Pharmacy Merchant Account: Get Yours Today

Last Updated on July 7, 2023 by Corepay

A pharmacy merchant account is vital for any business specializing in online prescriptions. Likewise, finding a reliable payment processing partner is critical for anyone in this industry, and that’s where Corepay comes in.

At Corepay, we consider ourselves one of the best high-risk online pharmacy merchant account providers, and we pride ourselves on 100% transparency with all of our clients.

This article will list everything you need to know about applying for a pharmacy/prescription merchant account and what to expect from a payment processing partner.

Online Pharmacy Payment Processing Made Easy

Finding a payment processing partner in this vertical is challenging for several reasons. At Corepay, it is our goal to make it easier so that you can focus on other things with your business.

The demand for pharma merchant accounts has grown tremendously over the last few years with eCommerce’s rise and certain retail establishments’ fall.

Pharmacy merchant accounts are similar to medical merchant accounts because they are both high-risk and require their own merchant underwriting guidelines.

Due to the nature of prescriptions and the risk involved to all parties, online pharmaceuticals are deemed high-risk by both processors and banks.

In short, you will likely have to pay higher fees to cover the risk that the processor takes on your business.

Apply For Your Prescription-Based Merchant Account

We make applying for your account painless and swift as we understand that time is of the essence.

When applying, you will need the following:

- Certificate of incorporation

- Voided check/proof of bank accounts, such as a signed bank letter displaying your account/routing numbers

- Organizational chart (if applicable)

- Personal and business financial history

- Prior processing statements (if relevant)

- Compliant website

- Necessary Permits & Licenses for your Online Pharmacy

- Chargebacks under 2%

- Six months of processing history

Remember that the more information you can provide us, the faster we can get you approved.

Choosing A High-Risk Provider

Finding a merchant account provider for pharma is not easy, but it is doable. When choosing a provider, you will want to pick a partner that is able to get you higher approvals and help you grow your account to the next level.

You will also want a gateway agnostic provider that can plug in at your convenience to a gateway of your choosing.

Why Choose Corepay

We are confident that we can grow your business. With over two decades of high-risk credit card processing experience and knowledge of the pharma industry, we have what it takes to get you approved and ensure you stay approved.

We also have our own payment gateway as well as a chargeback mitigation product that can guarantee you lower chargebacks.

Below is what we have to offer at Corepay:

- Fast Approvals Within 24-72 Hours, even for high-risk industries

- Exceptional Customer Service, including direct access to Management Team

- Risk mitigation with Rapid Dispute Resolution (RDR) by Verifi, 3-D Secure 2.1/ our partner product CB-ALERT

- Low-risk rates as low as $99 per month and $0.05 per transaction

- Waived fees (application, set up, annual)

- Maximize approval ratios due to routing technology based on your target customer base within our proprietary payment gateway

- Traditional chargeback alerts by Ethoca and Verifi

- High-risk rates as low as a blended 2.95%

What Is A Pseudo/Online Pharmacy?

An online pharmacy is a company that specializes in online purchases and is known for card-not-present transactions (CNP).

Both pharmacies depend on the type of medication/prescriptions you sell. A regular online pharmacy is accredited and licensed adequately by all necessary legal entities.

Pseudo pharmacies sell knock-off medicines that may have claims to do XYZ, but they do not give out doctor-prescribed medication.

Examples of this would be Nutra, weight-loss supplements, and CBD.

What’s important to note is that regular pharmacies can also sell CBD, and these are not always mutually exclusive entities.

Why Is Pharma Considered High-Risk?

It shouldn’t come as a surprise that pharmaceuticals are deemed high-risk, but let’s break down why banks and processors are wary of online prescription stores.

- Extensive government Regulation

- Use of pseudo pharmaceuticals

- Potential health problems/abuse

- Card Not Present Transactions

- Chargebacks

As you can see, chargebacks are on the list, but mainly because they appear in most high-risk verticals.

Government Regulation

Pharmaceuticals are heavily regulated by the government as well as the state. Whenever industries are heavily regulated, it adds to the risk of a merchant losing licensing or getting in trouble – both things that can get the banks and processors into trouble.

Use of pseudo pharmaceuticals

Pseudo-drugs can give online pharmacies a bad reputation, especially if the products develop high chargeback rates. This indicates that the products are ineffective, ultimately making the pharmacy lose credibility.

Health Problems

Specific prescriptions can lead to serious health problems. In addition, since the sales are all made online, there’s a greater chance of fraud, and individuals could get their hands dirty through your online platform, which is a reputational damage risk for banks.

CNP And Chargebacks

Card-Not-Present transactions always have a greater chance of chargebacks than a card-present transaction. However, when you pair this with the fact that customers might need specific medications and not have the means to fund them, they could partake in friendly fraud, which likely results in chargebacks.

Since pharma is a challenging industry, chargebacks must be kept at a minimum, especially if you’re looking for lower rates.

At Corepay, we are proud to offer chargeback mitigation through our partner product, CB-ALERT.

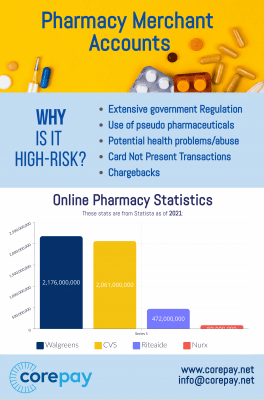

Online Pharmacy Statistics

Walgreens.com currently leads the charge when it comes to online sales. Here is a quick list that breaks down the top four in the world:

These stats are from Statista and as of 2021.

Avoiding Low-Risk Processing Solutions

One of the most important things you can do when finding processing is to avoid low-risk options such as Stripe, Paypal, or Square. While all three are incredible options, they specialize in low-risk and don’t take high-risk accounts.

Wrapping Up

Pharmaceutical merchant accounts are something that only high-risk merchant account providers will take on.

Should you choose Corepay, we would love the chance to lower your chargebacks and grow your business.

Now that you understand everything you need to get approved, we strongly urge you to apply today and find out what Corepay can do for your business.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].