Law Firm Merchant Accounts – Payment Processing 2024

Last Updated on February 5, 2024 by Corepay

Law firms/legal services are unique in terms of billing. Therefore, a law firm merchant account is vital for serious law firms as you will need payment processing specifically tailored to your individual needs.

With a market size of $330 billion, the law firm industry is expected to grow by 8.2 percent in 2024. As COVID-19 negatively impacted many businesses, the legal services industry was as well. The positive that came out of the pandemic is that companies found successful ways to meet with clients virtually to continue to operate.

Law firms can be considered high-risk by acquiring banks and processing companies. Because of this, it can be challenging for firms to find reliable payment processing that will accept them.

It is important to note that law firms will need to find processing from a high-risk credit card processor rather than a low-risk option such as Paypal or Stripe.

At Corepay, we understand the ins and outs of the law firm industry and know how to implement a successful payment processing plan for all of our clients.

Accepting multiple forms of payment is extremely important for any law firm as different clients may prefer or only be able to pay in a specific manner.

We tailor all of our merchant accounts to benefit our clients specifically. That means that every account we set up could vary depending on the nature of your business.

The firms that we serve, yet aren’t limited to, include the following:

We can provide solutions/services to all firms that are operating legally.

This article will break down why we believe we are the perfect fit for your law firm and explain what you need regarding your law firm’s merchant account.

Why Are Law Firms Sometimes Considered High-Risk?

Should a law firm have a shady practice or a bad reputation, this can negatively impact their business when applying for credit card processing.

This doesn’t mean they won’t be able to find processing; however, rates will likely be higher, making it much more difficult to find a processor.

Having a high number of chargebacks is also a culprit for law firms being considered high-risk.

Maintaining Low Chargebacks

Having a suitable processor for your law firm can significantly save you fees in the long run by helping you achieve lower chargebacks. At Corepay, we are confident that we can implement a strategy that will decrease your overall chargebacks through our partner product, CB-ALERT.

Not only can lower chargebacks save you monthly chargeback fees, but they can also save you money on monthly fees to your processor.

Staying In Good Standing With All Other Payment Processors

Staying in good standing with your current payment processor is essential. At Corepay, we strongly recommend that businesses operate with multiple merchant accounts to mitigate risk.

Should something happen with one merchant account, you can alleviate stress knowing that you can still accept payments.

Applying For A Law Firm Merchant Account

Applying for your law firm’s merchant account is an exciting part of your journey. At Corepay, we make applying for law firm businesses as seamless as we can.

Once you fill out your application, you can promptly expect a response from one of our trained specialists. The more information you can fill out on our application page, the faster we can get you approved and processing payments. Should you have any questions, you can also contact us, and we will be in touch quickly.

If you have bad personal credit, it is still possible to get approved for your merchant account, and at Corepay, we can make sure you get approved and stay approved.

You will need the following when applying for your merchant account for legal services:

When applying, here are a few tips that can make your business stand out to your processor:

When payment processors audit your account, they will be looking at all of these things to assess your overall risk.

When your business is clearly on top of chargebacks, refund policies and understands the operation in full, it can lower your processor’s fees.

Increasing Cash Flow By Choosing The Best Payment Processing For Law Firms

If your law firm has been around for a while, you probably remember the days where cash and check payments were the standards. Nowadays, clients have access to many different payment options. Therefore, your business must be able to accept as many forms of payment as possible to increase your law firm’s cash flow.

Choosing the correct payment processing for your business is no easy task. When selecting, the most important thing is to compare fees, services, and experience between reputable processors who understand the law firm industry.

Was Your Law Firms Merchant Account Terminated Or Frozen?

Frozen merchant accounts can be devastating to businesses. While law firms can fall into the medium, they can also be considered high-risk by credit card processors.

For this reason, choosing a low-risk processor such as Paypal or Stripe might prove to be detrimental. While these are by no means bad companies, they only work with low-risk merchants.

This means your law firm could begin processing payments, only to find your merchant account was terminated.

The main reason this occurs is that Paypal and other low-risk processors perform their underwriting after the application.

It can take up to 6 months for Paypal to realize that you are breaking the terms of your contract and decide to terminate your account.

Once this happens, your account can be terminated, or funds can be held for up to 180 days. This means you will not be able to access these funds, and you should immediately find a high-risk processor so you can continue to bring in cash flow.

Why Choose Corepay For Your Law Firms Payment Processing?

Your payment processing provider is an essential part of your law firm’s business’s growth. At Corepay, we offer anti-chargeback solutions through our partner product CB-ALERT and provide all our clients with merchant accounts tailored to their exact needs.

We offer the following for all of our legal service related merchant accounts:

Legal Services Industry Overview

The legal services industry is recovering in 2021 after the COVID-19 pandemic. The global legal services market is projected to reach 750 billion U.S. dollars in 2021.

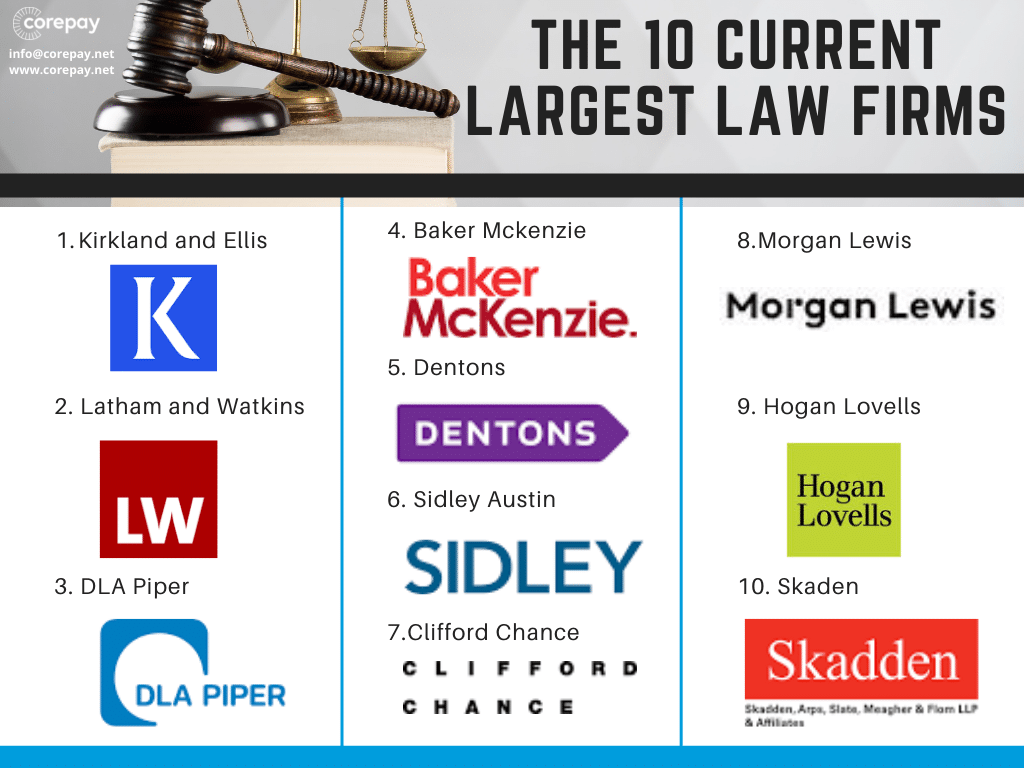

The 10 largest law firms in 2021 are:

- Kirkland and Ellis

- Latham and Watkins

- DLA Piper

- Baker Mckenzie

- Dentons

- Skaden

- Sidley Austin

- Clifford Chance

- Morgan Lewis

- Hogan Lovells

Law firms can have multiple practice areas worldwide, while expertise is required at both the local and global levels.

All of the law firms listed above have reliable payment processing, which has helped them grow to where they are today.

Law Firm Payment Processing Fees

Processing fees vary depending on a few factors. As a result, every processor will offer different rates, so it is important to compare that upfront.

Outside of comparing rates, the fees vary depending on the following:

Certain payment processing solutions result in different forms of payment, which may lead to a higher number of chargebacks. For example, card not present transactions (CNP) are statistically far greater to result in chargebacks than card present transactions (CP).

Payment Processing Solutions For Lawyers/Attorneys

Our merchant accounts/payment processing is tailored to your specific needs depending on which sub-niche your law firm operates in.

We are proud to offer payment processing for lawyers and attorneys regardless of your specialty.

The following are the most common methods of payment in the law firm industry. Corepay is proud to offer the following:

Virtual Terminal Internet Processing: This is one of the most popular and efficient ways to accept credit/debit cards. Merchants can check on the status of their transactions, set up recurring payments, and review activity from customers.

Mobile Phone: This method is common amongst law firms, and it’s a convenient/fast way to accept card transactions. Merchants attach a device to their phone and swipe the cards for transactions.

ACH: Ach is another standard solution that merchants can have available for accepting payments. It’s a cost-effective method that is highly secure.

Payment Gateways: A payment gateway is a service that authorizes and processes payments in e-commerce websites, serving as a portal to facilitate transactions between customers and merchants. Our team of merchant account managers is dedicated to providing you with the best possible gateway solutions.

MCC For Legal Services/Attorneys

The MCC is 8111 for legal services and attorneys. This is important as credit card processors can charge different rates for different types of businesses.

Wrapping Up

When it comes to finding the right partner for your law firm’s credit card processing, look no further than Corepay. We understand how to grow your business, keep your chargebacks at a minimum, and implement optimal security for your business.

You can get in touch with us about applying for your merchant account below and we look forward to helping you achieve your goals and grow your business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].