Payment Gateways – How They Work And What They Are

Last Updated on January 14, 2022 by Corepay

When it comes to understanding credit card processing, there any many terms and phrases that merchants must know. This article will explain in full detail how payment gateways work, what they are, how they are used to process credit cards, and whether or not your business needs one.

Payment gateways are crucial components of eCommerce businesses and most companies that have online stores. However, in the day and age where online sales have flourished, so have cyber-attacks, meaning security has never been more critical when scaling your online business.

Whether you’re familiar with payment gateways and looking to decide which is best for your needs, or you’re here to learn about them, you’ve come to the right place.

Let’s look at the basics of payment gateways and work our way into what merchants need to know when choosing the best payment gateway for their needs.

What Is A Payment Gateway

A payment gateway is a service that authorizes and processes payments in e-commerce websites, serving as a portal to facilitate transactions between customers and merchants.

Payment gateways allow merchants to accept credit card/debit card payments by connecting the payment processors and merchant account providers.

A payment gateway processes credit cards online through websites by securely validating the customers’ credit card details and enabling merchants to get paid.

You can think of payment gateways as an interface between a merchant’s website and its acquirer/customer.

Why Do Merchants Need Payment Gateways?

Online payments are processed as card-not-present transactions or (CNP). This means that the credit card cannot be physically verified or swiped on a POS terminal as you would in a typical brick-and-mortar setting.

To break this down further, credit cards still need to be verified to ensure that the transaction is legitimate and not fraudulent. The only thing processors/banks have to go off is the customer’s information on the payment page.

CNP transactions also have higher fraud than card-present (CP) transactions. This is where payment gateways come into play, adding additional security for merchants.

Fraudsters can have easier access to card data processed by merchants without a payment gateway, ultimately exposing them to more chargebacks/fraud.

Not only does this damage your overall brand, but it also ensures your business will pay higher processing fees because of your chargeback ratio.

You provide additional security with a payment gateway – think of this as a gatekeeper to a customer’s payment data. The payment gateway will send the information from the merchant to the acquirer and the issuing bank using data encryption to combat unwanted frauds from sensitive credit card data.

Merchants also protect themselves from expired credit cards, insufficient funds, and close credit cards. All of these are examples of things that typically end in chargebacks.

Below are some extremely helpful stats that break down the way customers interact with payment gateways/landing pages.

- 15% of customers abandon the shopping cart for a better experience

- 6% abandon due to a lack of payment options

- 4% abandoned due to technical issues

This is where selecting an experienced payment service provider (PSP) can be vital for your business. Not only can the right payment gateway decrease your cart abandonment, but it can also provide more security and a better shopping experience overall.

How does a payment gateway work?

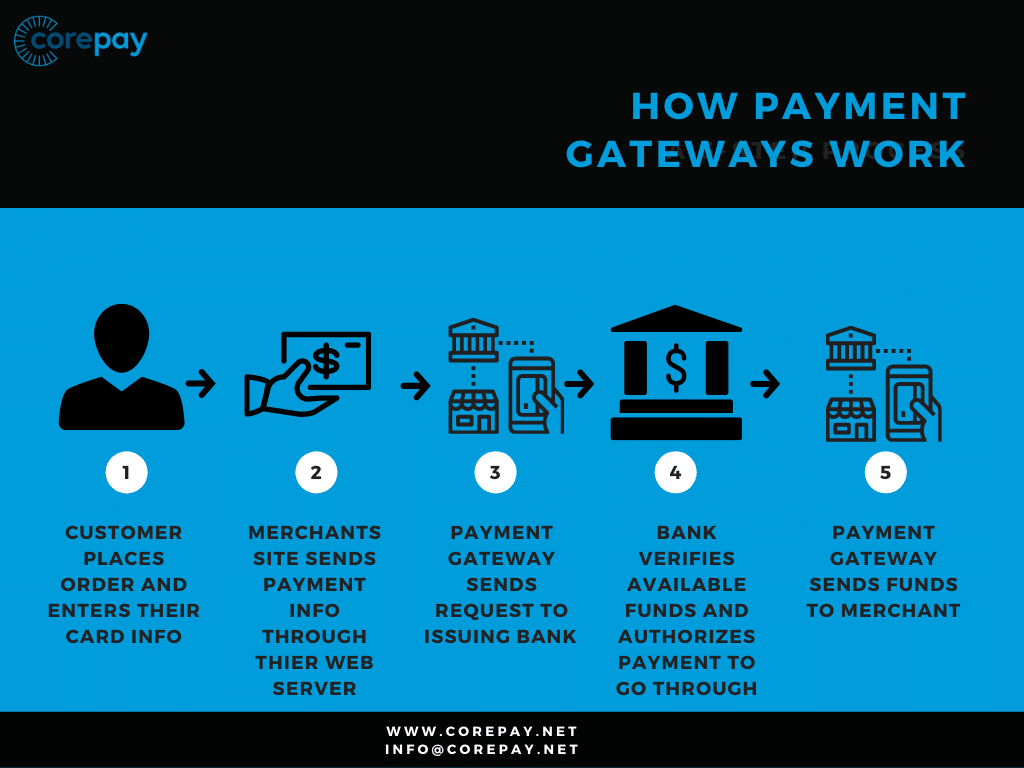

Now that we have established the basics for what a payment gateway does and why you might need one let’s break down exactly how a payment gateway operates.

We have broken down in complete the entire sequence in which a payment gateway functions.

- A customer picks a good/service.

- Customer heads to the payment page

- The customer proceeds to enter their credit/debit card information, including their name, expiration date, and CVV code.

- The information above is securely passed to the payment gateway – This depends on if your payment gateway is a hosted payment page or a non-hosted payment page. A hosted payment page means a 3rd party checkout page in which the customer is redirected – think Paypal. A non-hosted payment page means the checkout is directly on your website.

- The payment gateway then encrypts the credit card details and carries out an-anti-fraud check prior to sending the card data to the acquiring bank.

- The bank sends the information to specific card brands such as Mastercard, Visa, Discover.

- The card brands carry about another security check.

- The information is again relayed, this time to the issuing bank.

- The issuing bank performs one last fraud screening and either approves or declines the transaction.

- The approval or decline is then sent back to the acquirer by the card brands.

- The acquiring bank sends the approval or decline message back to the payment gateway.

- The payment gateway transmits the message to the merchant.

- The acquirer collects the payment amount from the issuing bank and holds it in your merchant account if the payment is approved.

- The confirmation page is now presented.

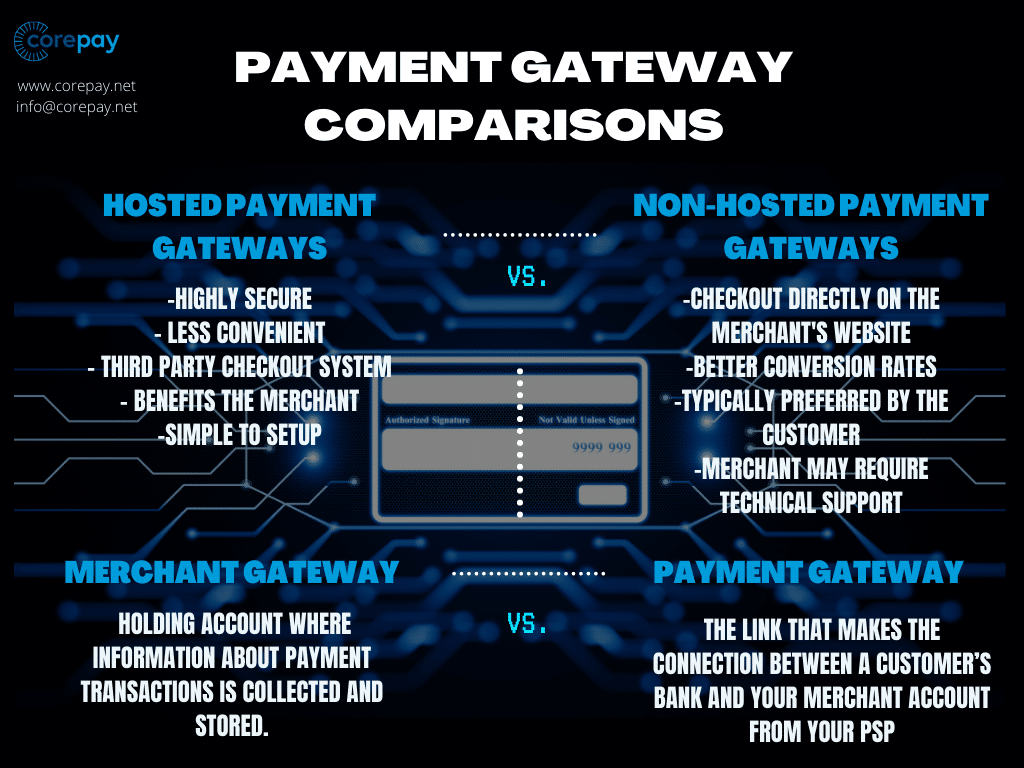

Hosted Payment Gateways VS Non-Hosted Payment Gateways

Hosted payment gateways are highly secure but less convenient than non-hosted payment gateways. The main difference between the two is that with non-hosted, the checkout is done directly on the website they are purchasing from. Customers almost always prefer a non-hosted payment gateway as they are far more convenient to use. Speed kills and always plays a role in your overall sales volume when it comes to landing sales. If customers get flustered along with the checkout, they can bounce from the page and choose not to return to your website.

For this reason, merchants must be sure that their payment pages are not clunky and poorly designed.

Choose Corepay For Your Payment Gateway Solutions

At Corepay, our team of merchant account managers is fully dedicated to providing our clients with bespoke payment gateway solutions.

We are proud to announce that we have a proprietary gateway, Solidgate, explicitly built to support high-volume e-commerce merchants. Solidgate has everything merchants need to scale their business, including the following:

- Extensive antifraud suite

- Tokenization

- Smart BIN routing functionality

- High volume support

In addition to our payment gateway, Corepay also partners with industry-leading high-risk gateways such as Inovio, Authorize.net, and NMI so we can consistently achieve seamless, agnostic integration to your current payments ecosystem at the best possible price.

Would you please inquire about our payment gateway solutions below?

Setting Up A Payment Gateway

When setting up a payment gateway for your website, you must ask your PSP for any requirements and setup configuration details.

At Corepay, we have an expert team that will walk you through a step by process and even integrates your payment gateway for you.

Payment Gateway Security

According to Statista, 62 percent of all cyberattacks in 2020 were targeted at the eCommerce industry. This number is overwhelming and appears to be increasing as we see more and more eCommerce businesses.

Payment gateways encrypt SSL data before sending it to the credit card network, protecting the buyer’s personal information. This codes the information to make it extremely difficult for those committing fraud to access the data.

When discussing payment gateways, it’s important to note that all gateways must be PCI compliant.

PCI Compliance

So what is PCI compliance? PCI compliance is a security checklist created by the Payment Card Industry Data Security Standard to reduce fraud/.

All merchants that process credit card payments must adhere to the guidelines of PCI compliance. However, one of the essential things for merchants to understand is that just because one service you offer is PCI compliant doesn’t mean your business as an entity is PCI compliant.

The reason for this is that PCI compliance pertains to your entire payment foundation, including how your payments are processed, how the systems are connected, and how you manage the customer’s data.

Difference Between A Merchant Account And A Payment Gateway?

To accept credit card payments and use an online payment gateway, you will need a merchant account.

Your payment service provider will set you up with a merchant account before utilizing a payment gateway. All merchants need a merchant account to accept payments via the web, especially in 2021 and moving forward.

- Merchant Account: The holding account where information about payment transactions is collected and stored. All businesses accepting credit cards will display funds held here.

- Payment Gateway: The link that makes the connection between a customer’s bank and your merchant account from your PSP. This allows funds to pass into the payment processing sequence.

Do Merchants Need To Worry About PCI Compliance If They Already Have A Payment Gateway?

The simple answer is yes. Just because you have a payment gateway doesn’t mean you are PCI compliant. Should you choose Corepay for your payment processing, we make PCI compliance a breeze for all of our clients.

Conclusion

Remember always to perform thorough research when deciding on the best solution for your business. In addition, different payment processors may charge various fees for payment gateways, so always be sure to compare rates.

Should you be growing your business, launching a second location, or just beginning to accept credit cards, you must have a deep understanding of what different combinations of payment processing make sense for your business.

If you have questions about the best payment processing solution for your specific business, inquire below.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].