Online Fraud is Increasing During COVID-19

Last Updated on March 16, 2021 by Corepay

Fraud has always been a problem in the payments industry, and online fraud seems to be growing even more, especially as the pandemic has continued. As far as industry experts have seen, there has been a sharp increase in fraudulent chargebacks, ecommerce hacking, and phishing attacks.

As Michael D’Ambrosio, deputy assistant director of the Office of Investigations at the U.S. Secret Service wrote in a Washington Post op-ed,

Swindles, scams, and outright thefts have long been a feature of major disasters. The more catastrophic the event, the more active the fraudsters. However, the COVID-19 pandemic provides criminal opportunities on a scale likely to dwarf anything seen before. The speed at which criminals are devising and executing their schemes is truly breathtaking.

According to Greensheet.com, the FTC fielded nearly 43,000 consumer complaints between January 1 and May 13, 2020, with 43.5 percent resulting in financial losses. Of those losses, 42 percent included fraudulent credit card transactions ($5.2 million) and wire transfers ($7.9 million).

Online gaming sites saw chargebacks increase by 18 percent in March and April, while digital content providers saw a 31 percent increase. Additionally, merchants that overstretched on their order volume and supply chain fulfillment issues are often neglecting to dispute chargebacks.

As a high-risk merchant account services provider, we see this kind of thing all the time and think it’s a HUGE MISTAKE. You should never NOT dispute a chargeback. If you get hit with a chargeback, you should always dispute it.

But more importantly, you shouldn’t ever let the chargeback issue arise. If someone requests a refund, you’re always better off paying it, unless you absolutely know you can win it.

For example, if you’re a digital content provider and you follow all the credit card networks’ requirements in terms of notifying your customers about the cancellation deadline and the impending charge, and you have a record of past communication, then you should absolutely fight the chargebacks. The only reason you’re being hit with it is because the customer most likely forgot to cancel by the deadline.

The same is true for merchants that ship products who are being hit with “my order never arrived” complaints. Be sure to keep track of all delivery notifications and correspondence so you can successfully fight any and all chargebacks.

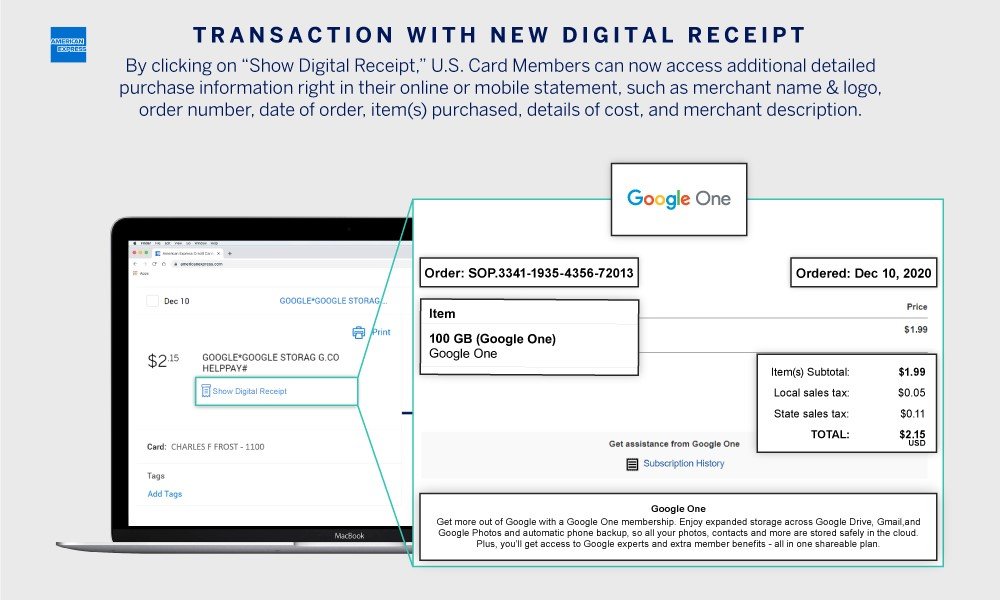

Visa is helping to address the problem with a new COVID-19 Dispute Monitoring Program (PDF). Their program offers:

- Dispute Prevention. They’ll provide issuing banks and customers with enhanced order details when a customer first inquires about a charge. The issuers can review all the information with the customer to resolve the dispute in real-time, which should reduce chargeback volume.

- Dispute Resolution. The merchant can resolve disputes by granting a refund, prove a previous refund, or let a chargeback commence so they can dispute it. Resolved disputes never enter the chargeback system, and you avoid all the extra chargeback fees.

- Dispute Representment. Also called “Recover,” this is where Visa’s Verifi team can help merchants who are dealing with an increased dispute volume by outsourcing their dispute processing.

Ecommerce merchants also need to be aware of account takeover fraud (ATO), which is what happens when crooks take over a legitimate customer’s ecommerce accounts and make purchases using the credit cards on file and shipping products to their own addresses. They’re harder to detect because the orders look like they’re coming from legitimate customers possibly sending gifts to a friend or family member.

Finally, says Greensheet.com, phishing attacks have been on the rise and make up nearly half of all reported cybercrimes — $1.77 billion — in 2019 alone. In a phishing attack, thieves send emails requesting payments for bogus invoices or opening links in a fake email that gives the hackers access to a company’s entire computer network.

Corepay can help you fight chargebacks and other forms of fraud, including online fraud, as well as help you dispute chargebacks more effectively. To learn more, please visit our website or call us at (866) 987-1969.

Photo credit: Patrick Cannon (Flickr, Creative Commons 2.0)

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].