ACH VS Wire Transfers – What’s The Best For Your Business?

Last Updated on August 27, 2021 by Corepay

Automated Clearing House transfers (ACH) and wire transfers are two of the most common ways to move money between banks. These are two terms that you likely hear when sending or receiving an invoice. ACH transfers typically take 3-4 days as the receiving bank has to accept the request and verify enough money in the account. Wire transfers are usually processed the same day and are a bit more costly on average.

The trend of electronic payments is more significant than it has ever been as it is also growing faster than ever. It is projected that there will be 1.96 trillion non-cash transactions in the year 2029.

While there continue to be new and exciting forms of electronic payment such as Venmo, Paypal, and Zelle, ACH and wire transfers remain and still have extreme value.

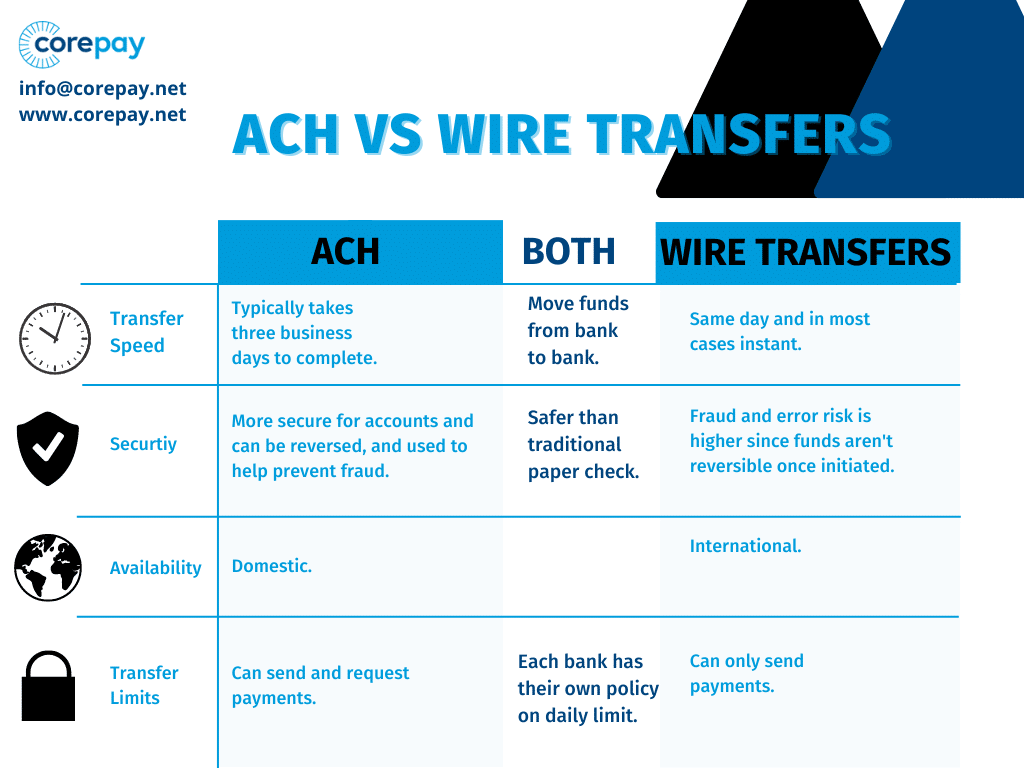

This article will discuss ACH transfers and wire transfers in full detail and provide an infographic that displays the difference between the two.

What Is An ACH

Simply put, an ACH transfer is a reliable way to move funds from one bank account to another in the United States.

The National Automated Clearing House Association manages the ACH banking network and includes the Federal Reserve.

Upon the initial approval for an ACH, funds are moved from the original bank to a central clearing house called the Automated Clearing House network.

Once the Automated Clearing House approves the transaction, the money is cleared and posted to the destination bank account.

The Automated Clearing House network includes near 10,000 financial institutions. Their network can also be used to process transactions, including the following:

Pros Of ACH Transfers

Cons

Who Uses ACH Transfers?

Consumers and businesses both use ACH transfers for transactions that fall into two separate categories: ACH debit transactions and ACH credit transactions.

Businesses can use ACH transfers to pay their employees or vendors as ACH transfers clear typically in 3 days or less, assuming the system doesn’t detect or suspect fraud.

ACH payments are most commonly used as a payment method for business-to-business (B2Bs) because they are efficient, paperless, and secure, saving time and money.

Processing Times For An ACH

ACH transfers typically take between 2 to 3 days to go through. Therefore, banks and clearinghouses will usually handle ACH transfers in batches in which they wait until enough are received before reviewing and then sending them through.

The ACH network is looking at ways to make funds available more quickly as some ACH payments are already capable of same-day processing.

Are ACH Transfers Safe And Secure?

ACH transfers are both safe and secure. Businesses typically use ACH to pay other companies for the added security benefits. Companies also elect to use ACH to pay employees directly into their checking accounts for this very reason.

What Is A Wire Transfer?

In simple terms, a wire transfer is an electronic payment service used to transfer money between bank accounts. They are much faster than ACH transfers; however, the service is usually far more expensive as well.

Wire transfers are often seen in real estate when the seller requests to be paid on the same day of the purchase.

Financial institutions typically charge between $15 and $35 for wire transfers sender fees. In addition, smaller banks will charge a small fee for receiving wire money as well.

Pros Of Wire Transfers

Cons Of Wire transfers

Two Types Of Wire Transfers

- Domestic wire transfers: Transfers sent to financial instituions in the same country. These wire transfers are typically faster than international transfers.

- International Transfers: Also referred to as remittance transfers, require more than $15 when money is sent from the United States to another country.

How Safe Are Wire Transfers?

Wire transfers are considered secure. Generally speaking, wire transfers are more secure than paper checks, as they are not subject to check fraud.

Wire transfers are also another efficient way to send/receive funds for B2B.

Are ACH Transfers Or Wire Transfers Safer?

Generally speaking, ACH is slightly safer for a few reasons.

ACH VS Wire Transfers

When considering the differences between wire transfers and ACH, there are a few things to keep in mind. Below we have listed everything you need to know about wire transfers/ACH.

THIS INFORMATION WILL BE AN INFOGRAPHIC

Availability/Location

ACH transfers are fantastic; however, they only work for domestic transactions. If you are looking to send funds internationally, you will need to use an international wire transfer.

Security

Both methods are safer than a traditional paper check as they offer an added layer of protection because banking information is encrypted during the transfer.

Transfer Limits

There are daily transfer limits for ACH and wire transfers. It is always wise to speak with your bank to check what their policy is.

Processing Times Compared

ACH transfers typically take 1-3 days to process, whereas wire transfers can be processed the same day.

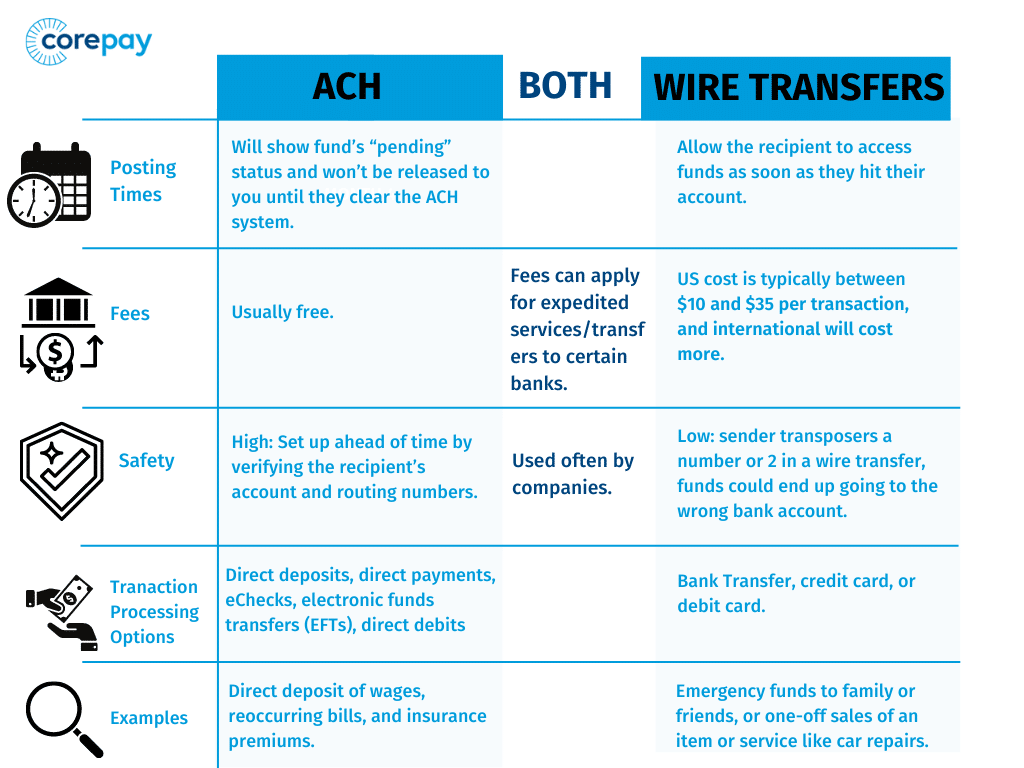

Posting Times

ACH transfers will show fund’s “pending” status and won’t be released to you until they clear the ACH system.

Wire transfers allow the recipient to access funds as soon as they hit their account.

Reversals

You can typically request a reversal for ACH transfers should there be an error in the transfer.

With wire transfers, you aren’t given this luxury, and once the transaction is initiated, it cannot be reversed.

Fees

Wire transfers will typically range between $10 and $35 for each wire transfer. There is also sometimes a nominal fee that recipients will pay to receive the wire transfer.

ACH transfers are usually free; however, fees can apply for expedited services/transfers to certain banks.

Payment Options

ACH: Bank transfers

Wire transfers: Bank transfers, credit card, debit card

Processing Times For A Wire Transfer

Domestic wire transfers are usually processed within 24 hours of initiation, whereas international wire transfers range between 1-5 days, depending on certain factors. This time can also be extended depending on bank holidays/federal regulations.

Choose Corepay For Your ACH Solutions

When it comes to ACH VS wire transfers, both ACH and wire transfers have their uses, and they are wholly viable and reliant in 2021.

ACH payments are proven to be one of the most cost-effective/convenient ways to accept/receive payments for businesses and their customers/employees.

Are you looking at ways to save some fees when paying out clients/employees? Fill out an application below, and we will get in touch with you regarding our ACH solutions.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].