WooCommerce High-Risk Merchant Accounts

Last Updated on January 5, 2024 by Corepay

If you landed on this page looking for a woo-commerce high-risk merchant account, you’ve come to the right place. You likely already know that Woocommerce comes integrated with Stripe, but you might not know that Stripe doesn’t accept high-risk merchants.

That’s where we come in at Corepay. With over two dozen years of high-risk payment processing experience, we are confident that we can help get you approved and ensure you stay approved, allowing for ultimate profitability.

What Is WooCommerce?

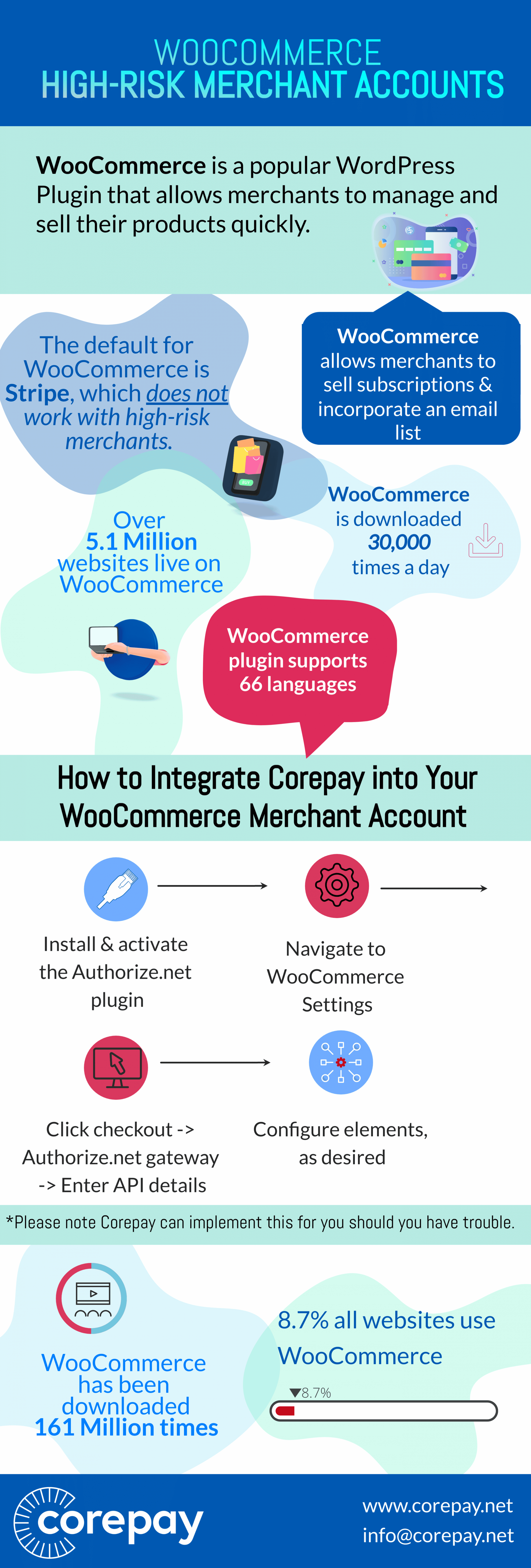

WooCommerce is an extremely popular WordPress plugin that allows merchants to manage and sell their products quickly.

On top of selling products, WooCommerce is also built to allow merchants to sell subscriptions and incorporate an email list.

Can High-Risk Merchants Use WooCommerce?

Merchants considered high-risk can use WooCommerce; however, they will need to find an alternative to Stripe payment processing.

The default for WooCommerce is Stripe, and it’s important to note that while Stripe is a great option, they do not touch high-risk merchants, and you could end up with your account terminated.

Be sure to review the terms of service when launching your WooCommerce store, as you can tell if you can use their built-in processing.

Which Are Merchants Considered High-Risk?

WooCommerce and Stripe view merchants similarly to how banks and other payment processors. While specific industries are deemed high-risk, it’s important to note that subscription-based stores are also high-risk, regardless of the industry.

Here are some industries that are deemed high-risk:

- Online Gambling merchant accounts

- Adult

- CBD

- Vape

- E-Cigs

- Travel

- Subscription Boxes

- Firearms

- Coaching

- Dating

If your business operates in the above industries, you will likely need to find a high-risk processor, such as Corepay, for your payment processing needs for WooCommerce.

At Corepay, we can swiftly integrate into your WooCommerce store so that you won’t miss out on any sales and continue to accept payments at ultimate profitability.

Outside of the industry, below are some other essential factors:

- High chargebacks

- Risky business (political affiliations)

- Rampant fraud

- You have poor credit

- You frequently sell high-ticket items

- If the bank thinks they will take a loss on your account

What Happens If High-Risk Merchants Use Stripe?

High-risk merchants will be able to process payments via Stripe initially; however, they are against Stripe’s terms of service.

This is because Stripe performs their merchant account underwriting after your application. This process can take up to six months, meaning you could unexpectedly have your account terminated.

What To Do If WooCommerce Merchant Account Was Frozen/Terminated

When your account is frozen or terminated via WooCommerce, you will get an email with instructions that tell you what the process is. Typically, you can expect to wait up to 180 days to regain access to your frozen funds.

The reason for this is that, legally, Stripe is given 180 days to perform their audit, in which they will let you know why your account was frozen in the first place.

If this happens to your company, you’re doing the right thing. However, you need to immediately find a high-risk processing solution so that you can begin accepting payments.

There is nothing you can do to speed up the process for Stripe outside of responding to emails in a timely fashion.

Why Do WooCommerce Users Choose Corepay?

At Corepay, we frequently work with clients who have WooCommerce-based stores. We have a gateway agnostic approach and the technological capabilities to make most setups happen swiftly.

We also understand eCommerce as well as anyone and know the risks that WooCommerce companies can run into in terms of volume caps/approvals.

If you’re a WooCommerce store that is viewed as high-risk, we are confident that we can assist and help your business grow to the next level.

If you choose Corepay, you are selecting the below:

- Highly competitive rates: We understand that providing you with the lowest possible processing fees allows your business to grow with optimal profitability.

- Fast approval times: Our quick approvals maximize the time that travel merchants need to make sales. We are able to provide approvals typically between 24-72 hours.

- High-volume processing: We have our own payment gateway, Netvalve, explicitly designed for high-risk companies processing high volumes.

- Security: We have a PCI-Level 1 secure payment gateway that is monitored around the clock and regularly tested for security issues

- Waived application, set up, and annual fees

- 24/7 customer service

Applying For Your WooCommerce Merchant Account

Applying for your Woocommerce merchant account is quick and simple. You will need the following for your high-risk merchant account.

- Company EIN document

- Financial statements – personal and business

- Proof of operating address

- Articles of incorporation

- Principal’s driver’s license

- Business plan – typically optional, but can help show the big picture of your business to your payment processor

- Voided check proving business bank account

Note: When applying, the more information you can provide us, the faster we can get you approved.

How To Integrate Corepay Into Your WooCommerce Merchant Account

If you’re a low-risk merchant, you can use one of the integrated solutions, such as Stripe. If you’re high-risk, you will need a partner that processes high-risk accounts.

Once you apply with Corepay, we will walk you through the steps to integrate your payment processing. We recommend using any primary payment gateway, such as Authorize.net, for simplicity.

Should you choose Authorize.net for your payment gateway, the steps are as follows:

*Please note we can implement this for you should you have trouble.

- Install and activate the Authorize.net plugin

- Navigate to WooCommerce settings

- Click checkout -> Authorize.net gateway -> Enter API details

- Configure elements as desired

Authorize.net

- Install and Activate the Authorize.net Payment Gateway For WooCommerce plugin

- Navigate to WooCommerce -> Settings -> Checkout -> Authorize.net Payment Gateway. Enter the API details (Login ID, Transaction Key)

- Configure the other elements as desired (Title, Description, Transaction Success Message, Transaction Failure Message, etc.).

Can You Use Other Payment Processors Than Stripe For Your WooCommerce Store?

The short answer is yes; you can use any payment processor supporting WooCommerce.

WooCommerce Stats

It is estimated that over five million online stores currently use the Woocommerce platform, accounting for 40.9% of all online stores.

Below you will find some interesting WooCommerece stats and an infographic:

- Over 5.1 M live websites on WooCommerce

- WooCommerce is downloaded 30,000 times a day

- 8.7% of all websites use WooCommerce

- In 2019, WooCommerce stores had an estimated $11.8 Billion of Gross Merchandise Volume(GMV).

- The WooCommerce plugin available on WordPress.org supports 66 languages

- Woocommerce has been downloaded 161 M times

CBD/VAPE WooCommerce Merchant Accounts

CBD and vaping are both considered high-risk industries. Therefore, you can use WooCommerce and set up a high-risk merchant account for both industries. Just be aware that you can’t use Stripe for these industries, as stated above.

Wrapping Up

High-risk merchant accounts for WooCommerce are a must if you operate in a risky industry. If you’re looking to grow your business, lower your chargebacks and maximize your approvals, Corepay is for you.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].