Payment Facilitators VS Payment Processors/ISOs

Last Updated on December 25, 2021 by Corepay

If you run an online business, you will come across terminology that can sometimes be confusing, but should be understood. For example, learning the difference between payment facilitators, payment processors, and ISO’s is critical if you’re new to credit card processing.

Credit card processing terminology is typically foreign to those who do not have any experience in the industry.

We created this article to provide the difference between payfacs, payment processors, ISOs, and their roles in the payment processing world.

If you’re wondering what your business needs and looking for payment processing, you have come to the right place.

At Corepay, we have over two decades of high-risk credit card processing experience, and we understand exactly what your business needs to take the next step.

If you are looking to accept payments for your business, fill out a free application below to see what we can do for you.

Let’s take a look at the difference between payment processors and payment facilitators below.

Payment Processor VS Payment Facilitators

Note: Payfacs don’t perform payment processing as intermediaries between the merchant and the payment processors.

One of the critical differences between payment processors and payment facilitators is the underwriting/approval process.

Payfacs typically don’t perform their underwriting for weeks to months after the time of the application.

Another difference is how payment processors and payfacs organize merchant accounts.

With payfacs, merchants are assigned a sub-merchant ID in which all of these sub-merchants are registered under the payfac’s master merchant account.

Paypal is an example of a payfac, and while Paypal is highly convenient and can be great for specific business models, they do not work with certain industries that can be deemed high-risk.

ISOs VS PayFacs

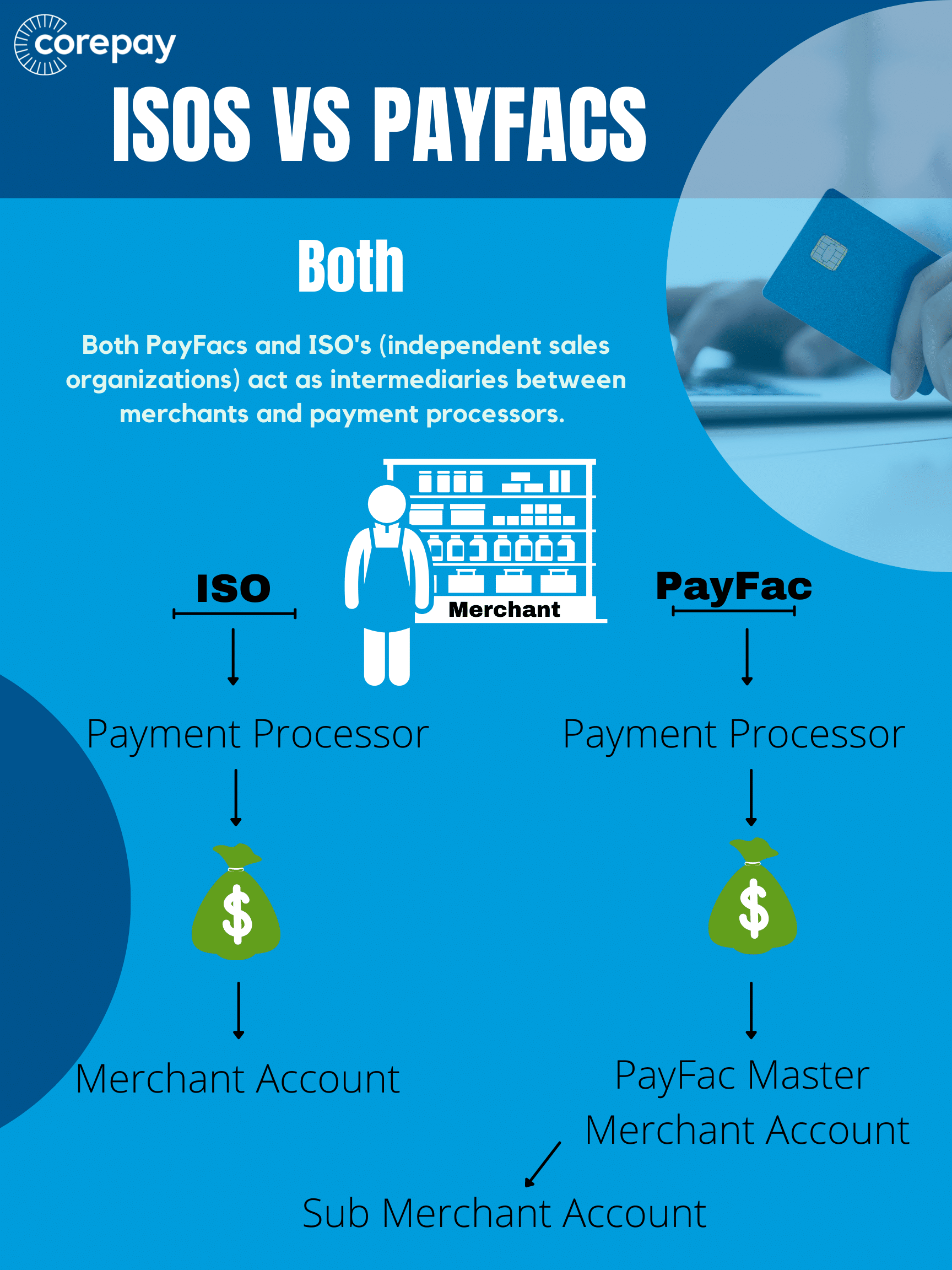

Both PayFacs and ISO’s (independent sales organizations) act as intermediaries between merchants and payment processors.

One of the most significant differences between Payfacs and ISOs is the flow of funds. ISOs never directly touch a merchant’s money as the money will flow directly from the payment processor to the merchant’s merchant account. In a Payfac model, the merchant operates under a sub-merchant ID meaning that all payments are distributed to the Payfacs master merchant account before being paid out to the merchant.

ISOs are also in charge of setting up merchant accounts for merchants through their banking relationships.

Typically ISOs provide you with your own MID or merchant account, whereas Payfacs set you up with a sub-merchant account under their master account.

What Is An ISO?

ISOs are independent sales organizations, third-party payment processing companies that handle merchant accounts for acquiring banks and payment processors/financial institutions. Corepay is a registered ISO in Europe with several acquiring banks, all of which serve the many different needs of our clients.

They act as the middleman and handle details for the merchant’s payment processing needs and financial institutions.

ISOs perform the following for merchants:

- Arrange access to payment processing

- Provide payment processing equipment such as payment gateways/terminals

- Provide customer support for the merchant’s payment processing

- May take on a level of financial risk/liability, dependent on their sponsor bank agreement.

- May have full control of their own BIN which is essentially a sub bank account with the sponsor bank.

Payment Processors

A payment processor is a company used by businesses to manage the logistics of accepting both credit/debit card transactions.

Essentially, payment processors do what the name says as they provide systems and technology that process transactions via routing them through various networks.

When a credit card/debit card is used for payment, your payment processor receives the initial authorization request and sends it to the specific card network, which then sends back the authorization response.

Transactions are typically settled on a daily basis in which the cardholder’s bank sends funds to the merchant’s bank.

All businesses wanting to accept credit card payments will require a payment processor.

Here’s a list of five of the most popular payment processors.

- WorldPay

- Elavon

- First Data

- Tysys

- Chase Paymentech

Payment Facilitators

Payfacs are a type of merchant service provider that provides businesses with a way to accept electronic payments online and in-store.

Payfacs don’t offer their merchants their own merchant accounts with their own merchant IDs. Instead, they use their own master account and pool merchants as sub merchants under their accounts.

When it is time for payment, merchants are then paid out through their Payfacs. While choosing a Payfac can sometimes be more convenient, it’s not always without additional costs or drawbacks.

Payfacs are generally very cautious when it comes to which merchants they approve. The main reason is that Payfacs usually go through fewer banks than ISO’s, which can lead to their acquiring bank not being too fond of high-risk merchants.

Examples Of Payfacs

The most famous example of a Payfac is Paypal. Upon applying to Paypal for payment processing, you are given a sub-merchant ID.

Cardholders know PayPal and trust them, so when shopping with a smaller merchant, they don’t have to rely on trusting them; they can trust PayPal.

When observing their statement, they will then notice a charge to Paypal rather than the merchant itself.

Below you will find four of the largest Payfacs today:

- Paypal

- Stripe

- Square

- Ayden

Underwriting

Underwriting can vary heavily between Payfacs and ISOs. When choosing a provider, choosing a PSP that performs its underwriting at the time of the application can help you avoid any surprises, such as your merchant account being terminated down the line.

Which Should You Choose For Your Business

Merchants should choose a payment service provider based on what they can add to their business. There are times when Payfacs make sense and times when an ISO makes sense.

What you should focus on more so is whether or not your business is deemed high-risk. Should you choose a service provider such as Paypal, your merchant account underwriting will not be performed at the time of the application/.

This means you could begin processing payments only to have your account terminated weeks to months down the line.

An important thing to keep in mind is that industry isn’t always the determining factor of a companies risk. Should the merchant have a high chargeback ratio, this can result in acquiring banks and payment processors to deem them high-risk.

Be sure to fill out applications and have conversations with multiple PSPs before deciding the route you want to take with your payment processing.

If you’re new to payment processing, choosing a provider that can guide you through the entire payment processing process and ultimately help you with things such as lowering your chargebacks is the smart move.

Corepay For Your Payment Processing Needs

At Corepay, we are here for all of your payment processing needs. We have over two decades of experience with exquisite experience in the high-risk processing industries.

We understand that payment processing can be confusing. Because of this, it is our goal to maintain 100% transparency with all of our clients and help them reach all of their goals.

Unfortunately, if merchants choose a sub-par payment processor, it can be highly detrimental to them as a growing business.

Wrapping Up

While the roles of Payfacs, ISOs, and payment processors differ, they all remain vital for all sizes of businesses.

If you’re in the market for payment processing, we highly recommend filling out an application to learn what Corepay can do for your business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].