How Merchants Can Defend Against Coronavirus Fraud

Last Updated on March 8, 2021 by Corepay

Credit card fraud has always been an issue, but now that we’re in the midst of a pandemic and people are doing a lot of credit card purchasing and ecommerce buying, crooks and fraudsters are taking advantage of the situation to perpetrate coronavirus fraud.

According to a new TransUnion report, there was a 23 percent increase in worldwide ecommerce orders in the month of March alone. We expect April will be even bigger.

A recent CardNotPresent.com article said that other companies are monitoring the situation as well. The Israeli identity fraud detection startup, Identiq, has seen increases in several different types of fraud that are affecting both merchants and consumers, including:

- Gift card fraud: Thieves are buying restaurant gift cards with stolen financial credentials.

- Phishing: Fraudsters are sending phishing emails about stimulus checks, airline refunds, and anything else that will get people to click on links and provide login information or credit card information.

- Fake sites: Many fake websites are popping up to sell snake oil cures and useless (at best) or dangerous (at worst) products that promise protection or even a cure.

- Shipping fraud: Thieves are taking over customer accounts, but not changing the shipping address right away. Once a package has shipped, they intercept it at the carrier’s website and change the shipping address there.

To that list, we would also add friendly fraud in the form of chargebacks and returns. In friendly fraud, a customer may order food from a restaurant, claim there was a problem, and then issue a chargeback for the full amount.

Uri Arad, co-founder and vice president of product and research for Identiq, said that because there’s an increase in the types of traffic patterns and transactions, merchants should provide training based on finding “good” customers based on positive identifications, rather than looking for bad customers and bad transactions.

“We see the weakness of looking for anomaly, because everything looks like an anomaly now,” Arad told Card Not Present.

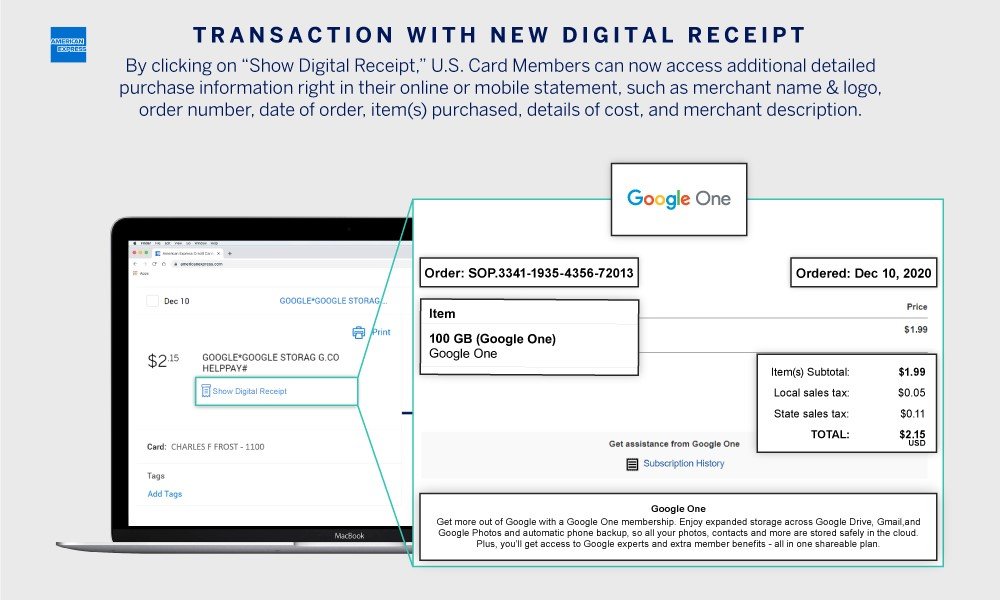

He also recommended that high-risk merchants communicate with their customers and let them know the different ways you will communicate with them in the future, and the ways you will not. Warn them of the types of fraud thieves may use to try to steal their information and their identities. Additionally, try to shift to payment wallets like Apple Pay and Google Pay, because of their “behind the scenes” risk management. Apple and Google are taking fraud prevention very seriously, which means they’re doing a lot of the heavy lifting to prevent their users from losing their access and information.

The pandemic is bringing people together and there’s a growing sense of “we’re in this together.” But just like any other crisis, thieves and scammers see an opportunity to take advantage of the situation. Corepay can help you figure out how to reduce the risk of fraud and fight back against it. For more information, please visit our website or call us at (866) 987-1969.

Photo credit: Tumisu (Pixabay, Creative Commons 0)

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].