Tiered Merchant Account Pricing Structures In 2024

Last Updated on February 5, 2024 by Corepay

Tiered merchant account pricing is currently the most common form of credit card processing. This article will go over what merchants need to know about tiered merchant account pricing and offer our advice on when it can be used as well as an alternative pricing model.

When it comes to choosing a credit card processing company, there is usually a lot of information immediately presented to merchants.

It is important to note that tiered pricing comes down to trust with your processing provider. As it’s usually not as transparent as Interchange Plus, you will need to trust that your processing partner is providing you with a fair pricing schedule.

Whether you’re an eCommerce merchant, restaurant, or retail merchant, you should be aware of tiered merchant account pricing and precisely what it means.

Tiered merchant account pricing is commonly used in high-risk industries. Since acquiring banks and processors are taking on the additional risks that come with these industries, this structure helps simplify the bank statement and protect against chargeback costs.

What Is Tiered Merchant Account Pricing?

Tiered pricing – also known as bundled pricing, is a credit card processing structure that breaks down the price that merchants pay their processing companies per transaction.

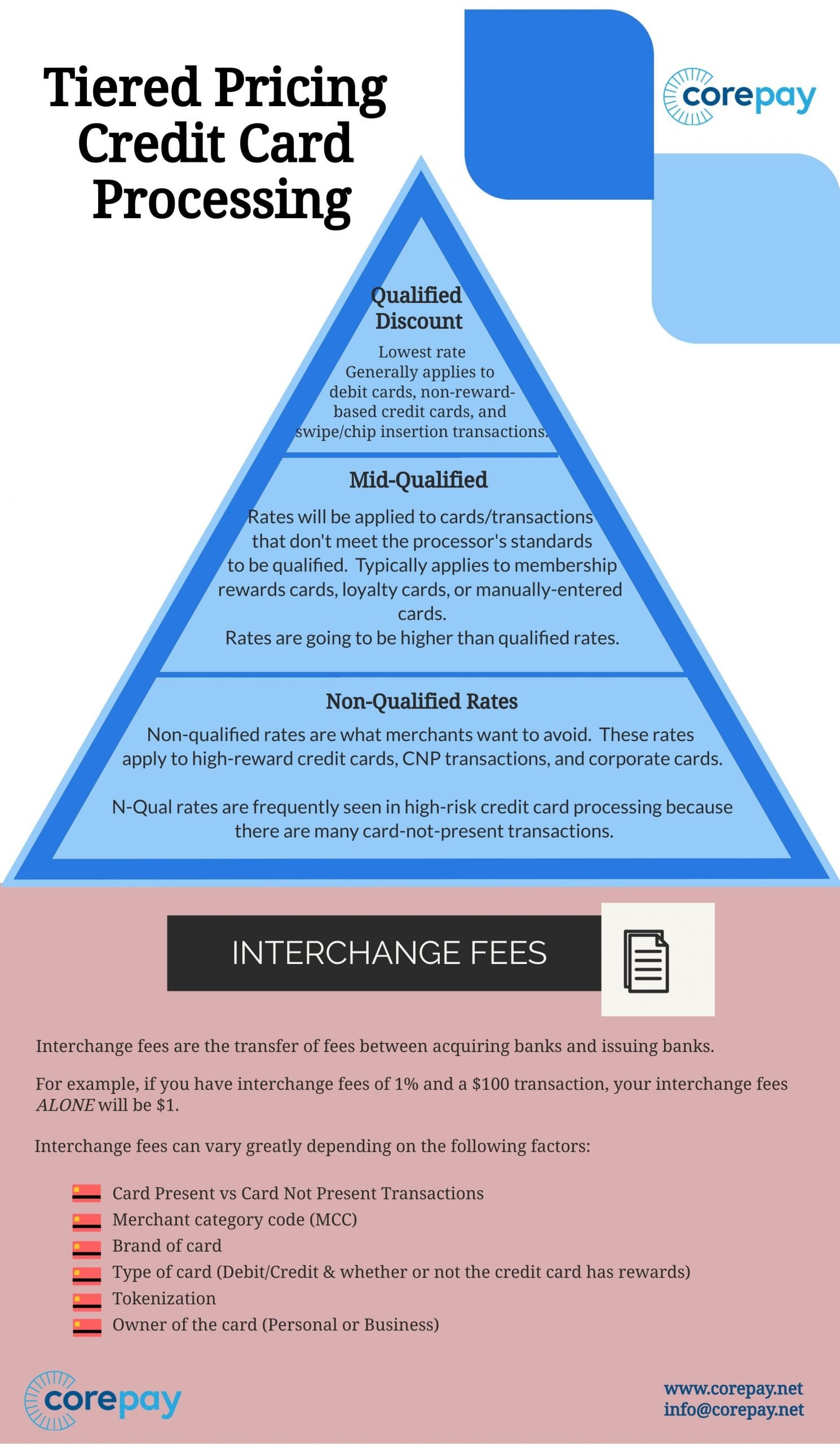

Processors can group interchange fees into general rate tiers of their own choosing. With tiered pricing, fees are normally broken down into three different tiers: qualified, mid-qualified, and non-qualified.

Other categorization systems do exist, but the three-tier approach is the most common pricing model.

In theory, tiered pricing is meant to make processing prices and fees the easiest to understand for merchants when reading a statement.

Unfortunately, some less honest credit card processors will pad “interchange fees” in order to increase their profit from the merchant. This process is the reason that tiered pricing can sometimes have a bad reputation.

In order to identify if your processor is using tiered pricing, you can observe your statement.

On your statement, you will see something similar to:

If you see this on your statement, you are using tiered merchant account pricing. Notice that the terms are often going to be abbreviated.

Other processors may not show qualified, mid-qualified, or non-qualified. In this case, you will want to check your statement for a flat set of rates for all card brands.

When observing your statement, you might see disc 2.5% across the board. This can vary typically between 1.65% and 3.5%.

Keep in mind; these numbers can vary depending on the number of tiers your processor is using.

When viewing your statement, you may notice a section that shows Visa and Mastercard transactions with a discount rate of 2.1% for both Visa and Mastercard.

The final way you can identify tiered pricing for your processor is to notice that each card brand has the same percentage charged. For example, you observe your statement and find:

Should you see this on your statement, you are paying for a tiered merchant account pricing structure.

All three of these tiers cover a transaction’s Interchange cost and one or both of the transaction’s assessment costs.

If the standard credit/debit card is used, such as Visa or Mastercard, you can expect this to be a qualified rate, while a rewards/corporate card could receive a Mid/Non-qualified rate.

Before taking an in-depth look at each tier, let’s do a quick review of what interchange fees are.

Interchange Fees

Interchange fees are essentially the transfer of fees between acquiring banks and issuing banks. These are also known as interchange reimbursement fees.

The fees are meant to cover the cost of handling the transactions and sending payments to the acquiring bank and merchant’s bank account while at the same time covering for the risk of fraud/chargebacks.

With each transaction, the acquiring bank charges a small percentage to the merchant. You can expect this to range between 1-3% of the transaction, with an additional fixed cost per transaction. The fixed price is usually around $.10. If the industry is high-risk, such as CBD merchants, the fixed price can be closer to $.15.

This means, if you have a card with an interchange fee of 1% and have a $100 transaction, you will pay $1.00 for interchange fees.

Interchange fees can vary greatly depending on the following factors:

Visa and Mastercard are the only two brands that charge interchange fees, and this fee schedule is transparently published every year. American Express has discount fees that are similar to interchange; however, they tend to be higher and more difficult to understand, which is why some merchants opt not to accept American Express.

Tier 1 – Qualified Discount

The qualified discount rate in a tiered pricing structure is the lowest rate a business will pay. The qualified rate is typically what is advertised by processors, as this is the lowest rate.

QUAL rates generally apply to debit cards, non-reward-based credit cards, and swipe/chip insertion transactions.

As a merchant, the more transactions that are considered “qualified” by the processor, the better. This is where transparency comes into play. Depending on your processor, certain transactions may not be considered qualified, where others will be. Corepay operates with complete transparency with our clients, and we strive to earn your trust by providing reliable and honest credit card processing.

When it comes to all three of these tiers, the qualifications vary greatly depending on the processor. In most cases, card-present transactions will result in the qual disc rate, assuming the card is a major brand such as Visa or Mastercard.

Tier 2 – Mid-Qualified

Mid-Qualified rates will be applied to cards/transactions that don’t meet the processor’s standards to be considered qualified. This is where transparency comes into play.

Mid-qualified typically applies to membership rewards cards, loyalty cards, or manually-entered transactions.

These rates are going to be higher than qualified rates. If you are a merchant, we highly advise you to consider the types of cards you frequently see before speaking with a processor.

While mid-qualified rates will vary from processor to processor, you will typically see these discount rates with the following:

Tier 3 – Non-Qualified Rates

Non-qualified rates are what you don’t want to see as a merchant.

These types of rates apply to high-reward credit cards, CNP transactions, and corporate cards.

N-Qual rates are frequently seen in high-risk credit card processing because there are many card-not-present transactions.

Possible Downfalls Of Tiered Pricing For Merchants

While your statement might look simple when reading fees, there can be another side to tiered pricing that makes it expensive and muddy. With this being said, this is dependent on your processing company. Not every processor is evil and is looking to take advantage of their merchant partners.

Often, your processing company may leave out important information regarding transactions.

When looking at your statement, be prepared to ask your processing provider essential questions that provide transparency into what you are being charged.

Here are the main reasons why tiered pricing might not be the best solution for your eCommerce business:

These are downfalls that merchants can face with tiered pricing, depending on their processor.

Pricing/Transparency

Since processors set the rates and criteria that determine where transactions fall, tiers are often inconsistent from processor to processor.

This can make it very challenging to compare rates between processors. If the information were disclosed, merchants would be able to seamlessly compare rates.

For example, a standard rewards credit card could fall into the QUAL tier with specific processors yet be categorized as MQUAL with another processing company.

Inconsistency

Depending on your processor’s tiers, you could be faced with entirely different fees from month to month. As it’s impossible to determine which cards your customers will be using each month, it’s hard to gauge and plan for fees.

Why Are High-Risk Accounts Typically Tiered Structures?

High-risk merchant accounts typically use tiered pricing as acquiring banks and processors are taking on additional risks. High-risk industries usually process many CNP transactions and also tend to have a lot of chargebacks. To help offset some of the financial risk, banks/processors can use this pricing structure to ensure a level of profitability.

Why Do Banks/Processors Implement A Tiered Pricing Model?

The main reason is to limit liability. Acquiring banks can pass liability and, in some cases, costs onto merchants. With every transaction, there is a risk of chargebacks and fraud, which can impact interchange costs.

When certain cards offer “cash back” or reward bonus points to their customers, the interchange costs are ramped up considerably.

Alternatives To Tiered Pricing

The most transparent alternatives to tiered are currently Interchange Plus and Interchange Plus Plus.

Interchange Plus (ICC+) shows merchants just how much processors are making from them per transaction.

Merchants can see the charges going to the issuing bank and the credit card associations, allowing the merchant to determine if what they’re being charged is fair.

While this model is more transparent, it is much harder to read and understand for merchants before processing. Many merchants would rather just hear what their effective rate is.

When it comes to tiered pricing VS. ICC+, ICC+ is more transparent however, there are cases in which both make sense over the other.

ICC++ is a pricing model which is most common in Europe; however, it is also used in North America.

ICC++ is available for payments made through Visa and Mastercard only. This model also includes the acquirer fees. When a transaction is processed through an acquirer, there will be 3 different components.

Calculating Your Effective Rate

The easiest way to compare prices when using pricing models such ass ICC+, tiered pricing, or ICC++, is to calculate the effective rate. The effective rate is essentially the rate merchants will pay for credit card processing after factoring in non-negotiable fees and the markup from their provider.

Effective rate calculation: (Total credit card processing fees/total processed amount) X100. Let’s take the following numbers for example:

Total fees= $50, total amount processed= $1,000. You will take 50 divided by 1,000 and multiply that times 100 to arrive at a 5% effective rate.

Corepay Pricing Models

At Corepay, we can accommodate businesses with all forms of merchant account pricing. We evaluate your business – weigh in the risks, and then put together the best proposal for your business. Our goal is always to provide 100% transparency regarding processing fees, policies, and terms of service.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].