invest their time and labor. The best way to effectively use RDR is trial and error, as it is used differently for certain businesses. For example, if a company is struggling with its chargebacks, it will need to be more aggressive when setting its refund rules.

To best understand, let’s break chargebacks down into two categories: friendly-fraud and true-fraud. True fraud or a merchant’s error is challenging to fight and not worth it. But, on the other hand, Friendly fraud is easier to fight and win.

With friendly fraud, the customer typically has no legitimacy around their reason for the dispute. The murky waters with friendly fraud usually look like true fraud.

This is where the merchant’s research can come in handy. Should the merchant understand their customers and their specific inventory, they can set the RDR ruleset to match particular criteria.

Analyze Data

Why are chargebacks occurring?

Merchants should set their RDR ruleset to target chargebacks that have patterns such as:

- Specific regions – Sometimes, chargebacks for certain businesses can be more frequent in particular regions.

- Particular products – If you have a product that sometimes has specific problems, it’s wise to refund those with RDR.

- Specific price-points – Certain price-points might have a higher number of chargebacks.

All three of these can show important patterns to a merchant. Some merchants can also choose to automatically refund disputes under $75-$100 as the cost of representment alone would be greater than the refund.

Once you have dialed in RDR, make sure to monitor your ROI so that you know you are saving money.

Here are the main questions to ask yourself when analyzing data:

- Are cases progressing through OI to RDR?

- How often are you refunding customers? Should you tweak this?

- What are the main dispute reasons?

- Are you winning chargebacks?

Does RDR Always Issue Refunds?

RDR allows merchants to set their own rules and guidelines for issuing a refund. As a result, merchants can choose precisely how they want to handle specific refunds.

If you’re a merchant who is concerned about issuing too many refunds, the question you need to ask is whether or not you’re willing to accept the risk of unwanted chargebacks?

What Are The Differences Between Order Insight, RDR, And Chargeback Dispute Resolution Network?

At CB-ALERT, we understand the importance of having an effective chargeback management strategy in place.

All three of these tools are highly effective in their own way regarding chargeback disputes. RDR, CDRN, and Order Insight are integrated tools and complement each other.

Let’s take a look at the dispute process to understand the differences between OI and RDR and know what to expect during the dispute.

1) Order Insight

Order Insight is the initial line of defense that merchants can implement. The bank is able to request purchase information that can potentially mitigate the dispute. At this stage, no refunds are made to the customer.

2) RDR

RDR is the next step in the chargeback dispute process should OI not resolve the issue. RDR seeks to make good on the customer by issuing them a refund on the purchase. The primary purpose of RDR is to refund customers based on the rules the merchant has set.

3 CDRN

This platform allows the merchant to refund a particular transaction if the dispute is for a non-Visa transaction.

While RDR, CDRN, and Order Insight are all effective when it comes to fighting chargebacks, merchants can and should also take advantage of our tool.

If you’re looking for the best way to fight chargebacks, you should be using several different tools outside of the Visa-specific tools. Here are a few we recommend:

- CB-ALERT

- Consumer Clarity (Mastercard)

- Identity Protection tools – 3DS, CVV, AVS

Conclusion

At Corepay’s sister company, CB-ALERT, they believe in a multi-tool approach which consists of our own product to fight chargebacks. RDR is an extremely powerful tool that merchants should use to lower their chargeback ratio. Merchants should constantly tweak their ruleset based on data they collect from customers. The one thing merchants should be cautious of is setting their ruleset to being too forgiving. While this is sometimes the only way forward, fraudsters spread information via social media, and they can catch on to merchants known for refunding without question.

Remember, at the end of the day, exceeding Visa’s chargeback threshold is the one thing you want to avoid at all costs.

If you are near the threshold and looking for ways to decrease your chargebacks, we can help you significantly lower your chargebacks by assisting you with RDR and our own tool.

Chargeback management companies like ourselves will show you the best way to implement RDR while not breaking the bank.

While RDR is a fantastic tool that stops a significant number of chargebacks from occurring, we always advise all of our clients to figure out why the chargebacks/complaints are happening in the first place.

Now that you understand RDR and why it’s essential to chargeback management, we urge you to signup for a demo today if you are looking for assistance or effective ways to lower your chargebacks.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].