Sometimes Chargeback Issues Lie with Issuing Banks

Last Updated on October 23, 2020 by

Over the last two months, we’ve written about the growing concern of chargeback issues, especially as a result of fraud and account takeovers. But after reading a recent white paper sponsored by Ethoca, and researched and written by Aite Group— Improving the Dispute Experience: Transparency Is Power — we think a large share of the burden needs to be shared by issuing banks and the way they report transaction data to their customers.

Aite Group surveyed 1,004 consumers to “. . .understand the degree of frustration that dispute resolution currently causes relative to other card experiences and to explore the perceived value that consumers place on tools that might ameliorate the dispute-resolution process.” They also interviewed 10 large North American credit and debit card issuers, and a number of large e-commerce merchants.

Here are some of the high points of what they found.

The problem is often the way transactions are listed on a consumer’s credit card statement. Many times, they’re unreadable garbage. Imagine seeing ##STARBPDX180701%#*** on your statement. What does that even mean?

If you spoke “fintech,” you might realize that means “Starbucks Coffee, PDX Airport, Portland, OR, Jul. 1, 2018.”

But if you didn’t remember that you had bought a latte at the airport Starbucks on your way to a conference, you might worry that you had a fraudulent charge on your statement and call your bank in a panic, ready to issue a chargeback. (Seriously, $7 for a latte? That should make anyone panic.)

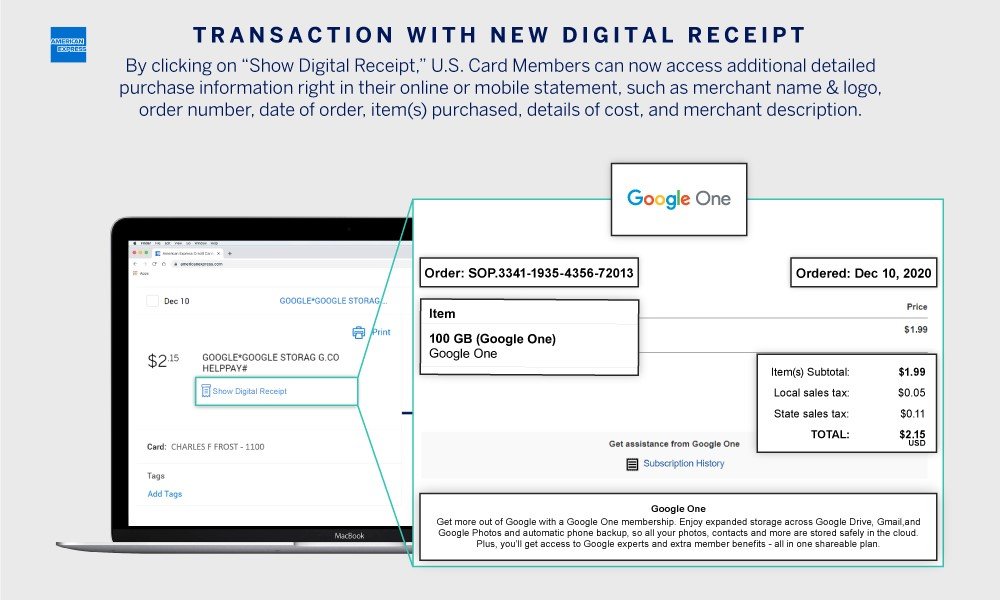

This is also why many financial institutions are being pressured to issue statements with enhanced transaction data, which spells out things like merchant name, location, and date in plain English. According to the survey, many consumers said they contacted the issuing bank to ask about or dispute a transaction because there wasn’t a clear description of the transaction available.

Aite Group reported that one executive for a large merchant said that his firm saw a 65 percent deflection rate among the issuers that had displayed this enhanced transactional detail. An executive at a large issuing bank said they had also seen a 30 percent deflection rate after they began using enhanced transactional data.

So it’s clear: enhanced transactional data reduces chargebacks and customer service calls about unfamiliar charges.

Meanwhile, 16 percent of consumers in the survey more or less admitted to perpetrating friendly fraud — issuing chargebacks despite receiving their products or services — which roughly matched the 15 – 20 percent the issuing banks estimated.

Merchants have a big reason to be concerned with this lack of enhanced transaction detail, because it often causes consumers to immediately call their bank and issue the initial chargeback. In fact, Aite Group found that when a consumer noticed an unrecognized charge on their bill, 73 percent of credit card users and 75 percent of debit card users called the issuing bank first. Out of the remainders, 23 and 22 percent respectively called the merchant first.

In other words, as many as three-quarters of all chargebacks could possibly have been dealt with if the issuing bank had either used enhanced transaction detail or if the customer had called the merchant first. At least the merchant would have had the option of issuing a refund if it were necessary, instead of dealing with a needless chargeback process.

Similarly, when asked about contacting their financial institution to resolve a problem, 52 percent of respondents said they did it because there was one charge for their credit card that they did not recognize, or the transaction description was confusing. Another 45 percent did it for a debit card.

On the other hand, only 28 percent of credit card users and 24 percent of debit card users did it because the amount they were charged was incorrect or there was a problem with the transaction.

While it’s difficult to say there’s one definitive cause to all the chargebacks that merchants have to deal with, many of them seem to lie with the issuing bank in how they share transactional data on a credit card statement. That means until the issuing banks are clearer on how they provide transaction detail, merchants need to be prepared to respond to every chargeback that comes their way. Keep all documentation and communication with customers, and respond to the chargeback within the time window the issuing banks allow.

Corepay can help you prevent chargebacks, as well as help you dispute them more effectively. To learn more, please visit our website or call us at (866) 987-1969.

Photo credit: Alexas_Fotos (Pixabay.com, Creative Commons 0)

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].