Payment Gateways VS Merchant Accounts – The Difference

Last Updated on October 6, 2022 by Corepay

Payment gateways, merchant accounts, and payment processors are three terms you will hear copiously when starting an eCommerce-related business.

You will need to know the ins and outs of these terms, including how they are related, what they do, and which you need for your specific business.

This article will focus on payment gateways vs. merchant accounts and help you determine precisely what you need for your business.

Whether you are an eCommerce merchant looking to start/grow your business or you are simply looking to switch payment providers, below you will find an in-depth analysis of two of the most important parts of selling online.

If you’re wondering which solution you need for your business, fill out an application with us below, and we will create a plan specifically tailored for your business needs.

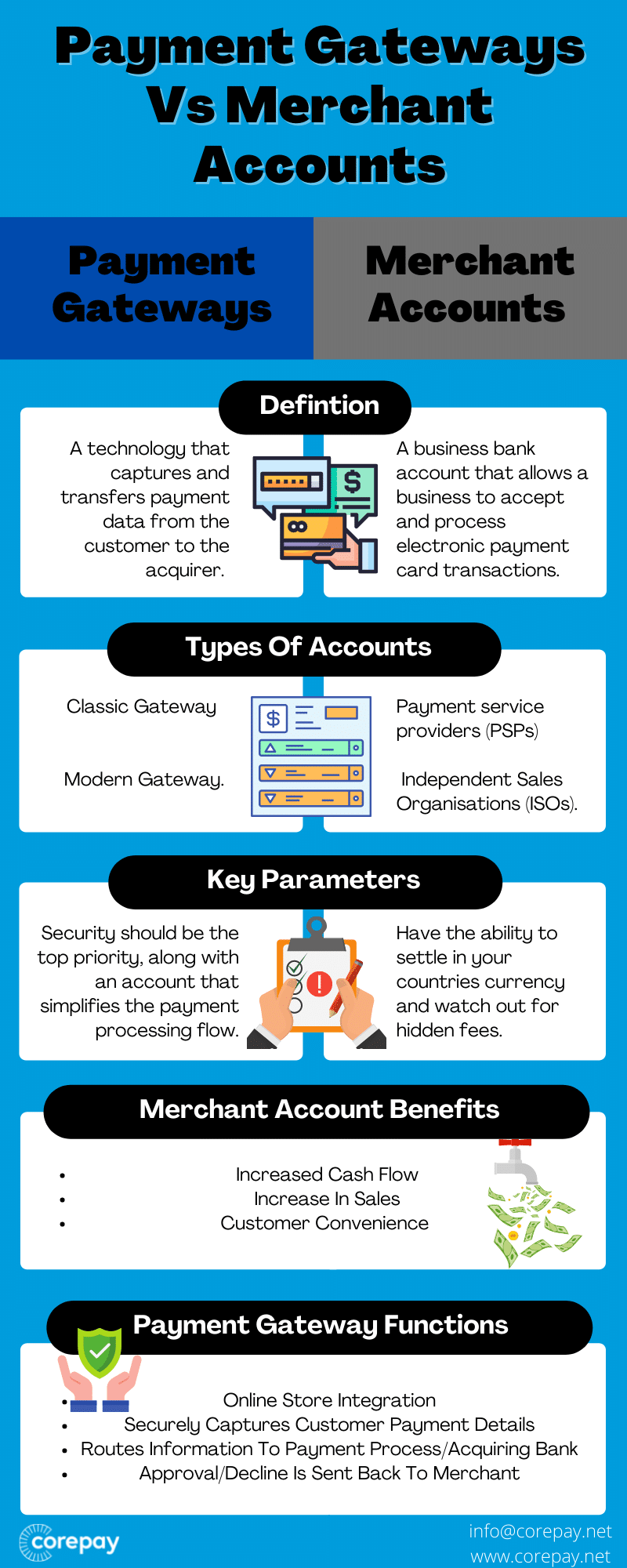

Payment Gateways Vs. Merchant Account Overview

Let’s grab a basic understanding before diving deep into payment gateways vs. merchant accounts.

To accept credit card payments and use a payment gateway, you will need a merchant account.

Merchant accounts are the holding accounts where information about transactions is collected and then stored.

The payment gateway is the link that connects a customer’s bank and your merchant account directly from your payment service provider (PSP).

What Is A Payment Gateway?

A payment gateway is a technology that captures and transfers payment data from the customer to the acquirer.

Payment gateways keep the entire payment ecosystem running smoothly and effectively while enabling online payments for consumers and businesses.

Developing a basic understanding of what a payment gateway is and how it relates to your online sales is vital as this is part of the payment flow process.

Payment gateways securely validate the customer’s card details, ensuring the funds are available, eventually enabling the merchants to get paid by the customer. During this process, sensitive/private information is encrypted, providing all information is passed securely from the customer to the acquiring bank via the specific merchant’s payment gateway age.

Think of the payment gateway as a middleman between customers and the merchant, which works to ensure the transaction is secure swiftly ultimately.

Payment gateways also simplify the payment processing flow.

One of the biggest things to note with payment gateways is that they do all of the following in about one second:

- Online Store Integration: The payment gateway gives your multiple online ways to integrate online credit card processing capabilities within your business

- Securely Captures Customer Payment Details: The payment gateway receives the shopper’s information provided via tolls provided by the payment gateway. During this process, the gateway encrypts the payment details.

- Routes Information To Payment Process/Acquiring Bank: During this process, the acquiring bank takes control. The bank might then provide additional antifraud screenings/protocols before routing this information to the credit card networks.

- Approval/Decline Is Sent Back To Merchant: Once the payment is accepted or declined, the merchant will direct the customer to a confirmation page or ask them to provide another form of payment.

Are All Payment Gateways The Same?

Payment gateways will all do the above; however, they differ in terms of offering additional services.

At Corepay, we are proud to offer our very own payment gateway, Solidgate, which was built specifically for high-volume eCommerce merchants.

Solidgate provides an extensive antifraud suite, including features such as tokenization and smart BIN routing functionality.

We are also partners with industry-leading high-risk payment gateways such as Inovio, Authorize.net, and NMI so that we can achieve seamless integration to your current payments ecosystem, all at the lowest possible price.

Below is a look at what certain payment gateways can do on top of the basics that they are expected to carry out:

- Multiple Payment Methods: Having the ability to pay in various ways can exponentially increase your conversion rate. In eCommerce, your conversion rate is of utmost importance. Specific payment gateways will allow you to pay with other payment methods outside of credit/debit, such as an e-wallet or bank transfer. The more ways you have to finish the transaction, the better you can bring the customer back.

- Fraud Protection That Is Offered: If you’re an online business, you understand the importance of having a secure checkout. Fraud is generally rampant amongst online stores. When fraud becomes a problem, you develop a terrible reputation and pay more fees to credit card processors. Corepay offers our partner product, CB-Alert, for chargeback protection to all of our clients.

- Recurring Billing Options: Subscription services are massive in today’s market. You will need the ability to manage automated billing, send quick payment reminds, and set up billing plans through your payment gateway.

- Analytics: Specific payment gateways will give you information that will help you establish better relationships with your customers and show you how to improve your conversion rate. We always recommend studying and developing an understanding of your customer’s behaviors when shopping on your website.

At Corepay, we are able to take care of all of your above needs and get you assisted in a way that helps take your business to the next level, whether you’re high-risk or low-risk.

Let’s look at what a merchant account is and what they can do for your business below.

What Is a Merchant Account?

A merchant account is a business bank account that allows a business to accept and process electronic payment card transactions.

Your funds are automatically transferred from your merchant account into your business account, depending on your payment gateway setup.

It’s important to note that your merchant account is different than your bank account. It’s different in the sense that you don’t have any control over your merchant account, as it exists to hold deposits prior to transferring to your bank account simply.

Merchant accounts often come with added fees, but they typically offer a wide array of additional services.

Merchant accounts are essential for online businesses. While they will cost you additional fees as a brick and mortar that only accepts cash, you are also introducing multiple payment methods to your business, increasing your conversion rate on sales.

Merchant accounts vary in terms of what is offered by your PSP. Some PSP’s will include more services than others and prices can all vary greatly.

Merchant accounts are also assigned different risk levels. They can vary between low-risk, medium-risk, and high-risk, with high-risk usually paying more in fees to cover the additional risk of chargebacks/fraud, reputational damage, etc.

Most eCommerce businesses will fall into the medium to a high-risk category as nearly all transactions for eCommerce businesses are debit/credit cards.

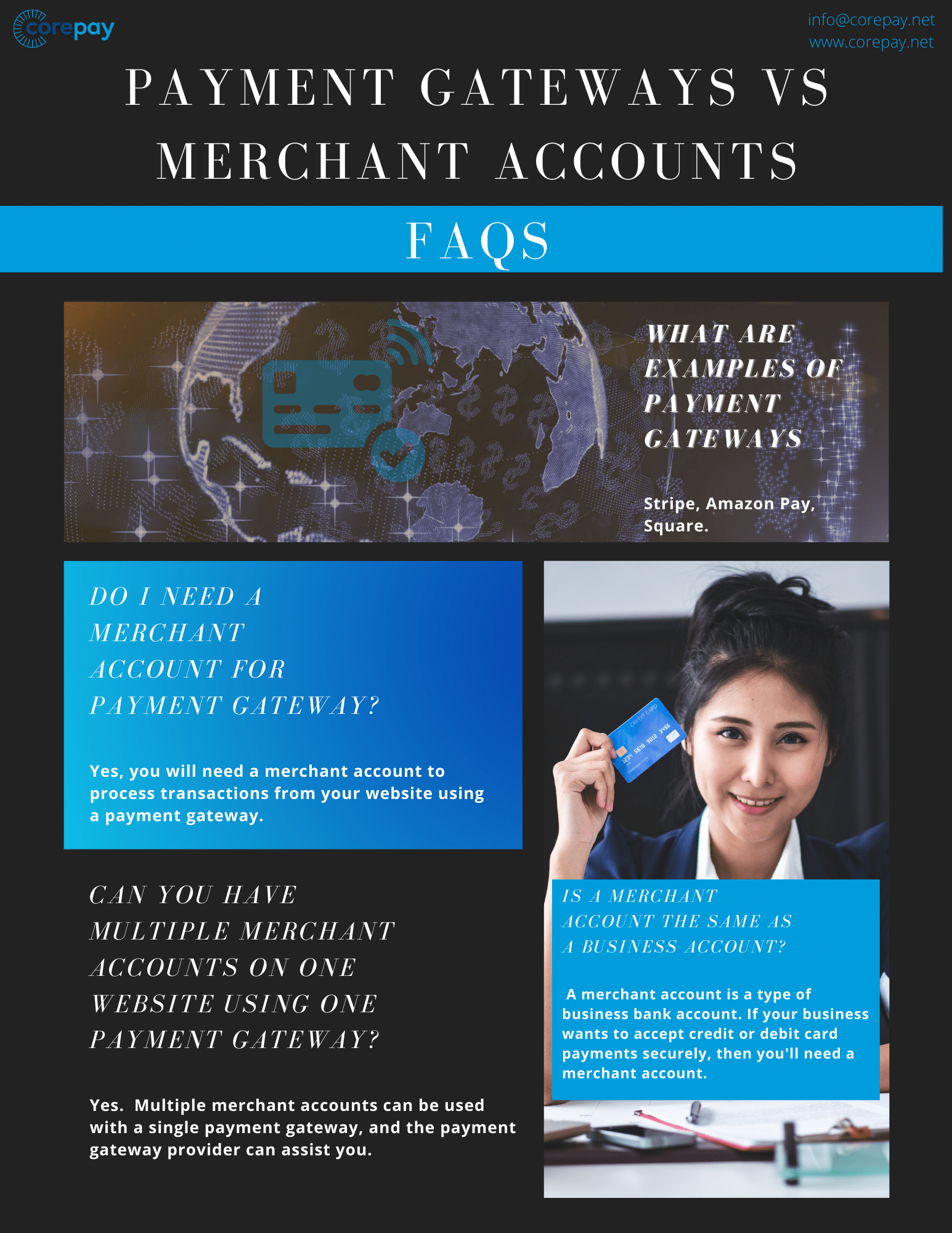

FAQ Infograph

Looking To Change Merchant Account Providers?

Should you feel like your merchant account provider is not giving you everything you were expecting, it’s important to note that you can change merchant account providers yet still keep your banking relationship.

What this means is that you could keep your original business bank account and only switch payment service providers without having to worry about altering your baking relationship.

At Corepay, we believe in diversifying your payment processing in order to mitigate risks, especially with eCommerce or high-volume stores.

Obtaining A Merchant Account

Applying for a merchant account has never been easier than it is today, thanks to the internet. Once you have filled out our form and applied for a merchant account, you will be assisted swiftly.

Once we view your application, we will provide you with the best payment processing solution for your business. Should be already using a payment gateway, we are confident that we can save your business money in processing fees by partnering with us. We are also able to provide seamless integration in nearly all payment gateways.

If you’re looking to apply for a merchant account, you will need to provide the following:

- Certificate of incorporation

- A voided check, or other proof of bank accounts such as a signed bank letter or barring that, your bank’s routing number and your bank account number

- Personal and business financial history

- Organizational chart

- Any licensing numbers and the name of the organization that granted the license

- Six months of processing statements, if applicable

- A compliant website (stipulating terms and conditions, including refund policy)

Where Do Merchant Accounts Vary?

- Ease Of Global eCommerce: Depending on your PSP, you will be able to receive money outside of USD, whereas in others, you can only receive USD. At Corepay, you are able to accept multiple currencies so that you can increase cash flow and grow your business more effectively.

- Underwriting Can Vary: Depending on your merchant service provider, the time of the underwriting can vary greatly. Low-risk providers typicaly perform their underwriting months after the initial application, which can lead to surprises down the road ending in your merchant account being terminated or frozen. Others will perform a more extensive audit of your account at the time of application (Typically high-risk merchant accounts)

- Some Specialize In High-Risk, And Others Specialize In Low-Risk: Certain merchant account providers specialize in different industries focused on varying levels of risk. For example, at Corepay, we specialize in online dating, adult, CBD, vape, eCommerce, and other typically considered risky industries.

Pros Of Merchant Accounts And Payment Gateways

As the primary purpose of a merchant account is to enable businesses to accept credit cards/electronic payments, some of the other benefits are listed below:

- Increased cash flow: Having a merchant account significantly increases an online business’s cash flow.

- Increase In Sales: A recent study conducted showed that having the ability to pay with credit/debit increases sales by up to 83%. Certain merchant accounts also make it possible to accept payments globally.

- Customer Convenience: Having the ability to pay with credit/debit results in happier customers at the point of checkout.

With payment gateways, you will typically notice them in eCommerce and mobile retailers; however, they can be used by all merchants. Incorporating a payment gateway allows for the following:

- Card-present transactions at a POS(point-of-sale system)

- Integrated payments within accounting, CRM, or ERP software allows for the following:

- Contactless payments

Wrapping Up

While payment gateways and merchant accounts can seem like a lot to understand at first, you will find that the learning curve happens quickly.

We are confident that we can take your business to the next level by offering bespoke payment processing specifically tailored to your business’s needs.

Depending on your business, you could benefit from a solution that incorporates a payment gateway and a merchant account.

Not only are we able to provide low-risk processing for businesses, but we also specialize in high-risk processing, allowing you to accept payments globally without any worries.

If you are looking to explore your payment processing, we highly recommend filling out an application and finding out what Corepay can do for you today.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].