Stripe, Paypal, Square Alternatives – High Risk Merchants

Last Updated on January 9, 2024 by Corepay

A lot of high-risk merchant accounts — companies that have been labeled high-risk by their payment services provider or the bank — may think PayPal, Stripe, Venmo or Square are their only alternatives if they want to accept credit and debit cards.

There are a few reasons you get labeled as a high-risk merchant, and that can affect the kinds of payment processors you can work with. You could be labeled as high risk if:

- Your company could be considered a reputational risk (e.g., adult entertainment, gambling, CBD, etc.)

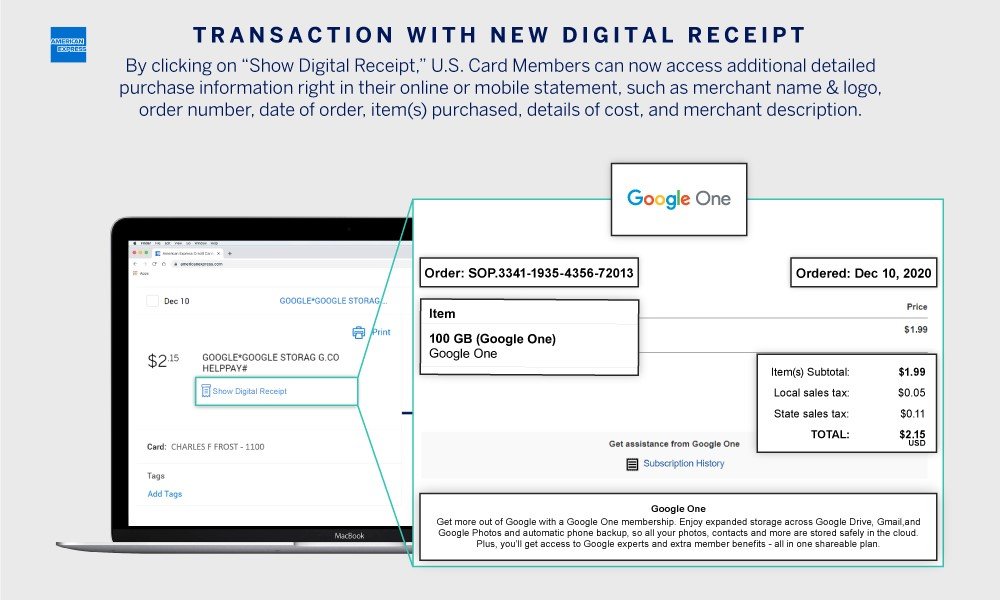

- You’re at a high risk of chargebacks (subscription services).

- You accept a lot of card not present (CNP) payments (ecommerce).

- Your business may be too new, or you have issues with your personal or business credit.

Any one of these issues can get your business labeled as a high-risk merchant, and that’s difficult when you need to accept credit card payments.

If you landed on this page wondering, “can I use Paypal, Stripe, Venmo, or Square as a high-risk merchant,” the simple as is no.

With this being said, we are proud to offer bespoke high-risk merchant accounts specifically tailored to your businesses needs

So here’s who cannot — and can — help you when it comes to high-risk merchant accounts

1. Paypal

PayPal isn’t as high-risk-friendly as you might think. For one thing, they’re anti-adult entertainment, having cut off Pornhub in August 2019.* They also don’t allow CBD sales and are strict about what kinds of gambling services they allow.

* In fact, none of the service providers listed in this article will allow payments for adult entertainment except for Corepay.

PayPal can also inexplicably freeze your account. Their algorithm may decide that there are suspicious behaviors on your account and freeze your account until they (but more likely you) can clear things up. So if you start offering a popular new product, or you start selling into a new country with some great success, you could find yourself locked out of your own money and your ability to take payments.

PayPal also charges a $20 fee for all chargebacks issued against you, on top of what the banks are going to charge you. The fee can be waived if the transaction was covered under the Seller Protection program, but otherwise, you’re being double-dinged for a single chargeback.

2. Stripe

PayPal started in 1998, and Stripe started in 2010, but it may say something when three of PayPal’s co-founders — Peter Thiel, Elon Musk, Max R. Levchin — started a new payment company. It’s now a multi-billion transaction hub.

Like PayPal, Stripe charges a base rate of 2.9% + $.30 per transaction, but you can get a better rate if you do over $80,000 per month ($1 million per year) in transactions. They also don’t charge monthly fees, refund costs, or other hidden fees like setup fees or card storage fees.

3. Square

Square was the first mobile credit card reader, created by Jack Dorsey, founder of Twitter. It plugged right into your smartphone and let you accept credit and debit card payments, which was great if you only occasionally sold items and didn’t need a full-time merchant account. Now, Square has grown up and lets you accept magstripe, chip card, and NFC phone payments. You can even pay someone remotely just by typing in your credit card.

But Square is just like all the others in that they will not process payments for high-risk merchants, including adult entertainment, gambling, service station merchants, or even bankruptcy attorneys.

4. Venmo

Venmo is a great cash-swapping app, and you could even ask customers to use Venmo for payments. It’s great for pop-up shops and food trucks, but it may not be a great way to run a business. In fact, if you want to use Venmo as a business payment option, you need to integrate with PayPal Checkout. That’s because Venmo is owned by PayPal, so is it really a viable alternative if you’re trying to get away from PayPal? (Hint: No.)

Why High-Risk Merchants Cannot Use Paypal/Stripe/Square/Or Venmo

All of these options are fantastic for certain industries. That being said, Paypal doesn’t do high-risk credit card processing. Many banks and credit card processors realize the risks that come their way such as chargebacks, reputational damage, security concerns, and regulation issues to name a few.

So, Who’s The Best High Risk Alternative For Stripe, Paypal, And Square?

Below we will discuss why we believe we make a fantastic alternative to the above choices.

Corepay

You think we’d do an article about high-risk payment processors and not include our own high-risk merchant account services? That’s crazy.

We work with a variety of high-risk industries, including adult entertainment, gambling, CBD, nutraceuticals, coaching merchant accounts, subscription services, online dating merchant accounts, and vape merchants. And our ownership has over two decades of experience in the high-risk payment processing space, and we offer e-commerce merchants credit card processing and alternative payment solutions tailored to their business’ needs. We offer the following to all customers who need credit/debit card processing.

-

- Quick approval process for all new high-risk merchant accounts to get you up and running in a few days;

- High-level fraud protection to help you reduce chargeback fraud and friendly fraud with CB Alert ;

- High-risk friendly approach to most businesses others consider high-risk;

- Dedicated customer service team available to answer any questions and solve any problems you have.

Corepay offers fair and transparent pricing for high-risk merchants, with rates starting at a blended 2.95%. This includes never having any application fees, setup fees, or annual fees unless mandated by the card schemes for your business type.

If you need a PayPal alternative, or an alternative to any of the other credit card processing services out there, Corepay can ensure you take your business to the next level.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].