High-Risk Merchant List – Top 100 Risky Industries

Last Updated on June 19, 2023 by Corepay

Starting a business is both fun and challenging at the same time. Launching a company and finding out you are a high-risk merchant is an example of the challenging part. So we’ve created the ultimate high-risk merchant list that details every industry banks and processors may deem high-risk.

If you’re searching for a high-risk payment processor after determining you are, in fact, high-risk, you’ve come to the right place.

The purpose of this quick list is simply to answer your question and give you a comprehensive list of every industry deemed high-risk.

So, here are the top five industries that require high-risk payment processing solutions in which we specialize in at Corepay:

- Online dating payment processing

- Adult payment processing

- Fantasy sports payment processing

- CBD payment processing

- Online gambling payment processing

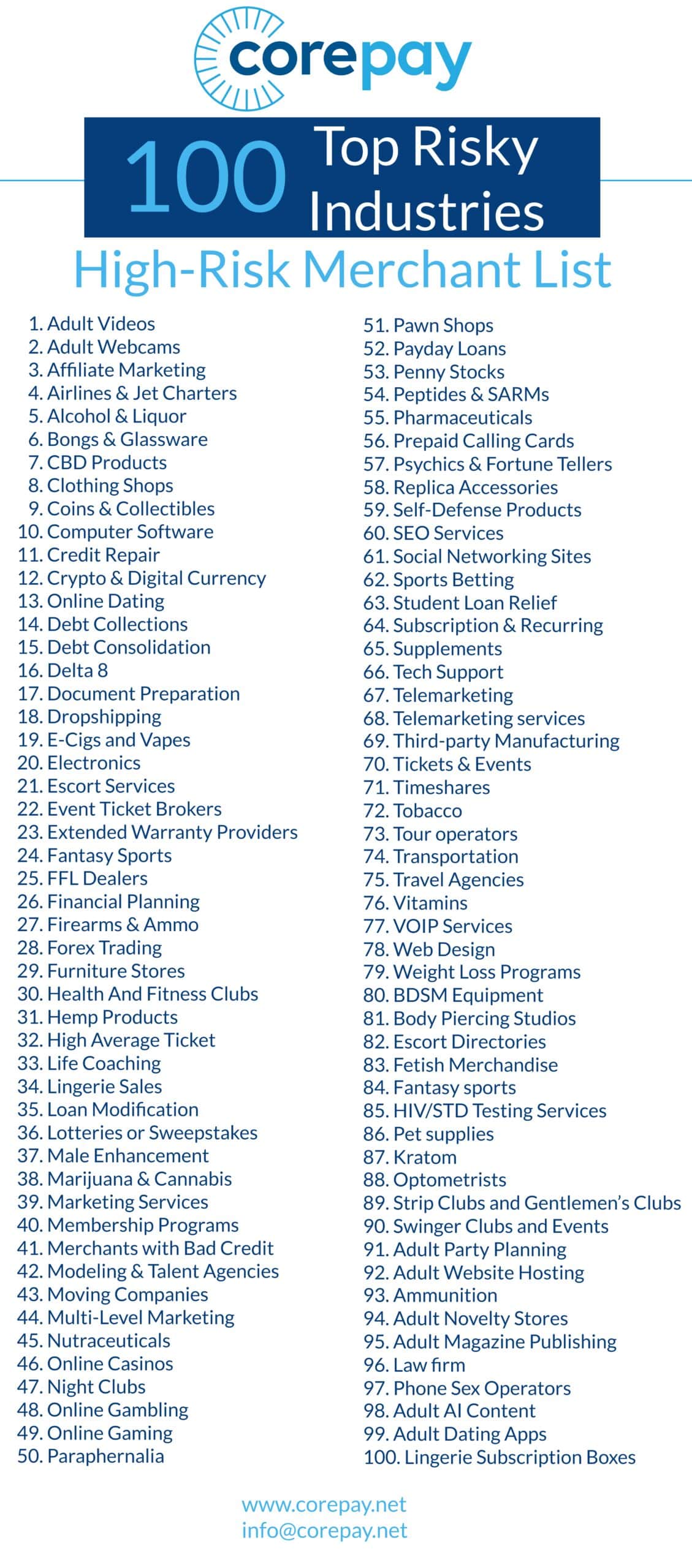

List Of All High-Risk Merchants

Here’s our comprehensive list of 100 industries you should save for future use when determining if you’re a high-risk merchant.

- Adult Videos

- Adult Webcams

- Affiliate Marketing

- Airlines & Jet Charters

- Alcohol & Liquor

- Bongs & Glassware

- CBD Products

- Clothing Shops

- Coins & Collectibles

- Computer Software

- Credit Repair

- Crypto & Digital Currency

- Online Dating

- Debt Collections

- Debt Consolidation

- Delta 8

- Document Preparation

- Dropshipping

- E-Cigs and Vapes

- Electronics

- Escort Services

- Event Ticket Brokers

- Extended Warranty Providers

- Fantasy Sports

- FFL Dealers

- Financial Planning

- Firearms & Ammo

- Forex Trading

- Furniture Stores

- Health And Fitness Clubs

- Hemp Products

- High Average Ticket

- Life Coaching

- Lingerie Sales

- Loan Modification

- Lotteries or Sweepstakes

- Male Enhancement

- Marijuana & Cannabis

- Marketing Services

- Membership Programs

- Merchants with Bad Credit

- Modeling & Talent Agencies

- Moving Companies

- Multi-Level Marketing

- Nutraceuticals

- Online Casinos

- Night Clubs

- Online Gambling

- Online Gaming

- Paraphernalia

- Pawn Shops

- Payday Loans

- Penny Stocks

- Peptides & SARMs

- Pharmaceuticals

- Prepaid Calling Cards

- Psychics & Fortune Tellers

- Replica Accessories

- Self-Defense Products

- SEO Services

- Social Networking Sites

- Sports Betting

- Student Loan Relief

- Subscription & Recurring

- Supplements

- Tech Support

- Telemarketing

- Telemarketing services

- Third-party Manufacturing

- Tickets & Events

- Timeshares

- Tobacco

- Tour operators

- Transportation

- Travel Agencies

- Vitamins

- VOIP Services

- Web Design

- Weight Loss Programs

- BDSM Equipment

- Body Piercing Studios

- Escort Directories

- Fetish Merchandise

- Fantasy sports

- HIV/STD Testing Services

- Pet supplies

- Kratom

- Optometrists

- Strip Clubs and Gentlemen’s Clubs

- Swinger Clubs and Events

- Adult Party Planning

- Adult Website Hosting

- Ammunition

- Adult Novelty Stores

- Adult Magazine Publishing

- Law firm

- Phone Sex Operators

- Adult AI Content

- Adult Dating Apps

- Lingerie Subscription Boxes

Why High-Risk Merchant Accounts Are Necessary

At first glance, you might wonder why you are labeled a high-risk merchant. Banks and payment processors consider these industries high-risk because they take the risk of processing your payments.

Download Our List Of High-Risk Merchants

Before heading out, save our list of high-risk merchants and subscribe to our newsletter.

Need High-Risk Processing?

If you’re in the market for credit card processing, we highly suggest filling out applications and comparing our services with the rest of the market offers.

There are several compelling reasons to choose Corepay for high-risk credit card processing:

- Expertise in High-Risk Industries: Corepay specializes in serving businesses operating in high-risk industriesThis expertise allows them to provide tailored payment solutions specifically designed to meet the needs of high-risk companies.

- Risk Management and Fraud Prevention: Corepay employs advanced risk management tools and fraud prevention measures to minimize the risk of fraudulent activities and chargebacks.

- Global Payment Solutions: Corepay offers various payment options and global coverage.

- Customized Payment Solutions: Corepay understands that each high-risk business has unique requirements.

- Dedicated Customer Support: Corepay prioritizes customer satisfaction and provides dedicated support to its clients.

- Competitive rates: Corepay offers extremely competitive pricing that allows you to save on processing fees.

If you are in the marketing for diversifying your payment ecosystem or just starting and need payment processing, fill out the application below to find out how we can help your business grow.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].