Chargeback Prevention Alerts 101

Last Updated on July 5, 2023 by Corepay

Chargeback prevention alerts are one of the most efficient ways for merchants to curb their chargeback disputes. Chargeback alerts give merchants the power to stop a dispute dead in its tracks, ultimately allowing the merchant to grow their bottom line. This article will break down chargeback prevention alerts, provide insight into who offers the best alerts, and give you the details you need to get started.

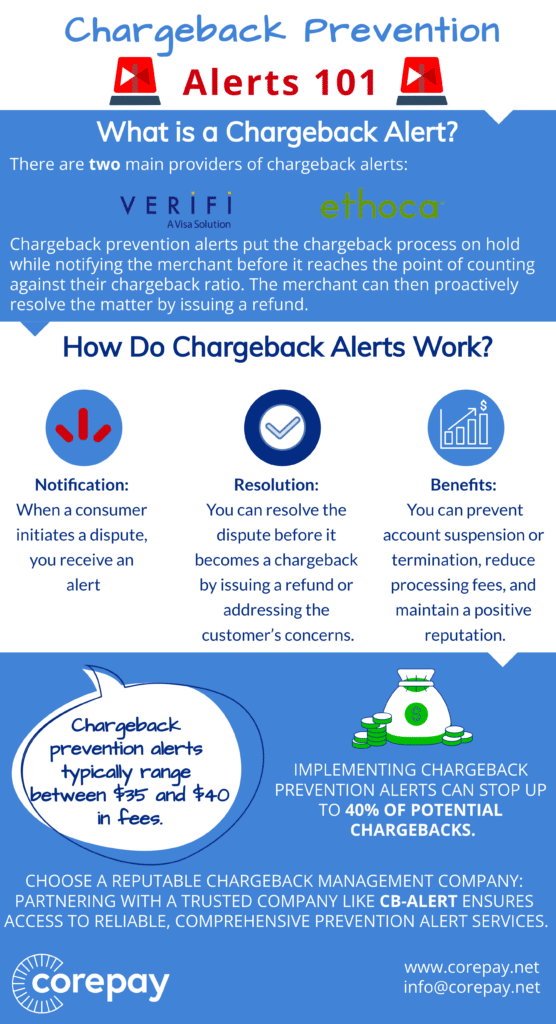

There are two main providers of chargeback alerts: Verifi and Ethoca. Chargeback management companies implement these alert networks for merchants to streamline the resolution processes and provide real-time alerts with detailed reports.

Key Takeaways

- Chargeback prevention alerts can significantly reduce chargebacks and protect a merchant’s bottom line.

- Merchants receive advance notice of potential chargebacks through chargeback alerts, allowing them to resolve the issue before it becomes a chargeback.

- We recommend CB-ALERT to implement chargeback alerts for your company. CB-ALERT is a chargeback management company that provides chargeback prevention alerts and helps merchants fight against invalid chargebacks.

- Implementing chargeback prevention alerts is recommended to avoid higher processing fees, reputation damage, and the consequences of exceeding chargeback ratio thresholds.

- Verifi And Ethoca are the two main providers of alerts

What Are Chargeback Prevention Alerts

Chargeback prevention alerts are messages sent to merchants via Verifi/Ethocas networks to alert them there has been a dispute.

Chargeback alerts utilize technology to resolve transaction disputes proactively before escalating into chargebacks. By receiving notifications when a consumer initiates a dispute, merchants can quickly take action to address the issue and prevent it from becoming a chargeback.

How Do Chargeback Alerts Work?

Protect your business and save money by implementing a robust system that gives you advance notice of potential disputes, allowing you to take proactive steps and resolve customer issues before they escalate with chargeback alerts.

A prevention alert puts the chargeback process on hold and notifies the merchant before it reaches the point of counting against their chargeback ratio. The merchant can then proactively resolve the matter by issuing a refund.

If the merchant believes the request is invalid, they can always let the process play out and dispute the chargeback.

Here’s how chargeback alerts work:

Notification: When a consumer initiates a dispute, you receive an alert immediately, putting the chargeback process on hold.

Resolution: You can resolve the dispute before it becomes a chargeback by issuing a refund or addressing the customer’s concerns.

Benefits: By utilizing chargeback prevention alerts, you can prevent account suspension or termination, reduce processing fees, and maintain a positive reputation.

How Much Do Chargeback Alerts Cost?

Chargeback prevention alerts typically range between $35 and $40 in fees.

While the cost may seem high, investing in chargeback prevention alerts can save you money in the long run.

You avoid higher processing fees and protect your bottom line by resolving customer issues before they become chargebacks. Additionally, dealing with account suspension or termination can be costly and damage your reputation.

Benefits Of Chargeback Prevention Alerts

By investing in chargeback prevention alerts, merchants can effectively resolve customer issues before they escalate into costly disputes.

This proactive approach saves businesses money and improves customer satisfaction and loyalty.

- Save money

- Build better customer relationships

- Save time

- Avoid merchant account closure

Which Company Has The Best Chargeback Prevention Alerts Management?

At Corepay, we recommend checking out CB-ALERT for your chargeback alert implementation. While there are many chargeback management companies, CB-ALERT also understands the payment processing side of things and what payment processors look at regarding chargebacks.

With CB-ALERT, you can proactively protect your business from the damaging effects of chargebacks. Their advanced technology puts the chargeback process on hold and notifies you immediately when a potential dispute arises.

This allows you to take immediate action and resolve the issue before it escalates into a chargeback. CB-ALERT guarantees a significant reduction in chargebacks, saving you money and preserving your bottom line.

Their experienced team provides 24/7 customer service and transparent pricing, ensuring you have all the support you need to fight fraud effectively.

Which Card Networks Offer Chargeback Prevention Alerts?

The primary dispute resolution networks for chargeback prevention alerts are Ethoca and Verifi. Both networks can be used in tandem to reduce your Visa and Mastercard chargebacks.

Verifi Alerts Vs. Ethoca Alerts

Here are four important factors to consider when comparing Verifi and Ethoca alerts:

- Coverage: Verifi provides better coverage in the United States, while Ethoca offers more extensive coverage internationally. Depending on your target market, you may prioritize one over the other.

- Focus: Verifi alerts intercept chargebacks, allowing merchants to resolve disputes before they escalate further. On the other hand, Ethoca alerts focus on preventing chargebacks by providing real-time transaction data and collaboration with issuers.

- Cost: Verifi and Ethoca chargeback alert services typically have fees ranging between $35 and $40 per alert.

By evaluating these factors, you can determine which provider aligns best with your business goals and effectively reduces chargebacks while protecting your bottom line.

Do Merchants Need To Implement Chargeback Prevention Alerts?

If you’re a merchant on the threshold for chargebacks, it would be wise to implement chargeback prevention alerts.

While you have to pay for prevention alerts, you significantly reduce your chargeback ratio, saving you money on processing fees and avoiding the closure of your merchant account.

What Percentage Of Chargebacks Are Stopped By Alerts?

Chargeback alerts have been proven to be highly effective in stopping chargebacks and saving businesses money. Implementing chargeback prevention alerts can stop up to 40% of potential chargebacks.

This means that by utilizing these alerts, merchants have the opportunity to resolve customer issues and prevent disputes from escalating into costly chargebacks.

How To Enroll For Chargeback Prevention Alerts

Registering for chargeback prevention alerts is a straightforward process that can be completed in just a few steps. Here’s what you need to do:

1: Gather your business information, including your business name, address, and merchant account descriptor.

2: Provide your account number for the merchant account you want to protect.

3: Choose a reputable chargeback management company that offers chargeback prevention alert services. (We recommend CB-ALERT)

4: Complete the application process by submitting all required information and granting access to your sales system if necessary.

How Long oes It Take To Implement Chargeback Alerts?

Implementing chargeback prevention alerts varies depending on your merchant status. For new merchants, the setup time typically ranges from 45 to 60 days, while new customers can expect a shorter timeframe of 20 to 30 days.

However, the process becomes more streamlined and efficient if you work with a chargeback management company. They provide dedicated teams to respond to alerts from both Verifi and Ethoca, ensuring prompt resolution of any potential disputes.

Best Way To Implement Chargeback Prevention Alerts

Here’s how you can implement chargeback prevention alerts:

1. Choose a reputable chargeback management company: Partnering with a trusted company like CB-ALERT ensures access to reliable, comprehensive prevention alert services.

2. Provide necessary information: Be prepared to share your business details, including your name, address, merchant account descriptor, and account number. This information is required for enrollment in the prevention alert network.

3. Set up the integration: Grant the chargeback management company access to your sales system or payment gateway. This allows them to receive real-time notifications of potential disputes and take immediate action.

4. Monitor and respond promptly: Responding to requests swiftly ensures a smooth implementation.

Why Hire A Chargeback Management Company To Help With Alerts

By enlisting the help of experts, you’ll have dedicated teams who are well-versed in handling chargeback prevention alerts from providers like Verifi and Ethoca.

A chargeback management company offers more than just an alert response. They provide valuable insights and analysis on chargeback trends, helping you identify patterns and take proactive measures to stop revenue loss.

It’s also important to note that outside of the money you save on fees, you save an incredible amount of time that would be spent dealing with chargebacks.

What Is The Chargeback Threshold For Visa And Mastercard?

Visa’s chargeback threshold is currently .09%, while Mastercard’s is 1.5%.

Exceeding the chargeback threshold set by Visa and Mastercard can lead to high-risk designation and additional fees. We recommend the following steps:

- Maintain a low chargeback ratio: Aim to keep your chargeback ratio below 1% to avoid any negative consequences.

- Implement effective prevention measures: Use chargeback prevention alerts and other methods to resolve customer issues before they escalate into chargebacks proactively.

- Monitor your chargeback activity: Regularly analyze your chargeback trends and take necessary actions to prevent future disputes.

- Work with a reputable chargeback management company: They can provide dedicated teams to respond promptly to alerts and help you maintain a low chargeback ratio.

How To Choose A Chargeback Management Company To Help With Chargeback Alerts

When choosing a chargeback management company to help with chargeback alerts, it is essential to consider a few key factors.

First, look for a company offering coverage from Verifi and Ethoca, as these are the leading chargeback alert providers. Additionally, ensure that the company provides dedicated teams to respond to alerts promptly and efficiently.

Transparency in pricing and 24/7 customer service are also crucial aspects to consider. Furthermore, opt for a chargeback management company with experience in your industry for high-risk credit card processing.

Wrapping Up

Now that you have an understanding of chargeback prevention alerts, we hope that you can make a decision and find the right provider.

Should you have any questions, please get in touch with us via our contact form.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].