CC Bill Alternatives – Are There Cheaper Options?

Last Updated on October 10, 2023 by Corepay

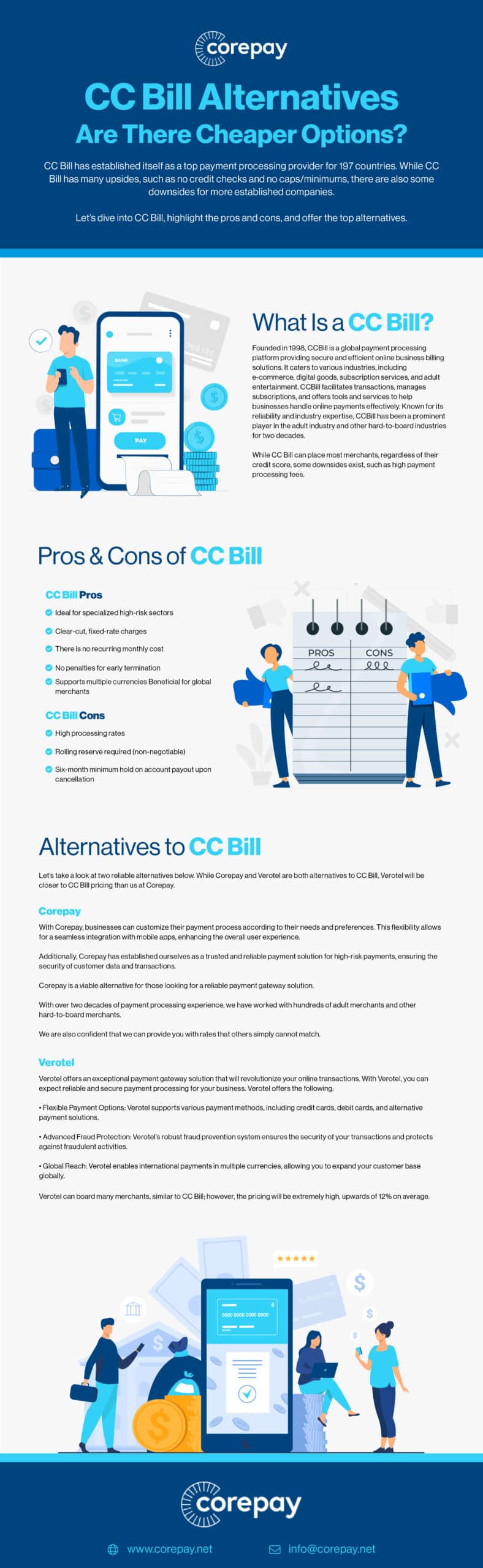

CC Bill has established itself as a top payment processing provider for 197 countries. While CC Bill has many upsides, such as no credit checks and no caps/minimums, there are also some downsides for more established companies.

Let’s dive into CC Bill, highlight the pros and cons, and offer the top alternatives.

Key Takeaways

- CC Bill offers payment processing regardless of credit

- CC Bill boards many hard-to-place merchants

- CC Bill is a payment aggregator

- The downside to CC Bill is high payment processing fees upwards of 10%

- Corepay is the most reliable alternative to CC Bill, offering lower payment processing fees

What Is CC Bill

Founded in 1998, CCBill is a global payment processing platform providing secure and efficient online business billing solutions. It caters to various industries, including e-commerce, digital goods, subscription services, and adult entertainment. CCBill facilitates transactions, manages subscriptions, and offers tools and services to help businesses handle online payments effectively. Known for its reliability and industry expertise, CCBill has been a prominent player in the adult industry and other hard-to-board industries for two decades.

While CC Bill can place most merchants, regardless of their credit score, some downsides exist, such as high payment processing fees.

What Industries Does CC Bill Serve?

CC Bill serves a wide range of industries. Some industries that benefit from alternative payment solutions include adult entertainment, digital goods, e-commerce, and subscription-based services.

Here’s a quick look at industries CC Bill commonly works with:

- Digital goods

- Adult entertainment

- Online dating

- Delta-8

- CBD

- Credit Repair

- Vape

CC Bill Rates

One option for businesses looking for flexible payment rates is to explore CC Bill’s pricing options. Here are three key factors to consider:

1. Tiered Pricing: CC Bill offers pricing plans based on a business’s transaction volume. This allows companies to pay lower rates as their sales increase, providing cost savings and flexibility.

2. Customizable Packages: CC Bill offers customizable packages that cater to the specific needs of different industries. Businesses can choose from various features and services to create a package that suits their requirements, ensuring they only pay for what they need.

3. Transparent Fees: CC Bill provides transparent fee structures, clearly outlining all charges associated with their payment processing services. This transparency helps businesses plan their budgets effectively and avoid any unexpected expenses.

Here’s a quick breakdown of CC Bill pricing:

- High-Risk Pricing: 5.9% + $0.55 no adult-oriented businesses

- Adult Entertainment: 10.8% to 14.5% plus annual fee of $1,000

As you can see, while CC Bill will board most merchants, it comes with a hefty price.

CC Bill Pros

- Ideal for specialized high-risk sectors

- Clear-cut, fixed-rate charges

- There is no recurring monthly cost

- No penalties for early termination

- Supports multiple currencies Beneficial for global merchants

Cons Of CC Bill

Consider a few cons when using CC Bill as your payment solution. One drawback is the limited customization options. With CC Bill, you may find yourself restricted in customizing your payment process to meet the specific needs of your business. This lack of flexibility can hinder your ability to provide a seamless checkout experience for your customers.

Another potential drawback is the potential for hidden costs.

Here’s a quick breakdown of the cons:

- High processing rates

- Rolling reserve required (non-negotiable)

- Six-month minimum hold on account payout upon cancellation

Alternatives To CC Bill

Let’s take a look at two reliable alternatives below. While Corepay and Verotel are both alternatives to CC Bill, Verotel will be closer to CC Bill pricing than us at Corepay.

Corepay

With Corepay, businesses can customize their payment process according to their needs and preferences. This flexibility allows for a seamless integration with mobile apps, enhancing the overall user experience.

Additionally, Corepay has established ourselves as a trusted and reliable payment solution for high-risk payments, ensuring the security of customer data and transactions.

Corepay is a viable alternative for those looking for a reliable payment gateway solution.

With over two decades of payment processing experience, we have worked with hundreds of adult merchants and other hard-to-board merchants.

We are also confident that we can provide you with rates that others simply cannot match.

Verotel

Verotel offers an exceptional payment gateway solution that will revolutionize your online transactions. With Verotel, you can expect reliable and secure payment processing for your business. Verotel offers the following:

- Flexible Payment Options: Verotel supports various payment methods, including credit cards, debit cards, and alternative payment solutions.

- Advanced Fraud Protection: Verotel’s robust fraud prevention system ensures the security of your transactions and protects against fraudulent activities.

- Global Reach: Verotel enables international payments in multiple currencies, allowing you to expand your customer base globally.

Verotel can board many merchants, similar to CC Bill; however, the pricing will be extremely high, upwards of 12% on average.

Why Choose Corepay

By choosing Corepay for your merchant account, you can expect the following benefits:

- Competitive Pricing Structure: We’re committed to providing you with the most cost-effective processing rates, enabling your business to thrive with maximum profitability.

- Swift Approval Process: Our streamlined approval system ensures that travel merchants can start making sales promptly. Approvals are typically granted within 24-72 hours.

- High-Volume Transaction Handling: Our specialized payment gateway, Solidgate, is tailored to accommodate high-risk businesses processing substantial transaction volumes.

- Multi-Currency Capabilities: We recognize the importance of accepting payments in various currencies, allowing you to expand your reach and serve a global clientele.

- Stringent Security Measures: Our PCI-Level 1 secure payment gateway undergoes continuous monitoring and rigorous testing to ensure the highest level of security for your transactions.

- Mobile Payment Integration: Embrace the mobile payment revolution and easily accept payments from customers using their mobile devices, catering to evolving consumer preferences.

- Fee Waivers: We believe in a transparent pricing model. Therefore, we waive application, setup, and annual fees, allowing you to focus on growing your business without unnecessary financial burdens.

- 24/7 Customer Support: Our dedicated customer support team is available round-the-clock to address any inquiries or concerns you may have. Your satisfaction and success are our top priorities.

Please fill out the application below to find out what Corepay can do for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].