High Risk Merchant Account Underwriting

Last Updated on October 10, 2022 by Corepay

Merchant account underwriting differs significantly depending on the risk associated with your business. This article will summarize everything you need to know about high-risk merchant account underwriting to avoid surprises during your application process.

First, high-risk merchant account underwriting is more in-depth than your traditional underwriting process, as banks and processors are taking on additional risk with your account.

Whether applying with Corepay for your high-risk merchant account or simply searching for the information you will need for underwriting; you’ve come to the right place.

The Basics Of High-Risk Underwriting

Payment Processors who have been around and are familiar with high-risk underwriting from acquiring banks will underwrite your account in a process called “getting pre-approved.”

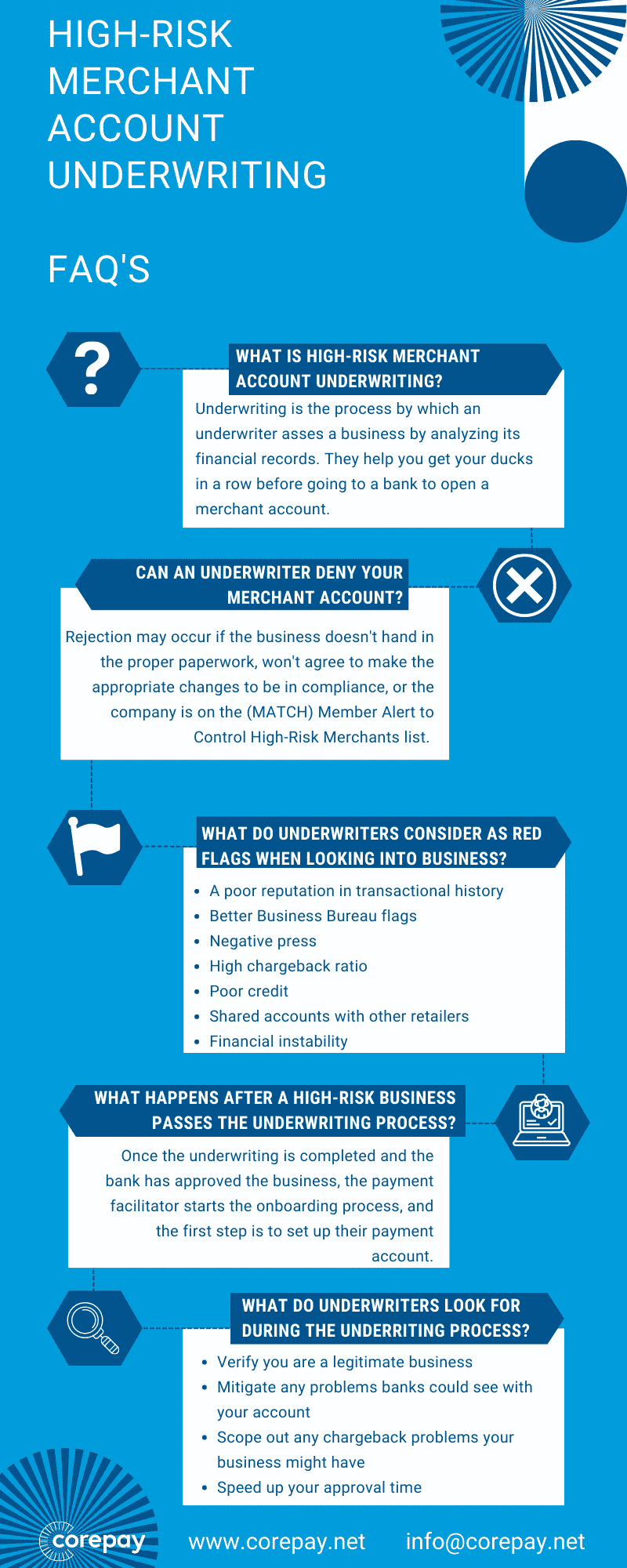

Here at Corepay, we have our merchant account underwriting before getting you approved for your account. We do this for the following reasons:

- Verify you are a legitimate business

- Mitigate any problems banks could see with your account

- Scope out any chargeback problems your business might have

- Speed up your approval time

The Perfect High-Risk Application

When applying with Corepay, we will underwrite your account before sending it to the acquiring bank, which will perform separate underwriting.

Always be up-front when applying for your account, so there aren’t any surprises later on.

A suitable applicant typically has a low-charge back ratio, a processing history, solid credit, and good communication. There will be communication back and forth; the better the communication, the faster we can get you pre-approved.

If you are not prepared with all the information you need or if there’s a red flag, the application process could take a little longer.

Here is a short list of information that will surely be examined:

- Articles of incorporation

- EIN Proof

- Proof of company bank account (voided check)

- Photo ID

- 3-6 months processing history

- Six months of bank statements

- Test credentials to your website

- Contact Us Page

- Explicit Content Warning

There will be additional information, but this will be information that you will need.

Common Red Flags

Before approving your account, underwriters will dive deep into the history of your business. You typically have nothing to worry about if you run a legitimate business.

Underwriters are looking for several things during this process, including:

- A poor reputation in transactional history

- Better Business Bureau flags

- Negative press

- High chargeback ratio

- Poor credit

- Shared accounts with other retailers

- Financial instability

Why Is High-Risk Underwriting More In-Depth?

High-risk merchant accounts can be more challenging to get accepted for as banks and processors are taking on additional risk by working with your business. For this reason alone, these accounts are underwritten to avoid surprises.

What To Expect When Applying For Your High-Risk Account

When applying for your high-risk merchant account, be ready to answer questions about your business and be sure that you have all the information on the application.

There will likely be a phone call or a chain of emails while you’re applying so that the processor can better understand your business.

Industries That Are Typically Labeled High-Risk

Many businesses specializing in card-not-present sales(CNP) can be labeled high-risk for many reasons. Below is a short-list of some industries that can be considered high-risk:

- CBD

- Travel

- Alcohol

- Kratom

- Adult

- Dating

- E-Commerce

- Coaching

- Courses

- Credit Repair

- Gun shops

Wrapping Up

Now that you understand high-risk merchant account underwriting, we encourage you to fill out an application to see what Corepay can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].