Credit Repair Merchant Accounts 2024

Last Updated on February 5, 2024 by Corepay

If you run a credit repair business, you likely know the struggles of finding reliable payment processing. While the credit repair industry is a hefty 4 billion dollar industry, it doesn’t come without its hassles. Credit repair merchant accounts are accounts that are tailored to your businesses specific needs, ultimately optimizing your profitability.

At Corepay, we are confident we can provide you with a merchant account tailored to your specific needs, ultimately allowing you to grow to your full potential.

The credit repair industry is challenging and is viewed by banks and processors as a high-risk business for several reasons.

So, why do we feel we can help you at Corepay? Because we understand the credit repair industry and believe in the end goal, which is assisting individuals in getting out of debt.

When run correctly, we also know that the credit repair business can be highly profitable, meaning you will need a merchant account specifically tailored to your needs as a credit repair company.

Credit Repair Businesses Corepay Serves

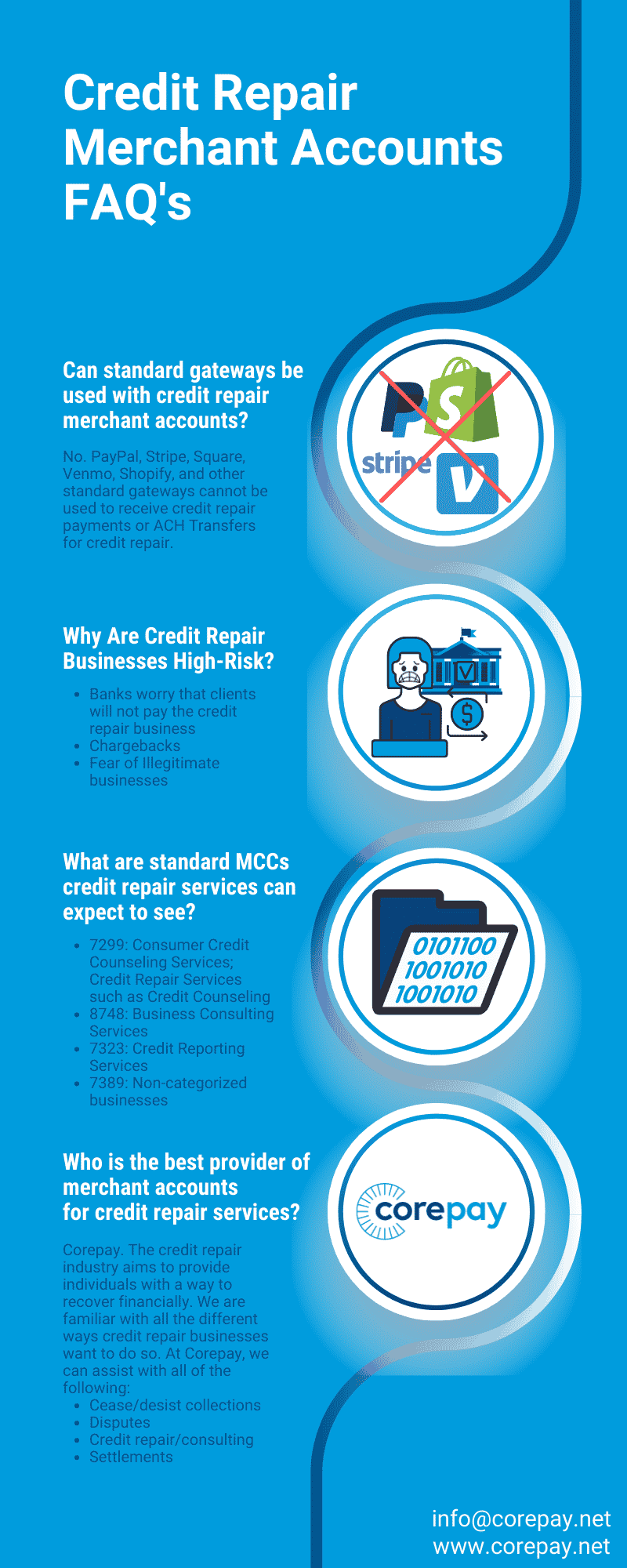

The credit repair industry aims to provide individuals with a way to recover financially. We are familiar with all the different ways credit repair businesses want to do so. At Corepay, we can assist all of the following:

- Cease/desist collections

- Disputes

- Credit repair/consulting

- Settlements

If you own a credit repair business that operates legally, we are confident that we can help grow your business to the next level.

Why Are Credit Repair Businesses High-Risk?

Credit repair businesses are labeled high-risk for several reasons. Here are the main reasons:

- Banks worry that clients will not pay the credit repair business

- Chargebacks

- Fear of Illegitimate businesses

On-Time Payments

Banks and processors worry that the credit repair businesses are working with clients who are unable to make timely payments.

If the credit repair business has enough clients that aren’t paying, they are in trouble. For this reason, having established processing history will help when it comes to landing your merchant account.

Chargebacks

Chargebacks plague nearly every high-risk industry. While they are unavoidable, there are many things merchants can do to improve their chargeback ratio.

You will pay higher fees if you have high chargebacks and risk having your merchant account terminated.

Excessive chargebacks indicate to banks and processors that something is going wrong with your business. You will also face penalties if you aren’t able to get them under control.

Credit repair merchants are vulnerable to chargebacks due to the industry and clients. Most customers who need credit repair businesses have little to no money.

Why Choose Corepay For Your Credit Repair Merchant Account?

At Corepay, we are confident that we can help you whether you are a startup or you have been processing for years. We have a suite of anti-charge back tools, our proprietary gateway, and multiple partnerships with acquiring banks to ensure you receive the most competitive rates.

We also can get you approved and processing payments swiftly.

Having a merchant account that you control and don’t have to worry about having terminated is essential for a credit repair business.

With a credit repair merchant account through Corepay, we can guarantee the following:

- Highly competitive rates: We understand that providing you with the lowest possible processing fees allows your business to continue growing with optimal profitability.

- Fast approval times: Our quick approvals maximize travel merchants’ time to make sales. We can provide approvals typically between 24-72 hours.

- High volume processing: Our payment gateway, Solidgate, is explicitly designed for high-risk companies processing high volumes.

- Multiple currencies: We understand the importance of being able to accept different currencies

- Security: We have a PCI-Level 1 secure payment gateway that is monitored around the clock and regularly tested for security issues

- Mobile payments: You can easily accept payments from customers paying with their mobile device

- Waived application, set up, and annual fees

- 24/7 customer service

We are also experienced in debt collection merchant accounts, should you be interested.

MCC Categories For Credit Repair Companies

Credit repair businesses can find various Merchant category codes on their statements. These codes are used to identify businesses’ primary purpose.

The following are the MCCs you can expect to see:

- 7299: Consumer Credit Counseling Services; Credit Repair Services such as Credit Counseling

- 8748: Business Consulting Services

- 7323: Credit Reporting Services

- 7389: Non-categorized businesses

How To Increase Volume Caps For Your Credit Repair Merchant Account

Increasing volume caps is essential when trying to grow your business. Established businesses don’t have as much trouble doing so as startups.

The easiest way to increase your volume caps as a merchant is as followed:

- Establish good credit

- Have a squeaky clean website

- Maintain low chargebacks

- Have great customer service

- Develop a good relationship with your processing partners

Applying For A Credit Repair Merchant Account

Applying for your merchant account is an exciting and stressful time. We understand you might be pressed on time, and we ensure a swift process.

With this being said, here are the things you will need prepared for any credit repair type of business:

- A fully compliant website

- A Voided check or proof of bank accounts

- A Driver’s license or a valid government I.D.

- Social security number

- Six months of processing statements, if possible

- Articles of incorporation

- A fulfillment agreement

- A customer service center agreement (if outsourced)

- Chargeback ratio under 2%

What Do Our Underwriters Look For During The Application Process?

We want to see at Corepay that you are running a legitimate business and have a growth plan. We want to work with like-minded business owners who wish to achieve great things.

During this process, we will look for any red flags that the acquiring bank might point out and ensure you are up to date with all compliance issues.

We will then examine your risk levels by looking at your credit card processing history, chargebacks, credit history, and your website.

If you believe you have anything questionable, it’s best to let us know so that we can guide you on what you need to do to fix it.

The more evidence you can show that you are a reputable business, the better when applying for a high-risk merchant account.

Can We Use Paypal/Stripe/Square As A Credit Repair Business?

Paypal, Stripe, and Square mainly work with low-risk businesses unless you have substantial processing history with extremely low chargebacks.

Technically, all businesses can begin accepting through Paypal. The problem is that Paypal doesn’t work with any company classified as high-risk.

Underwriting for high-risk businesses must be done at the time of the application to avoid surprises. However, with options like Paypal, the underwriting isn’t performed immediately and can take up to six months.

This means businesses can start accepting payments only to have their merchant account terminated later for breaking terms of service.

When this happens, your funds will be frozen for up to 180 days, meaning you cannot access any of them until it is lifted.

Paypal Shut My Merchant Account Down For Credit Repair

If this happened, we are very sorry to hear. On a positive note, the following steps are relatively simple:

- Reach out to Paypal to determine why

- Find a new processing partner that is capable of supporting your business

- Diversify and add another merchant account in the future in case this happens again

Wrapping Up

If you’re in the market for choosing the best credit repair merchant account, we strongly suggest filling out an application with us below.

Since we are confident that we are a great fit, we recommend shopping around to make sure you make the right choice with your payment processing partner.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].