Weight Loss Merchant Accounts – Supplement Processing

Last Updated on February 14, 2024 by Corepay

Are you seeking payment processing in the diet program/weight loss industry? While this is no easy feat, we are pleased to tell you that we specialize in weight loss merchant accounts and have over twenty years of high-risk credit card processing.

Key Takeaways:

-

- We offer highly competitive weight loss payment processing

-

- Weight loss is a challenging industry to board for traditional processors

-

- Weight loss/diet programs are deemed high-risk by banks

- Corepay supports licensed GLP-1 (tirzepatide) processing

At Corepay, we specialize in payment processing for the weight loss/diet program industry and offer the following merchant accounts:

-

- Exercise/fitness programs

-

- Dietary supplements

-

- Weight loss/control programs

-

- Health and fitness counseling

-

- Weigh reduction programs

We can process for any of the above categories, provided the product and company run a legitimate business/service.

This article explains why we offer the best weight loss/diet program merchant accounts and tells you everything you need to know to get started.

Applying For Your Weight Loss Supplement Merchant Account

We shrink the application process to as little time as possible so that we can get you processing in no time. You will need the following to apply for your supplement merchant account:

-

- 3-6 months processing history of statements

-

- Voided check

-

- Principal’s driver’s license

-

- Proof of operating address

-

- Company EIN document

-

- Business plan – optional

-

- Chargeback ratio

-

- A functional and compliant website with login credentials

When applying, it’s best to be honest, and provide us with as much information as possible to ensure a speedy boarding process.

*The weight loss/Nutra industry has a reputation for illegitimate products, and we ensure all our merchants are selling legitimate products/services.

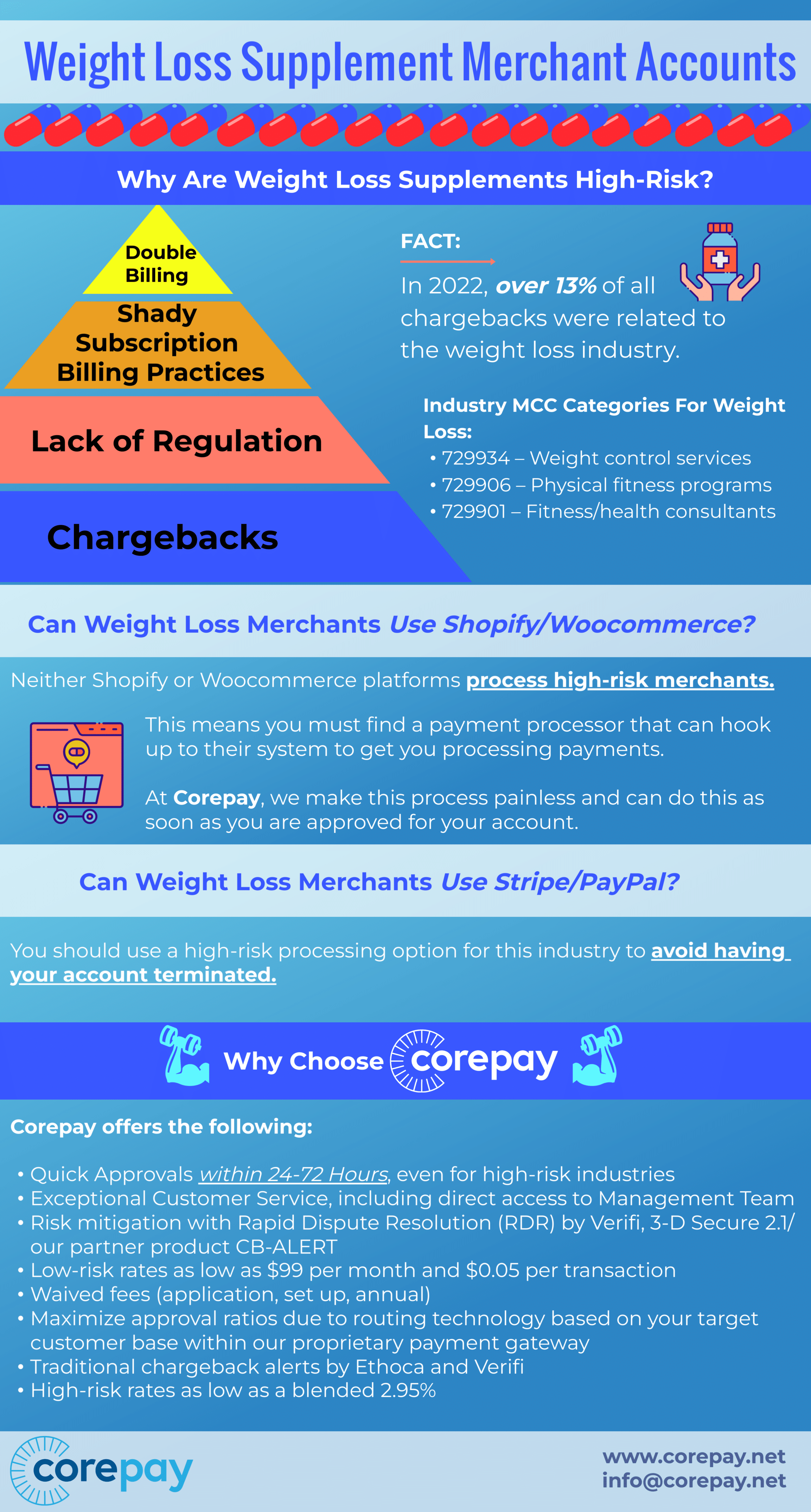

Why Are Weight Loss Supplements High-Risk?

The dietary supplement/weight loss industry is one of the most high-risk industries, with the most significant risk of fraud/chargebacks.

In 2022, over 13% of all chargebacks were related to the weight loss industry.

Below you will find the main risks associated with these types of merchant accounts:

-

- Chargebacks

-

- Lack of regulation

-

- Double billing

-

- Shady subscription billing

Chargebacks

Chargebacks are notoriously high in this industry for several reasons. This industry often makes claims such as, “Lose 20 pounds in the first 30 days.” Claims like this typically result in chargebacks when the customer doesn’t see the results they hoped for, even if your product/service is usually effective.

Eliminating claims like this is a must when trying to fight chargebacks.

If customers experience any side effects, this usually results in a chargeback.

Poor customer service is often found within this industry, and some companies choose to dropship the products.

While dropshipping can be fine, it can result in lousy customer service and confusion when an unhappy customer reaches out.

Lack of regulation

While the FDA does regulate dietary supplements, they don’t require premarket review or approval from the FDA.

This can make it near impossible to know whether or not the product is actually safe and will come without a list of harmful side effects.

Double billing

For years companies in the Nutra industry would use practices such as double billing their customers in hopes that their customers wouldn’t notice.

Shady Subscription Billing Practices

Credit card brands are constantly revamping their policies regarding remaining compliant. Over the years, they’ve cracked down on companies for shady subscription billing related to free trials.

Merchants must follow all Visa and Mastercard guidelines regarding subscription billing.

Industry MCC Categories For Weight Loss

-

- 729934 – Weight control services

-

- 729906 – Physical fitness programs

-

- 729901 – Fitness/health consultants

It’s important to note that how your business is viewed is how banks and processors will determine your MCC.

Why Choose Corepay

At Corepay, we can offer clients highly competitive pricing and control over their merchant accounts. With over two decades of payment processing experience emphasizing Nutra/weight loss management, we know exactly what our merchants need in a partner.

Netvalve, our gateway, is explicitly designed for high-risk, high-volume merchants.

We offer the following at Corepay:

-

- Quick Approvals Within 24-72 Hours, even for high-risk industries

-

- Exceptional Customer Service, including direct access to Management Team

-

- Risk mitigation with Rapid Dispute Resolution (RDR) by Verifi, 3-D Secure 2.1/ our partner product CB-ALERT

-

- Low-risk rates as low as $99 per month and $0.05 per transaction

-

- Waived fees (application, set up, annual)

-

- Maximize approval ratios due to routing technology based on your target customer base within our proprietary payment gateway

-

- Traditional chargeback alerts by Ethoca and Verifi

-

- High-risk rates as low as a blended 2.95%

While our gateway is designed for these verticals, we take a gateway-agnostic approach to hook up to whichever gateway you choose.

Can Merchants Use Shopify/Woocommerce That Sell Nutra?

Shopify and Woocommerce are two incredibly popular choices for selling fitness products on the web. We can offer payment processing for both of those platforms with seamless integration.

It’s important to note that both platforms have their own payment processing available, but keep in mind that neither processes high-risk merchants.

This means you must find a payment processor that can hook up to their system to get you processing payments.

We make this process painless and can do this as soon as you are approved for your account.

Can We Use Stripe/Paypal For Weight Loss Merchant Accounts?

The short answer is that we only advise you to use a high-risk processing option for this industry to avoid having your account terminated.

While you might be intrigued by the lower fees that Paypal or Stripe offer, they assume that your industry is low-risk and that the second you realize what you’re selling, they will freeze your account.

Wrapping Up

Choosing a payment processing partner for your supplement company can be challenging. At Corepay, we recommend that all of our merchants compare other payment processors before deciding.

We are confident that we can help grow your business to the next level by offering transparent payment processing focusing on minimizing chargebacks and maximizing approvals.

Fill in the application below to get your pre-approval.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].