Merchants, Prepare for Return Fraud This Holiday Season

Last Updated on July 7, 2023 by Corepay

Fraud is on the rise, thanks to the holiday sales season as well as the pandemic. And after the shopping season is over, returns season begins, and so does an increase in return fraud. But that doesn’t mean you have to fall prey to it. Corepay has a few steps you can take to help reduce the chances of friendly fraud and malicious fraud.

First, if you have an ecommerce site, make sure you require CVV2 codes on your shopping carts. This way, anyone who’s trying to pay with a stolen credit card number won’t be able to complete the purchase without the physical card. You should also require Address Verification Service (AVS), and even using 3DSecure 2.0.

If you normally have regulars or ongoing customers, set spending limits for new customers. This won’t stop fraud from occurring, but it will reduce the impact.

If customers tell you an item arrived damaged or late, especially high-priced electronics, always ask for the item to be returned before you give a refund. It’s a common return fraud practice to claim an item is damaged or incorrect because many retailers don’t want to deal with those returns. But, surprise of surprises(!), people lie, even during the holiday season. So, send out a pre-paid return label and ask the customer to return the item. If they do, you can see for yourself if it was damaged and then possibly fix it. If they don’t, then they clearly don’t want the replacement.

But watch out for another return fraud trick: Some crooks will stuff an envelope full of junk paper, slap the return label on it, and then send it back. When it arrives at the return department, someone will scan the envelope that notifies your system that the item has been returned. What usually happens, however, is that the envelope gets sent somewhere else like the mailroom. When it’s opened, it’s filled with junk papers that no one knows what to do with. They throw it away, and the customer has “returned” the item.

Another trick is that the item gets “returned” at a UPS or FedEx store. (Some retailers will consider an item returned once it hits the UPS/FedEx store.) If possible, compare the weight of the original package and the new one. You could be getting a box filled with magazines or dirt, and it could weigh significantly more or less than the original package, and that should trigger an alert of some kind.

Provide additional training to employees, teaching them how to recognize potential signs of fraud. Teach your cashiers to recognize signs of return fraud. Create a process that confirms all returns against the orders to make sure they’ve been returned.

Look for patterns of returns and return fraud among past customers. Do you have customers who return a lot of items? Have they sent back something other than the original purchases? Flag customers’ names in your database with a hidden field to identify frequent fraudsters.

Look for unusual buying patterns like multiple cards being used for shipments to the same address, or one card shipping to multiple locations. Of course, this could just be someone buying gifts for family, but look for a pattern in the items being shipped: expensive electronics being shipped to several addresses in the same neighborhood, for example, might be a sign of fraud.

Watch out for returns coming from a location that’s different than the original delivery location. This could be the result of porch pirates or return fraud where, say, items were purchased with a stolen credit card and shipped to one person’s house and returned from somewhere else. A shipment from a UPS/FedEx store or post office in the same city is less concern for alarm than a return coming from a completely different city.

You should also have a strong fulfillment provider, ideally domestic to most of your customers. Domestic is especially important if you’re using a third-party fulfillment option, such as a drop shipper. This way, you’ll know that the correct products are actually going out and on schedule. The best ones have the latest barcode scanning and RFID technology to track their picking and packing, and can show that they sent the correct products on daily reports.

Work with a payment service provider that uses third-party tools to identify patterns of return fraud and friendly fraud. They have access to customer data and can tell if someone has a past history of return fraud and friendly fraud. This way, those fraudsters can’t trick merchants they’re shopping at for the first time.

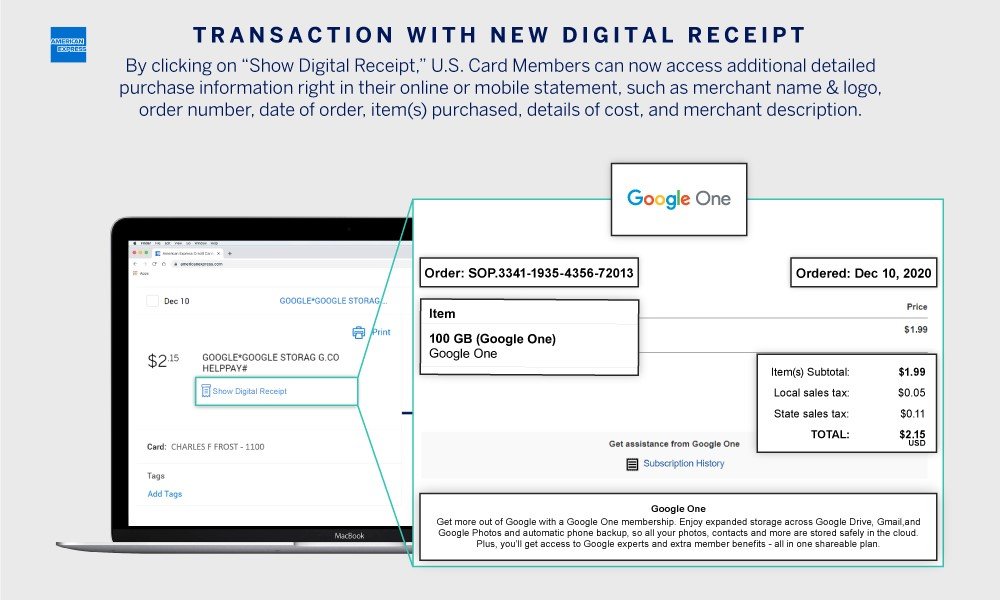

Participate in Order Insight by Verifi , which can help you stave off a lot of not-quite-fraud. In many cases, a dispute or chargeback happens when consumers don’t recognize a charge on their card. Given how jumbled up those transaction codes are, that’s no surprise. With Order Insight by Verifi, when a bank’s customer service rep handles a call for a customer wanting to dispute a transaction, they can see details related to the original transaction within a second of the inquiry, and ask the consumer a few questions to see if it’s actually something they forgot or if a family member unknowingly charged the card (such as a child making in-app purchases on a game), or if some type of fraud is occurring. For more information, visit Verifi.com or our preferred chargeback partner, CB-Alert.

Don’t ignore the benefits of having an amazing customer support service yourself. Ideally, it would be based locally, staffed 24 hours a day, and even include live chat and chatbot functionality on your website.

It also helps if you send out email receipts to avoid the above problem, but if possible, use detailed transaction codes, and be sure to fill out your merchant location properly.

Finally, ensure your return policies are clear and easily understood. Make sure people know how to find them, and include a copy of the policies with each shipment. Sometimes consumers will file a false claim for a refund on a product they’re not happy with rather than trying to get a refund.

This last issue is why it’s also important to know your chargeback rights as a merchant. For example, you can require anyone asking for a refund to ship back the item they purchased. (See item #3.)

If you’d like to learn how to protect yourself from chargebacks and fraud, especially with different third-party tools, Corepay can help. To learn more, please visit our website or call us at (866) 987-1969.

Photo credit: David Shankbone (Wikimedia Commons, Creative Commons 3.0)

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].