When Paypal Terminates Your Merchant Account

Last Updated on December 13, 2022 by Corepay

Having your Paypal merchant account terminated or frozen is a total nightmare. If you landed on this page looking for a step-by-step guide as to what you need to do next, you’ve come to the right place.

This article will explain why your Paypal merchant account was frozen and what you need to do to begin processing payments again.

Why Did Paypal Freeze Your Merchant Account?

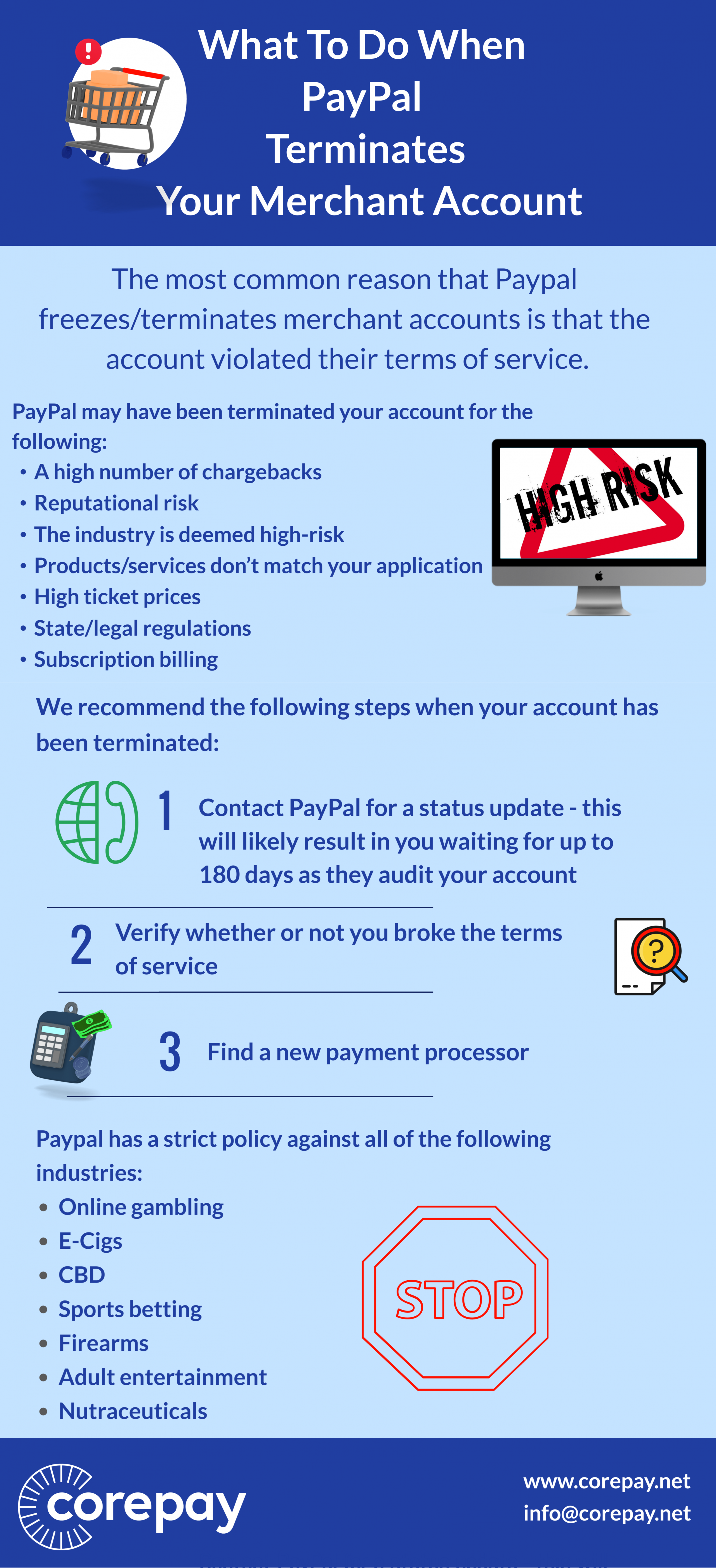

The most common reason that Paypal freezes/terminates merchant accounts is that the account violated their terms of service.

Here’s a list that breaks down the most common reasons Paypal terminates merchant accounts:

*Paypal is a fantastic company; they focus on low-risk merchant accounts and not high-risk merchant accounts.

- A high number of chargebacks

- Reputational risk

- The industry is deemed high-risk

- Products/services don’t match your application

- High ticket prices

- State/legal regulations

- Subscription billing

What To Do Once Your Merchant Account Is Dropped

By coming to this page, you are already doing the right thing. Next, you need to find a payment processor specializing in your industry and understand high-risk merchant accounts.

At Corepay, we frequently get merchants approved who have had their Paypal accounts terminated as we specialize in high-risk payment processing.

We recommend the following steps when your account is terminated:

- Reach out to Paypal for a status update – this will likely result in you waiting for up to 180 days as they audit your account

- Verify whether or not you broke the terms of service

- Find a new payment processor

The third step here is the crucial one. You must get a reliable payment processing solution swiftly to avoid missing out on significant revenue.

We highly recommend applying with us as we specialize in all high-risk merchant industries and are confident we can assist with your business.

At Corepay, we can process payments for all legal companies with a chargeback ratio under 2%.

Banned Paypal Industries

Paypal has a strict policy against all of the following industries:

- Online gambling

- E-Cigs

- CBD

- Sports betting

- Firearms

- Adult entertainment

- Nutraceuticals

At Corepay, we are proud to service all of the above industries and boast over two decades of payment processing experience.

Why Choose Corepay

If you’re looking to skip the headaches of payment processing and find a reliable solution for your business model, look no further than Corepay.

We can provide you with a high-risk merchant account that is dedicated and controlled by you, the merchant.

With Corepay, you are choosing the following:

- Competitive processing fees

- 24/7 customer service

- Fast approvals

- High volume processing

- Waived fees

Apply With Corepay Today

At Corepay, we make applying for your account a breeze. We understand the importance of having your account terminated and we are confident we can get you pre-approved quickly.

You will need the following when applying:

- Company EIN document

- Personal and business bank statements

- Articels of incorporation

- Principal’s driver’s license

- Voided check

- Chargeback ratio

Is PayPal a merchant account?

Paypal is an aggregate merchant account, meaning merchants don’t have control over their accounts.

Paypal Doesn’t Provide High-Risk Merchant Accounts

As mentioned above, Paypal does not service high-risk merchants as they focus solely on low-risk merchants.

Wrapping Up

We are confident that we can assist you with a high-risk merchant account and help grow your business to the next level without headaches.

Whether you are searching for a CBD merchant account, online gambling merchant account, pharmacy merchant account, or any other high-risk industry, make Corepay your payment processing partner.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].