B2B Merchant Accounts – Reliable Processing

Last Updated on February 12, 2024 by Corepay

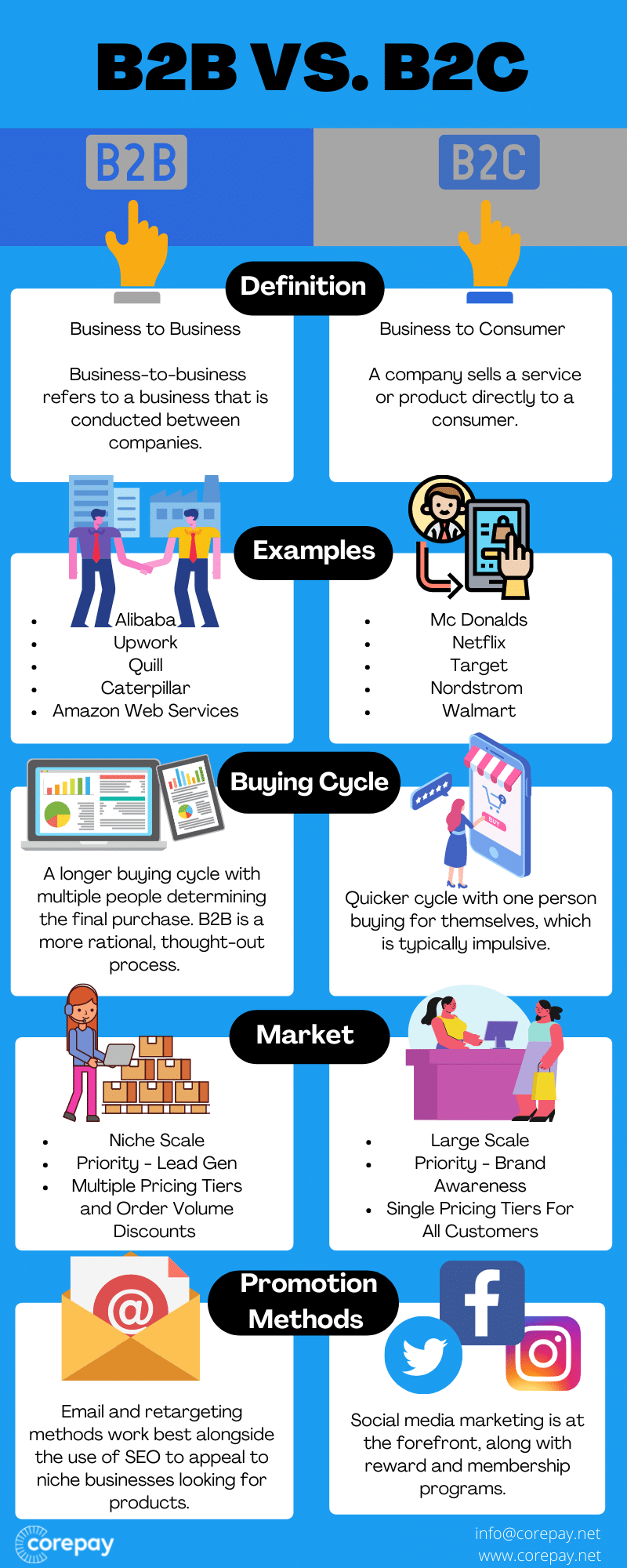

Business to business or B2B merchant accounts is essential for selling goods or services to other companies or government agencies. These types of merchant accounts differ from B2C as B2C focuses on consumers.

A B2B merchant account is for any business that frequently sells to other companies or government agencies. It differs from a retail merchant account in that it requires a customized setup to ensure that commercial credit card transactions qualify at their lowest possible interchange rate.

This article will break down precisely what you need to know about B2B merchant accounts and explain why we think we are an excellent fit for your business.

The global B2B eCommerce market valuing US$20.4 trillion in 2023 is over five times that of the B2C market, which is a staggering difference in market value.

Choosing A B2B Merchant Account

Once you begin making sales, you must have the appropriate payment processing system in place. Like any merchant account, you will want to develop an understanding of credit card processing terminology.

By doing this, you will be able to understand your monthly credit card processing statement to make sure you are not being taken advantage of by specific processors.

When it comes to choosing your credit card processor for B2B, determining your risk is essential. If your industry falls into the category of high-risk merchant accounts, you will need to choose a processor that specializes in high-risk services.

Applying For A B2B Merchant Account

Having reliable credit card processing for your B2B company is the only way to make consistent sales, as most of your transactions will come online.

You will need the following when applying for your B2B payment processing:

- EIN document

- Operating address

- Voided check to show proof of funds and account

- Business plan – Although optional, provides processors with an understanding of your business

- Principal’s driver’s license

- Articles of incorporation

- Financial statements – both business and personal

The more information you can provide us with at the time of application, the faster we can get you approved for your B2B account. We also like to develop an understanding of the big picture for your business to get you started with a plan that meets your needs.

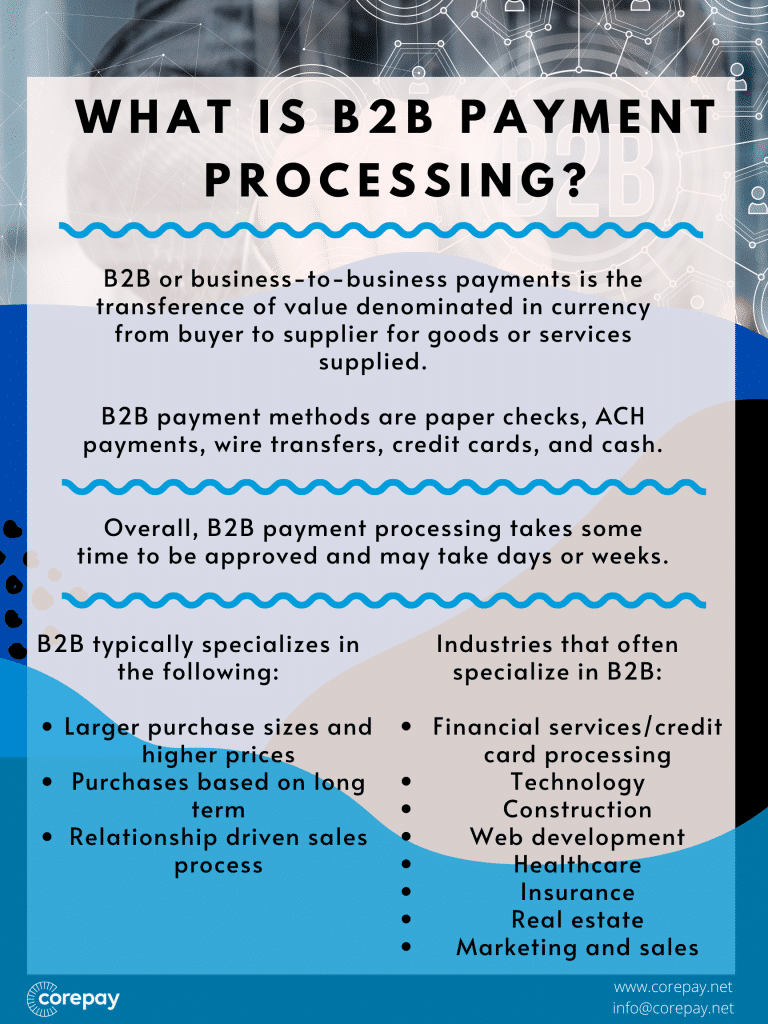

What Is B2B Payment Processing?

B2B stands for business to business, and it refers to payment processing between companies. An example of this is web development. Web development services are typically sold to businesses looking to grow their online business or those who want to expand their outreach from their retail location

B2B typically specializes in the following:

- Larger purchase sizes and higher prices

- Purchases based on long term

- Relationship driven sales process

The following are industries that often specialize in B2B:

- Financial services/credit card processing

- Technology

- Construction

- Web development

- Healthcare

- Insurance

- Real estate

- Marketing and sales

All of these industries will need reliable credit card processing that is capable of high volumes. Corepay specializes in not only high-risk payment processing but also low-risk as well.

B2B Underwriting

Depending on the processor that you choose to partner with, your underwriting could look much different. For example, low-risk processors such as Paypal or Stripe do not perform their underwriting at the time of the application.

Should you choose Corepay, we perform our underwriting at the time of the application so that you can avoid any surprises down the road.

When performing our underwriting, we strive to achieve a deep understanding of your business so that we can make sure you are set up with the best payment processing solution for your needs.

Why Choose Corepay For your B2B Account?

Our goal at Corepay is to provide our clients with bespoke payment processing specifically tailored to your needs as a company.

We are proud to offer the following:

- Swift account approvals – 24-72 hours on average

- Risk mitigation through Order Insight by Verifi and our partner product, CB-ALERT

- Chargeback alerts

- Cost-effect rates, as low as a blended 2.95% for high-risk

Maintaining 100% transparency and offering bespoke payment processing to our clients is what we pride ourselves on at Corepay.

Once approved, we will make sure your company has exactly what it needs when it comes to payment processing so that you can grow your business to its true potential.

Largest B2B Companies

While there are many wealthy B2B companies, here are some of the most profitable in the world today:

- Alibaba

- Upwork

- Quill

- Caterpillar

- Amazon Web Services

Alibaba is unique as they specialize in selling wholesale goods that other companies often resold to consumers.

With business models like this, you will often be processing sales globally and typically in high volumes. For this reason, it can be wise to choose a high-risk credit card processor.

B2B Payment Processing Solutions

There are a few different ways businesses can accept payments proficiently for B2B; two of the most popular methods to transfer and receive funds are via ACH or wire transfer.

Both of these have their advantages over one another, and it ultimately is a decision made on a situational business.

At your application, we will assess your business and help you determine the best payment solution for your specific needs.

We are confident that we can offer highly competitive rates with incredible value.

ACH For B2B

ACH payments are most commonly used as a payment method for B2Bs because they are efficient, paperless, and secure, saving time and money.

At Corepay, we can assist you in achieving low- costs, even for high-risk industries. With ACH processing, collecting payment from customers is cost-effective for your business. This is even the case for many high-risk sectors.

With fraud rampant, ACH payments are an extremely safe way to pay. By providing bank account information once, customers can sign up for encrypted electronic payments, cutting all our intermediaries, reducing the risk of fraud, and removing the risk of paper checks or invoices ending up in the wrong hands.

B2B Security/PCI Compliance

Any business that makes online sales will need to maintain PCI compliance to stay approved by major credit card companies. PCI compliance has to do with security and the way companies collect their information/data.

PCI compliance is essential as it pertains to the protection of the data that is being stored. This is directly related to fraud protection, and it is a must for all companies looking to stay in business.

If your company isn’t PCI compliant, you can be on the hook for any fraudulent charges/data breaches that may occur. This would be devastating to any successful company, and it is a recipe for disaster.

At Corepay, we make sure all of our clients are always up to the latest PCI compliance revisions to prevent any surprises.

Why Online Payment Systems Might Be Greater Than Checks

Every successful business needs a reliable way to accept and transfer funds to stay afloat. With this comes security, and unfortunately, checks are not as secure as specific online payment methods.

B2B conversion rates are directly affected by your ability to accept multiple forms of payment. When customers can be paid or send payment through specific methods, it will dramatically increase your conversions.

A commonly used pricing model is called Interchange Plus Pricing. This works by passing through your credit card transactions at their respective interchange rates with only a small markup.

B2B Codes You Need To Know

B2B servicer providers/consultants are typically categorized by MCC, SIC, and NAISC codes to comply with the payment industry requirements.

The following are the codes you can expect to see in B2B sales:

- SIC Code 7380: Misc business services

- NAICS Code 42: Wholesale trade

- MCC Code 9950: Business to Business, Intra-Company

Low-Risk Processors For B2B

Low-risk processing is possible for B2B; however, most low-risk processors such as Paypal, Stripe, or Square have industries that are against their terms of service.

For example, if you sell vape products, your merchant account could be terminated or put on hold until they complete an audit of your account.

This can take up to 180 days to complete, and your funds will be held until completion.

For this reason, we always recommend viewing the terms of service and asking questions to your processor.

At Corepay, we specialize in high-risk credit card processing, and we have a deep understanding of B2B and what you need to do to maximize profits and avoid any surprises from a processor.

Choosing the suitable processor for your B2B merchant account is vital. We hope you have developed an understanding of what you need from a processor after reading our article.

Wrapping Up

We highly encourage you to fill out the application below to find out what Corepay can do for your company. Curious about ecommerce? Check out our ecommerce merchant accounts here.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].