Fast Food Restaurants Fighting Friendly Fraud

Last Updated on January 14, 2020 by

Fast food and quick service restaurants aren’t a likely place for typical credit card fraud, but they’re facing their own version of it, something called “Friendly Fraud.”

Regular credit card fraud is the typical stuff we all hear about: A thief steals a credit card or the card number and starts buying a bunch of stuff until the card is shut off or runs out of funds. When this happens, and the issuer is alerted in time, the customer and the merchant won’t be charged for the stolen items. The bank will also begin an investigation into the fraud.

But this is only one type of fraud that merchants and banks face: There’s also the issue of friendly fraud, which is when a customer reports a fraudulent transaction when there actually isn’t one. They’re the person who actually made the charge, but they’re lying to get out of paying it.

Pymnts.com recently wrote about the growing problem of friendly fraud and how it’s affecting quick service restaurants.

Other times, the consumer may not recognize the charge, but it did come from someone in their household, like if a teenager borrowed their parent’s card to make an in-game purchase.

And then there’s the “Friday Night Fraud Parties.”

According to Rich Stuppy, Kount Chief Customer Experience Officer, friendly fraud is contagious in the QSR space. A friendly fraud tactic will pop up one day and then spread virally within a local area. Stuppy said the idea is to use the chargeback system to buy a group of people some free food.

“Imagine on Friday we are having a house party, so someone buys the pizza for the gang, and then later calls up and charges back the order,” Stuppy said. “The next Friday night comes, and it is another guest’s turn to call in the order — and then charge it back a few days later. This can persist for weeks.”

These schemes not only affect the merchants who are hit with the chargeback, the issuers are also bearing some costs by processing and routing the chargebacks, which increases their operational costs.

Stuppy said Merchants need anti-fraud systems to deter fraud, but as sophisticated anti-fraud systems go into place, the criminal fraud drops while the friendly fraud shoots up — mostly because it’s only criminal fraud that has dropped, not because more people started committing friendly fraud.

“Merchants that don’t have sophisticated anti-fraud systems will start out with something like 50 percent criminal fraud, 40 percent friendly fraud and about 10 percent that is an error or a problem in their system,” he said. “Once they put in a more sophisticated system, the pie gets smaller, the criminal fraud goes down, and the proportion of friendly fraud shoots up. It can be 60 percent to 80 percent of the frauds are now friendly.”

Fighting Friendly Fraud

This kind of fraud is on the rise, says Stuppy, because most people don’t actually see it as criminal behavior, not like robbing a place or shoplifting. Or if they do recognize it as a crime, they don’t believe anything negative will happen to them.

Merchants can also start tracking consumer behavior patterns to spot the outbreaks of chargeback fraud and “cut them off by directly addressing the groups perpetrating it.”

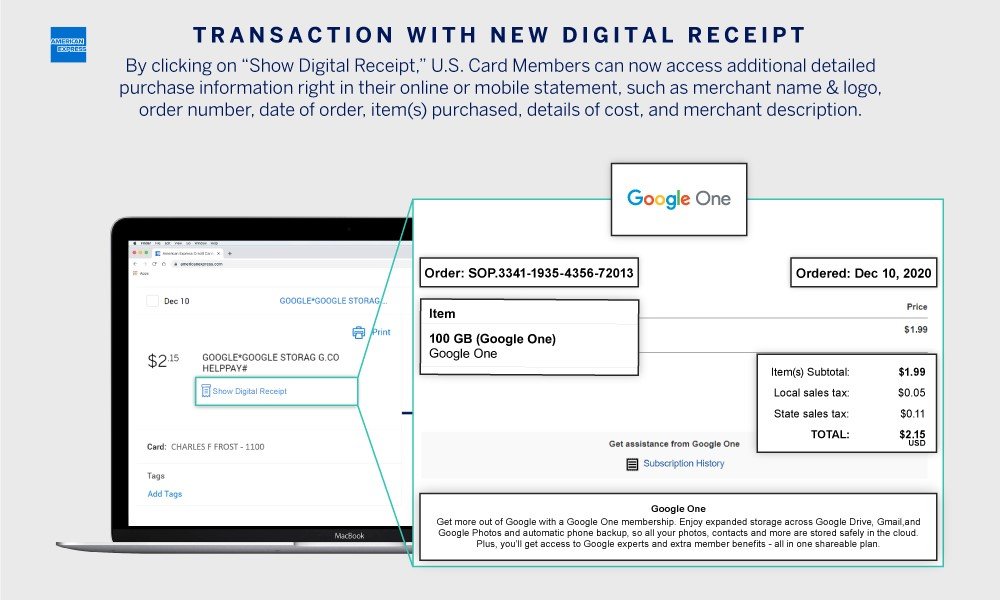

There are also tools like Kount’s own “Friendly Fraud Solution,” which uses Visa Merchant Purchase Inquiry to allow the issuing bank to push back when a customer calls with a chargeback. The bank can verify the information such as the account number, address, and so on.

Plus, the new changes to Visa and Mastercard’s dispute process can also cause some more friction for the fraudulent chargebacks and let the fraudster’s know that the jig is up.

To learn more about friendly fraud and how Visa and Mastercard’s new dispute process can help, please visit our website or call us at (800) 408-0095.

Photo credit: Kajaanifoto (Wikimedia Commons, Creative Commons 4.0)

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].