High Risk Credit Card Processing Fees Guide

Last Updated on July 7, 2023 by Corepay

Are you looking to learn more about high-risk credit card processing fees? Then, you’ve come to the right place. In this article, everything both green and seasoned veteran merchants need to know about high-risk credit card processing fees.

Since you’ve landed on this page, you probably already know that high-risk merchants will typically be subject to higher credit card processing fees.

With all things said, it’s not all doom and gloom, and there are certain things every merchant should know when it comes to processing fees. If you are unaware of how to read your current credit card processing statement, we urge you to check out our linked post above.

High-risk credit card processing fees vary heavily from one processor to the next. For this reason, we recommend comparing rates and services before choosing a processing partner. We can do this at Corepay because we are highly confident in our rates, and we pride ourselves on transparency.

So, what are the high-risk merchant account fees that you can expect when signing up for an account with a payment processor?

The different types of fees you can expect as a high-risk merchant are the following:

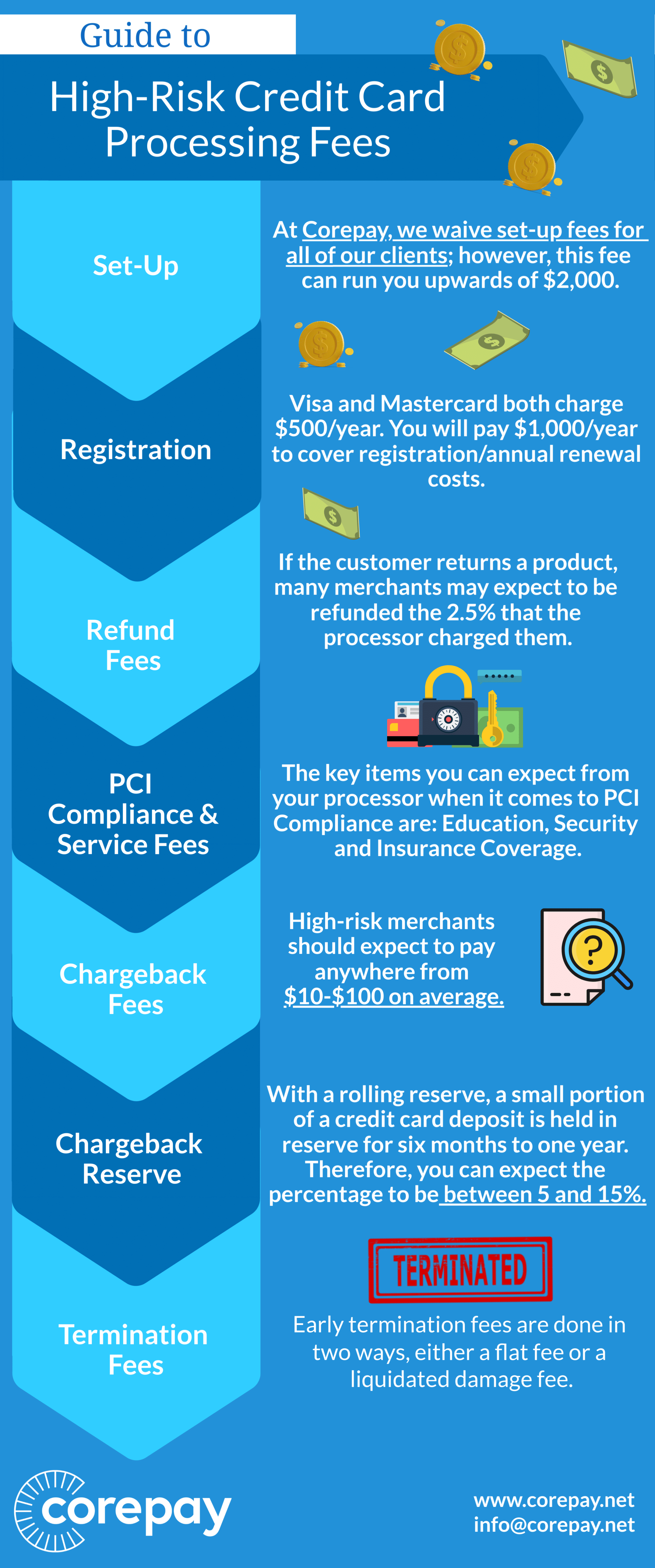

- Set-up

- Registration

- Refund fees

- PCI compliance/services fees

- Chargeback fees

- Chargeback reserve

- Termination fees

Set-Up/Registration Fees

Set-up fees are standard in the high-risk industry. When applying with different processors, please pay attention to whether or not they waive this fee. At Corepay, we waive set-up fees for all of our clients; however, this fee can run you upwards of $2,000.

In terms of registration/annual fees, you will pay these for registering as a high-risk merchant. Credit card brands such as Visa, Mastercard, Amex, etc., will initially charge your processor these fees. After that, you will then reimburse your payment processor.

Note: Annual/registration fees are paid every year. Visa and Mastercard both charge $500 per year for these fees. You will pay $1,000 per year to cover registration/annual renewal costs.

Refund Fees

Transparency is one of the most important things when it comes to choosing a payment processor. Refund fees play into this. For example, you have a customer who purchases an item, and your processor charges you 3%. The customer then decides to return the product. Many merchants may expect to be refunded the 2.5% that the processor charged them. While some processors may do this, others won’t and might even charge you an additional 3% to process the refund.

Be sure to ask your payment processor about refund fees before signing, as there very well be refund fees in your merchant account agreement.

PCI compliance/services fees

PCI compliance fees/costs are calculated differently by every processor. Prices fluctuate because of a few different variables. One of these variables is whether or not your payment processor offers PCI compliance as a service. Some payment processors will choose to charge you if they provide it, whereas others may not.

Below we will break down a few scenarios in which processors typically handle PCI compliance fees.

- The payment processor offers PCI compliance and charges merchant: This scenario is the most common in the credit card processing world. The charged fee will vary depending on what your processor chooses to charge you to keep you compliant.

- The Payment Processor doesn’t offer PCI compliance: In this scenario, you will need to figure out a solution to remain in compliance.

- The Payment Processor Provides PCI Compliance but doesn’t charge you: This is the preferred method for merchants. You are given PCI compliance and aren’t charged by your processing partner.

It’s best to reach out to your payment processor and ask them about your PCI compliance fee and its services. While most reputable payment processors will take care of the technical end here, merchants will still have to do simple things such as filling out the questionnaire and annually renewing.

The biggest things you can expect from your processor when it comes to PCI compliance are the following:

- Education: Merchants should be well aware of what is required of them when it comes to PCI compliance.

- Security: This is perhaps the most crucial aspect of PCI compliance. When a merchant states their business is PCI compliant, customers expect the websites to be as secure as they come. If you are being charged for PCI compliance, security is a must. Inspections should be regularly made on your payment gateway, card terminal, and website. Your system needs to be scanned quarterly at a minimum to maintain PCI compliance.

- Insurance Coverage: Certain processors will offer insurance coverage with your PCI compliance services fee. In this case, that’s great, as you will be reimbursed for any losses your company takes due to a data breach.

Chargeback fees

As a high-risk merchant, chargeback fees are something you can surely count on dealing with. However, the number of chargebacks is solely on you as a merchant. You will be responsible for paying chargeback fees to your processor/bank, so you should do everything to mitigate them. At Corepay, we work with our merchants to effectively lower their chargebacks through tools such as our product, CB-ALERT.

Your processing partner/bank determines the cost of chargebacks, so it’s best to understand what you will be paying for them before signing your contract.

With this being said, the actual price of the chargeback isn’t as problematic as the consequences of having a high chargeback ratio.

To break this down further, high-risk merchants should expect to pay anywhere from $10-$100 on average.

Reserve Fees

Reserve fees are standard amongst high-risk merchants, and this is one of the areas in which a low-risk and high-risk merchant accounts vary.

A reserve, in simple terms, is a security deposit for the acquiring bank, and its goal is to protect them from potential risks associated with your merchant account.

The reserve funds aren’t used unless a customer files a chargeback dispute. This guarantees the bank/processor they won’t suffer any financial losses.

The most common reserve that you will encounter is a rolling reserve. A rolling reserve functions like this:

A small portion of a credit card deposit is held in reserve for six months to one year. Therefore, you can expect the percentage to be between 5 and 15%.

Early Termination Fee

Should a high-risk merchant decide to terminate their merchant account contract prior to their contract end date, they might be charged an early termination fee (EFT).

Early termination fees are done in two ways, either a flat fee or a liquidated damage fee. If your contract states liquidated damage fees, this could be extremely problematic.

A flat fee is exactly what you would expect in which you pay one fee and move on. A liquidated damage fee can be troublesome if the merchant decides to end their contract two years early. In this case, the merchant would have to pay processing fees for the following two years.

Depending on your volume, this can add up and be quite the expense to pay. It’s best to ask your processing partner how they handle early termination fees before signing a contract. If you are already signed up, it’s wise to figure out if it’s flat fee-based or liquidated damages.

How Much Does High-Risk Credit Card Processing Cost?

Determining the fees associated with your merchant account is tough as every processor/bank is going to charge you a different rate based on what their underwriting teams assess.

On average, it’s common for high-risk merchants to expect to pay at the shallow end of 3.5% to at the higher end of over 10%. Much of this is determined by the industry the merchant operates within and the merchants’ prior processing history.

If you are looking for a quick quote, we highly recommend filling out the application below and comparing it with other processors to ensure that you get the best rates/services.

Industries that you can expect to pay higher fees in are the following:

- Adult

- CBD

- Vape

- Nutra

- Online dating

- Crypto/Forex

With this being said, at Corepay, we are confident in our pricing models and believe we can deliver highly competitive pricing with bespoke services.

Types Of High-Risk Pricing Models

We touched on the fact that high-risk credit card processing fees can vary significantly from one processor to another; it’s important to note that the merchant’s industry also affects the rate they will be charged.

High-Risk Merchant Account Pricing Models

Below you find the following pricing models high-risk merchants can expect to encounter.

Flat-Rate

Flat-rate pricing is a model in which the merchant will pay a fixed percentage and fixed transaction fee. This model is fantastic for merchants as it’s predictable, and it also can sometimes be negotiated when merchants hit a certain processing volume.

Tiered

Tiered pricing can be a great option if you work with a transparent processor. In this pricing model, you are given three different rates.

You rely on your processor to charge you somewhat with this pricing model. Calculating your effective rate will show you precisely what you are paying with this model.

- Qualified rate: The qualified rate is the lowest price the merchant will pay for processing. These are typically the least risky transactions.

- Mid-qualified rate: The mid-qualified rate is the in-between. You aren’t getting the lowest rate, but you’re also not charged the highest.

- Non-qualified rate: The non-qualified rate is the highest you will pay for processing. An example of this would be a CNP purchase made with a rewards credit card.

Interchange-Plus

The interchange-Plus is a great pricing model that is transparent. While you will be paying a different percentage each time, you will also be able to see what the payment processor is making per transaction.

The typical structure you will see with this is interchange + % + $ / transaction.

In other words, the interchange fee is determined by the card networks and a markup set by the credit card processor itself. With this billing model, you will pay a monthly subscription fee, and then you’ll be offered a per-transaction fee, which will be on top of the applicable interchange rate fee.

Blended vs. Pass-Through

When looking at high-risk pricing models, the biggest thing to pay attention to is what happens to interchange fees.

The pass-through model is if the interchange rates are itemized and charged separately from the payment processor’s markup.

If your interchange fees are blended with your payment processor’s markup, you receive a blended pricing model.

Can You Negotiate Rates With Payment Processors?

Rates can be negotiated with processors to an extent, but this isn’t always the case. In certain instances, the processor has already gone as low as possible.

It is common that merchants will go to their processors after a year of a substantial increase in volume. Your processor will then go to the bank to see if they can go lower.

If you are trying to lower your credit card processing fees, you will want to have the following:

- Low chargebacks

- Solid business plan

- Growth in volume

Looking For Competitive Rates, Fast Approvals, And Experience? Choose Corepay

Credit card processing fees for high-risk verticals will almost always be higher than low-risk. With this being said, the pricing models will change depending on your processor and the industry you operate in.

In closing, high-risk merchants carry more risk than low-risk; therefore, you can typically count on higher fees. With this being said, banks/processors love to see their merchants grow and keep chargebacks at a minimum. If you focus on the right things, such as increasing your business and bringing back returning customers, you could expect to have a conversation with your processor to see if they can do anything on their end in terms of fees. Processors cannot always come down as they might have already pulled springs to get your rates where they are, but an open and transparent talk isn’t a bad thing.

Should you be in the market for a new payment processor, fill out the application below to get pre-approved.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].