Merchant Category Codes Explained

Last Updated on December 13, 2022 by Corepay

If you are wondering what merchant category codes (MCC) are or want to learn what it means for your business, you’ve come to the right place. We will break down everything you need to know about MCCs and provide some of the popular MCCs.

Key Takeaways

- Merchants do not choose their merchant category code

- Your merchant category code can impact processing fees

- Merchant category codes (MCCs) are four-digit numbers that describe a merchant’s primary business activities

What Is A Merchant Category Code?

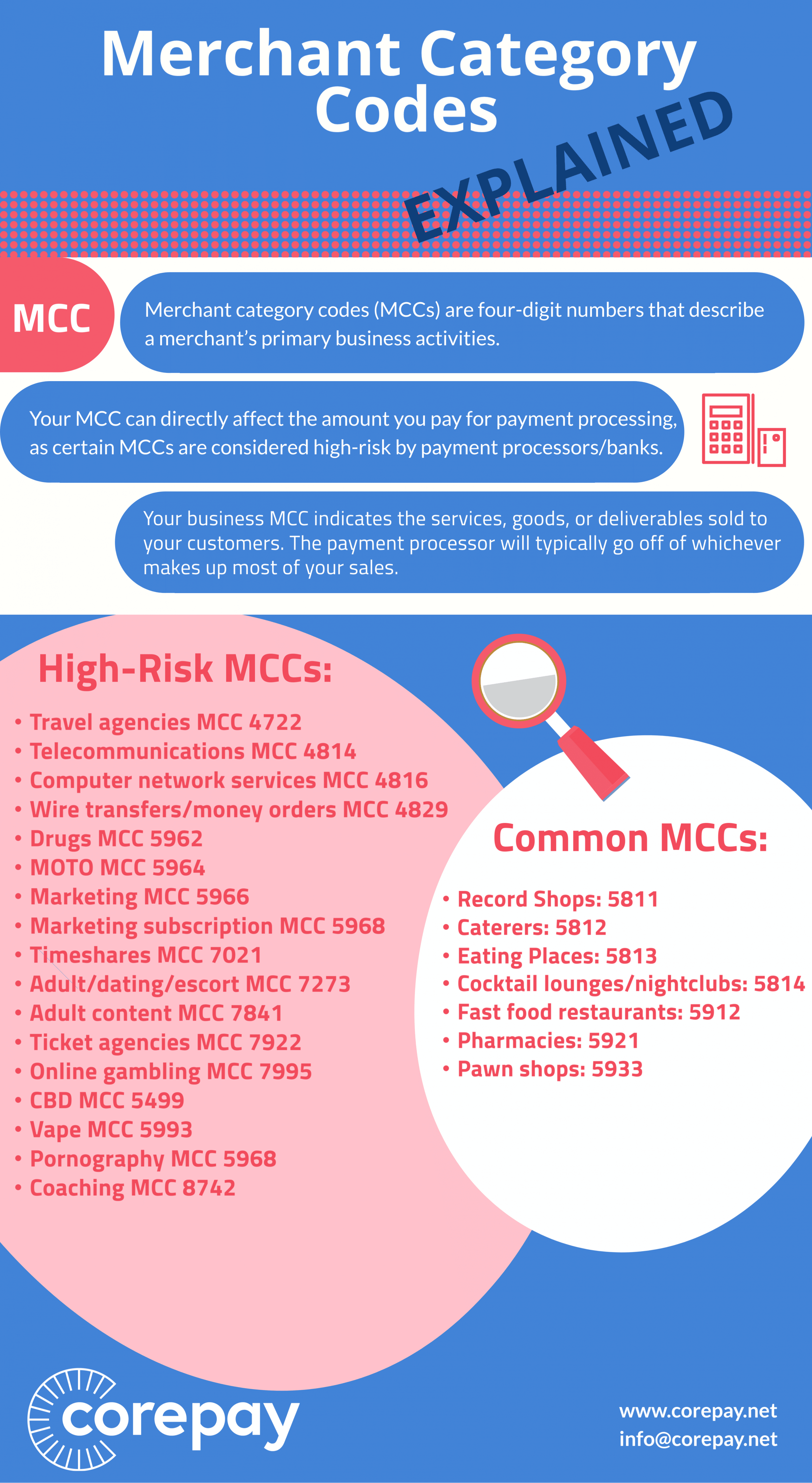

MCCS are four-digit numbers used by credit card companies/payment processors to classify a business.

Your business MCC indicates the services, goods, or deliverables sold to your customers. Your MCC can directly affect the amount you pay for payment processing, as certain MCCs are considered high-risk by payment processors/banks.

When a business sells services and goods, the payment processor will typically go off of whichever makes up most of your sales.

Merchants do not decide which MCC they have; their processor assigns it to them.

Looking to save money on processing fees for your high-risk business? Apply below.

Common MCCs

Some common MCCs are as follows:

- Record Shops: 5811

- Caterers: 5812

- Eating Places: 5813

- Cocktail lounges/nightclubs: 5814

- Fast food restaurants: 5912

- Pharmacies: 5921

- Pawn shops: 5933

Here’s a full list of Visa and Mastercard MCCs:

- Visa MCCS

- CITI MCCs (both Visa and Mastercard)

- Mastercard MCCs

Below, we will analyze some popular high-risk MCCs we frequently see at Corepay.

High-Risk Merchant Category Codes

At Corepay, we specialize in payment processing for high-risk merchants.

- Travel agencies MCC 4722

- Telecommunications MCC 4814

- Computer network services MCC 4816

- Wire transfers/money orders MCC 4829

- Drugs MCC 5962

- MOTO MCC 5964

- Marketing MCC 5966

- Marketing subscription MCC 5968

- Timeshares MCC 7021

- Adult/dating/escort MCC 7273

- Adult content MCC 7841

- Ticket agencies MCC 7922

- Online gambling MCC 7995

- CBD MCC 5499

- Vape MCC 5993

- Pornography MCC 5968

- Coaching MCC 8742

These are just some of the high-risk MCCs we come across, but they are some of the more popular ones.

How MCCs Can Boost Credit Card Rewards

While MCCs are incredibly important for merchants and business owners, they are also important to consumers. For example, many credit card rewards programs award customers based on the qualifying MCC with the purchase.

For example, certain credit cards will give you 3% back on grocery purchases.

Where to find a merchant category code

Your payment processing provider should tell you which MCC they assign you when you sign up. If they don’t, you ask them or view your credit card processing statement. You can also view Visa and Mastercard links above, which include every category available.

You can also view your bank statement to see how a credit card purchase is classified.

Can You Change Your MCC?

Merchants can only change their MCC if they change the types of services/goods offered. Even then, the processor will need to re-evaluate.

Importance Of MCCs

A high-risk MCC will come with higher interchange rates and may prevent businesses from getting certain e-commerce fraud protections. In addition, chargebacks are also affected by the MCC and can be higher directly because of your MCC.

Wrapping Up

In conclusion, merchant category codes are four digits and vital for business operations. Having the correct classification is not only essential for taxes but also interchange rates/savings.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].