How To Read A Credit Card Processing Statement

Last Updated on May 3, 2022 by Corepay

Learning to read and understand a credit card processing statement from your payment service provider can be a cumbersome task, especially if your business has frequent online transactions.

With this being said, reading a credit card processing statement can be incredibly confusing, and this is sometimes sadly intentional. The main reason is that no “standards” or guidelines regulate them, so processing statements vary depending on your processing company.

In this article, we will break down everything you need to know about reading credit card processing statements, and we will also answer the following commonly asked questions:

- Am I paying too much for credit card processing?

- Why are my fees so much higher this month?

- Can I lower my costs while keeping the same processing provider?

- Why am I paying more in fees than friends/partners of mine?

- How do I read a credit card processing statement?

Are You Paying Too Much For Credit Card Processing?

While high-risk merchants will typically pay more than low-risk, it’s important to note that fees can drastically vary. If you believe you are paying outrageous rates, contact at Corepay team member, and we might be able to help provide some clarity.

When analyzing a processing statement, you need to look at both the minor details and the big picture. Should certain charges on your statement alarm you, it’s wise to check the entire statement and write down all questions you have. If you decide to do this, it’s best to analyze a few different statements, so you know you’re looking at the full particulars.

Need help understanding your statement?

What Is A Merchant Statement?

A merchant statement (or month-end credit card processing statement) is a document that itemizes the transactions for your business at any given month. Merchant statements contain the number of your transactions and the fees, charged to your account. You will also find the type of card used, the amount of each transaction, and the number of total transactions.

How To Read A Credit Card Processing Statement

The first thing you need to do when analyzing your credit card processing statement is to calculate your effective rate.

Calculating Your Effective Rate

An effective rate is a term that you will come across heavily when researching this topic. When you first signed up with your credit card processor, they either gave you a flat rate, a tiered rate, or another rate based on interchange.

To determine precisely how much you’re being charged, let’s calculate your effective rate. Once you understand how to calculate this, you will be able to tell on average the percentage you are being charged.

The following is the formula for checking the effective rate:

(Total monthly fees / Total monthly sales) x 100 = Effective Rate

Total monthly fees include processing charges, statement fees, gateway fees, monthly fees, equipment fees, compliance fees, and any other fees.

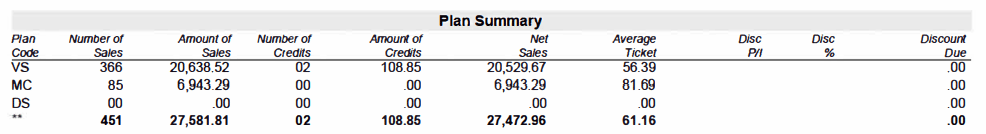

Let’s take the following for example. You can see in this example that merchant “A” processed $27,581.81 and was charged $1,290.37.

We divide the monthly fees by the monthly sales and multiply that number by 100 to reach a 4.67% effective rate.

*The math looks like this: $1,290.37 / $27,581.81 = .0467 x 100 = 4.67%

The effective rate accounts for every fee on the statement, which brings to light any “hidden” fees you might not have known about.

Your turn: Follow the formula we gave you above and use it on your credit card processing statement. Once you do this, you will see how much you are paying to your processor and how much you are paying to Visa, Mastercard, Discover, etc.

It’s important to note that your effective rate is going to vary heavily depending on what industry you operate in. For example, a large retail store paying a 3.0% effective rate could be considered high, whereas a merchant selling vape/CBD at high volume could be charged 4.0%, which could be considered an excellent deal.

Determining Interchange Fees

Interchange fees are charged by card issuers such as Visa or Mastercard. It’s important to note that payment processors do not control these rates, and merchants typically pay these fees.

These fees will change from brand to brand, but as you can see, they are labeled on your processing statement.

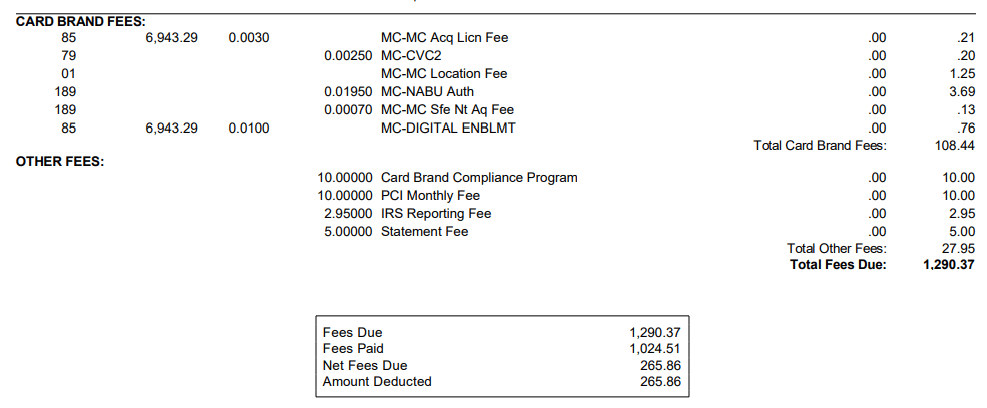

By looking at this statement, you can see $1,024.55. You can add up the individual transactions interchange fees or simply find the column that shows the total interchange fees to get to this number.

To verify just how much is going to your merchant service provider (MSP), subtract the total fees paid by the total interchange fees.

In the case of this statement, it would look like the following:

- Total Fees: $1,290.37

- Total Interchange Fees: $1,024.55

1,290.37 – 1,024.55 = $265.82

This means the processor’s fees are $265.82 – Also known as the effective markup (or interchange plus).

Once you have a couple of months down with a processor, be sure to go through this process and send them any questions you might have regarding your statement.

Types Of Processing Fees Merchants Need To Know

The two main types of fees can be broken down into wholesale and markup. Wholesale means that the price is fixed throughout the industry, and markup means the price varies and is negotiable, depending on your business industry and your merchant service provider.

Let’s take a look at a few examples of wholesale fees.

Wholesale Fees

- Card Brands: Visa, Mastercard, Discover, etc. These brands take a cut of processing costs.

- Card Issuing Banks: Banks that have issued credit/debit cards charge a fee to your customers

- Interchange: This is the cost of running each card transaction. The card brands set these fees for the issuing banks.

Markup Fees

Any other fee that isn’t what we discussed above can be considered a markup fee. Let’s take a look at where your markup fees come from.

- Merchant Service Provider/Acquirer: Your MSP is responsible for managing and setting up your merchant account. Please note: At Corepay, it is our goal to provide 100% transparency with all of our clients. You typically will view your credit card processing statement through your MSP. It is important to note that there may be additional fees for your MSP or acquirer/processor.

The Main Pricing Models

When you sign up for a merchant account, you will be given a price model. There are currently four pricing models that merchant service providers commonly use.

All of the models are based specifically on interchange fees and whether they are blended in with your MSP rate markups.

Interchange-Plus Pricing (Interchange separate from markup)

The interchange rates will be itemized and passed through separate from MSP markups. The rate markup will include a % markup plus a per-transaction markup.

Subscription/Recurring (Interchange separate from markup)

A spinoff of interchange-plus. Pricing charges a monthly membership fee as a markup.

Tiered Pricing: (Interchange blended with markup)

Interchange rates are blended in with MSP markups, creating multiple customer rate tiers. Tiered Pricing will have the following based on the type of card used to purchase:

- Qualified – lowest rate charged – typically debit cards.

- Mid-Qualified – mid-rate charged – typically lower-end credit cards.

- Non-Qualified – highest rate charged, typically higher end credit cards (Visa Signature, Infinite etc) and corporate credit cards.

Flat Rate Pricing (Interchange blended with markup)

Interchange rates are blended in with markups to create one flat processing rate. This is typically seen with merchant aggregators such as Square, Stripe, Ayden, or Paypal.

Keep in mind that this type of pricing model doesn’t usually apply to high-risk merchant accounts as banks/processors must mitigate their risk.

Compare Your Rates With Other Processors

After calculating your effective rate, you will be able to grasp a solid understanding of what you are paying each month.

When comparing rates, be sure to be honest, and let the processing companies know what industry you are operating in, as this can massively affect your total fees.

Why Am I Paying More In Processing Fees Than Others I Know?

This is a common question that is often seen in high-risk processing. As a result, specific industries pay more for processing to cover the acquiring bank and credit card processor’s risk.

For example, someone operating in the adult industry or the CBD industry will pay more in fees than a simple online store selling books, which has fewer chargebacks.

Online (card-not-present) businesses on the whole pay higher interchange than brick and mortar (card present) businesses. This can be seen in the pricing models of payment aggregators/payfac’s such as Paypal, Stripe, and Square where they have two sets of fees, depending on whether merchant is card present or card-not-present.

The simple answer to this question is usually one of the following:

- You are paying too much in fees due to the PSP not acting in good faith

- You operate in entirely different niches -card presents vs. card-not-present, or low risk vs. high risk

- You have higher chargebacks

- Your online store is brand new

How To Lower Processing Fees While Maintaining The Same Processor

The easiest way to do this is to establish excellent credit (if a new business), never have a processor receive an ACH reject for agreed fees, and reduce your chargebacks/disputes. While you can’t always lower your processing fees, there are certainly circumstances where it’s entirely possible.

Red Flags

If your credit card processing statement seems disorganized, this could be a potential red flag. Cluttered statements are easier for processors to hide hidden fees/markups.

Always check and confirm that you are being charged the rate that you were quoted from your processor. If you are paying significantly over what you were quoted, it’s best to have a conversation and figure out exactly what the culprit is.

Need Help Answering Questions About Your Processing Statement?

If you’re in a rut with your processor and looking to switch to 100% transparency, contact our customer support team at Corepay. We understand the headaches and frustration that vague statements can bring you, and it is our goal to make sure all of our clients understand every fee on their statements.

Conclusion

Now that you understand how to read a credit card processing statement, you should be able to tell if you’re being ripped off or if you’re being charged a fair amount.

If something seems off, reach out to various processing companies, including us at Corepay, to get price quotes and see if the prices are in the same realm.

To sum everything up, a large majority of reading your credit processing statement comes down to learning how to calculate your effective rate. Once you know to do this, you should calculate this monthly to make sure everything adds up and makes sense compared with your other statements.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].