UK High Risk Merchant Accounts – Get Yours Today

Last Updated on May 18, 2023 by Corepay

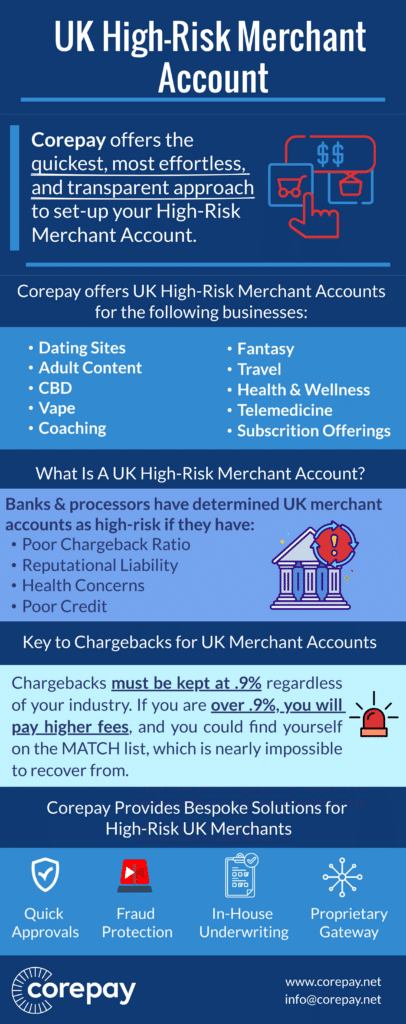

Are you looking for UK high-risk payment processing services? Then, you’ve come to the right place. At Corepay, we provide direct high-risk merchant accounts for UK businesses, allowing them to accept payments globally. This article will explain why we offer the best UK high-risk merchant accounts available and how you can apply.

We offer UK high-risk merchant accounts for the following businesses:

- UK dating sites

- Adult content

- CBD

- Vape

- Travel

- Health and wellness

- Telemedicine

- Subscription offerings

- Coaching

- Fantasy

Above are just a few of the industries in the UK we offer payment processing solutions for. We can get you credit card processing if you run a legal business in any industry.

Key Takeaways

- We offer direct high-risk merchant accounts to UK clients

- We waive setup, application, and annual fees

- UK high-risk merchant accounts are needed for merchants not considered low-risk

Apply For Your UK Merchant Account Today

We make the application process a breeze at Corepay. We aim to get your account up and processing in no time, with minimum headaches.

You will need to provide the following when applying:

- 3-6 months processing history of statements

- Voided check

- Principal’s driver’s license

- Proof of operating address

- Company EIN document

- Business plan – optional

- Chargeback ratio

- A functional and compliant website with login credentials

Your personal and business credit are considered when the bank does its vetting. Therefore, if there are any surprises, it’s best to be transparent and give us a heads-up so that we are all on the same page and can solve any issues.

What Is A UK High-Risk Merchant Account?

These merchant accounts refer to UK merchants requiring a high-risk processing partner. These are essentially business bank accounts for merchants that would have trouble finding services otherwise.

Banks and processors have determined UK high-risk merchant accounts to present an added risk to chargebacks and or fraud.

This is typically due to the industry in which the business operates, poor chargeback ratio, reputational concerns, health concerns, and poor credit.

Chargebacks

Chargebacks are the number one reason that UK merchants will find themselves at high-risk. Certain business models typically find themselves with more chargebacks due to payment type and industry type.

For example, subscription services typically have high chargeback numbers for various reasons.

Industries such as adult, online dating, and online gambling also have higher chargebacks.

A chargeback is when a customer calls their bank instead of going through the merchant for a dispute. While there are a lot of measures merchants can put into place, many merchants often don’t implement practical techniques until they find themselves in chargeback trouble.

Chargebacks must be kept at .9% regardless of your industry. If you are over .9%, you will pay higher fees, and you could find yourself on the MATCH list, which is nearly impossible to recover from.

Industry Of Your Business

The industry in that your business operates can solely determine your risk. That is because banks and processors have specific industries that are automatically considered high-risk, no matter your sales volume or chargeback ratio.

That said, the better your chargeback ratio and the more sales you drive should play in your favor when negotiating rates.

Reputational Concerns

Reputational concerns are a common reason why many industries are considered high-risk in the UK. If a bank thinks they could catch any lousy press for working with merchants in taboo industries, they will either opt to avoid working with you or place you as a high-risk merchant.

Health Concerns

Suppose you operate within an industry such as vape, CBD, marijuana, alcohol, or anything that can negatively affect health. In that case, this can place you in high-risk territory.

Poor Credit

Poor personal and business credit can deter processors and banks from working with you. That said, if you are showing movement in the right direction, you can get a high-risk merchant account approved.

Can Merchants Use Paypal, Venmo, Stripe, Or Square For Their High-Risk Business?

Before signing up for payment processing, always review the provider’s terms of service. Paypal, Venmo, Stripe, and Square all are strictly against any high-risk merchants.

Each of these companies has its terms of service page that breaks down specifically which industries they do not process for, but as a rule of thumb, if you’re high-risk, you need to find a high-risk processing partner.

Shopify/Woocommerce Integrations For UK Merchants

UK merchants can rest assured as we offer seamless integration with Shopify and Woocommerce. However, if you are using these platforms in a high-risk vertical, you will need a high-risk payment processor to accept payments.

Why Choose Corepay

At Corepay, we have multiple banking relationships in the UK, with the ability to quickly board merchants at the most competitive pricing points.

We also have two decades of high-risk experience and understand what it takes to help businesses grow.

We offer the following at Corepay:

- Quick Approvals Within 24-72 Hours, even for high-risk industries

- Exceptional Customer Service, including direct access to Management Team

- Risk mitigation with Rapid Dispute Resolution (RDR) by Verifi, 3-D Secure 2.1/ our partner product CB-ALERT

- Waived fees (application, set up, annual)

- Maximize approval ratios due to routing technology based on your target customer base within our proprietary payment gateway

- Traditional chargeback alerts by Ethoca and Verifi

- High-risk rates as low as a blended 2.95%

Our gateway Netvalve is specifically designed for high-risk verticals; however, we are gateway agnostic and pride ourselves on being able to plug into any gateway at your convenience.

Wrapping Up

UK high-risk merchant accounts can vary regarding rates, services offered, and time of approval. When searching, you must compare various processors to ensure you’re getting the best deal.

At Corepay, with multiple banking relationships, and two decades of payment processing experience, we are confident that we are an excellent match for your business and ready to take you to the next level.

Fill out the application below to find out what Corepay can do for your business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].