High-Ticket Item Merchant Accounts – Payment Processing

Last Updated on May 23, 2022 by Corepay

There are some differences to be aware of when selling high tickets. For example, credit card processors will typically charge a different rate for those who specialize in business-to-business sales and those who favor business-to-consumer.

You must understand the main differences between fees so that you know you are receiving a fair rate with your processor.

This article will break down everything you need to know about high ticket merchant accounts and why we believe we are an excellent fit for your business.

Whether you specialize in B2B or B2C, you have come to the right place. At Corepay, we tailor all of our high-ticket merchant accounts specifically to their business needs and offer industry-leading anti-chargeback solutions.

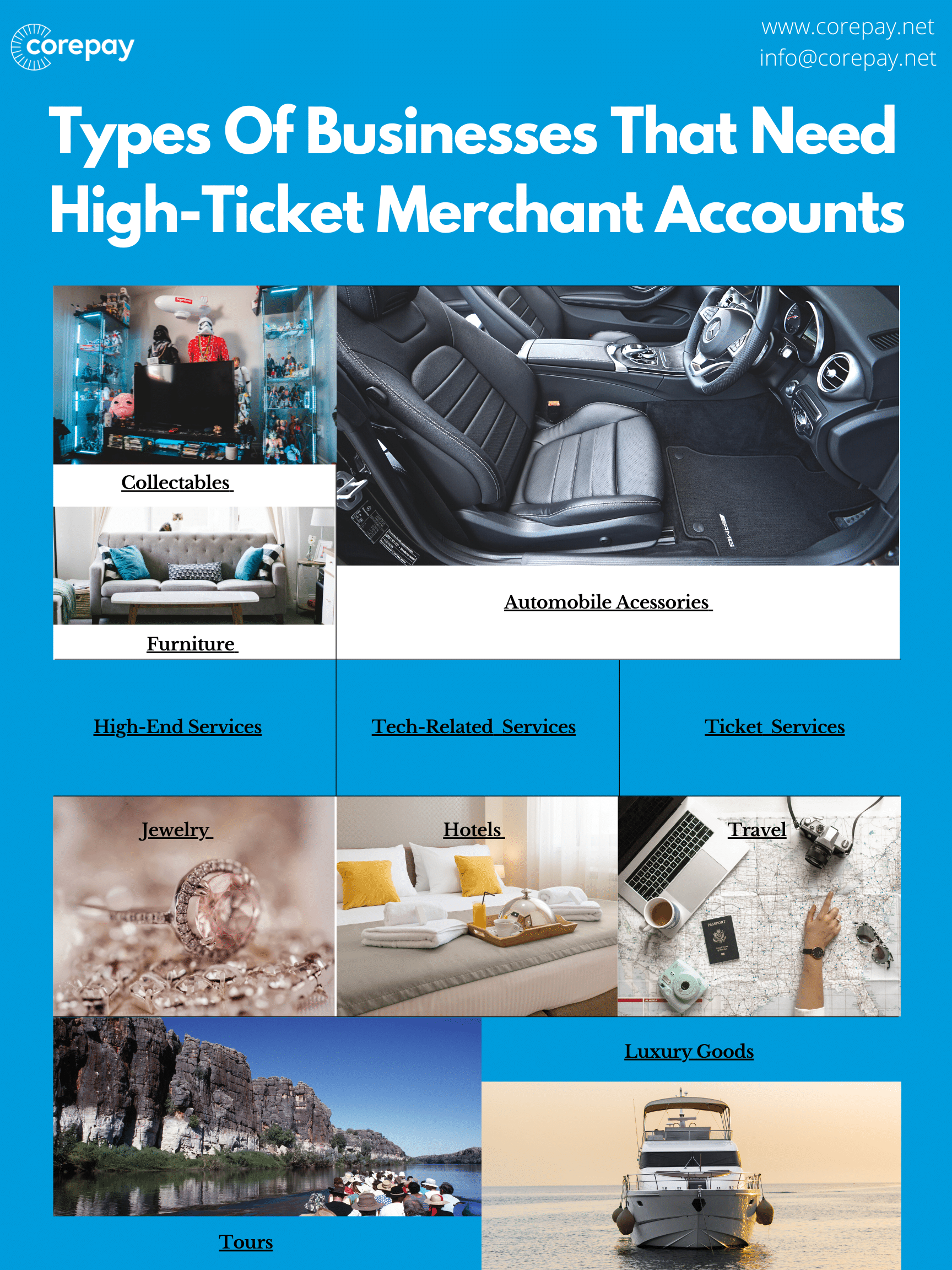

Types Of Businesses That Need High-Ticket Merchant Accounts

There is a wide range of businesses that sell high-ticket services/goods. With our merchant accounts, you will be able to accept credit/debit card transactions quickly and effectively for the following:

- Automobile accessories

- Collectibles

- Furniture

- High-end services

- Tech-related services

- Jewelry

- Hotels

- Luxury goods

- Ticket services

- Tours

- Travel related services

These are just some of the high-ticket businesses we work with on a daily. For example, if your company sells legal goods/services, we are confident we can provide you with reliable and efficient credit card processing.

Let’s take a further look at why high-ticket businesses are considered high-risk by banks and processors.

How To Apply

Applying for payment processing for your business has never been easier. To apply, you will need the following:

- Financial statements – both personal and business

- Articles of incorporation

- Principal’s driver’s license

- Proof of address – operating

- Company EIN document

- Voided check to prove back account

- Six months or processing history if applicable

The more information you can supply us with at the time of the application, the quicker we can get you approved and processing.

Why Choose Corepay For Your High-Ticket Business?

Corepay understands what it takes to establish payment processing from the ground up for US and international businesses in the high-ticket industry. Our diverse network of banking partners and an unparalleled high-risk processing experience will propel your business to the next level.

When you choose Corepay for your high-ticket merchant account, you siding with over two decades of high-risk credit card processing experience as well as bespoke anti-chargeback solutions.

You can expect the following with our merchant accounts:

- Competitive rates for both low and high-risk

- PCI Level 1 security through our payment gateway, Solidgate, designed explicitly for high tickets/high volumes

- Extensive banking network

- Chargeback prevention and monitoring services to protect your account and save you money in processing feesapply

- Fraud fighting tools

- Multiple payment methods (MOTO, mobile, ACH)

- 24/7 customer service

- Waived application, set up, and annual fees

What To Expect During The Underwriting Process

Once you have applied for your high-ticket account, we will begin our underwriting process. During this, we will review your business as a whole to get a better understanding of your company.

Most high-risk processors will perform their underwriting prior to approving your account to avoid any surprises/terminations months in.

Once everything is reviewed and approved, we will contact you to know the following steps you need to take to get your account up and running.

The more information you can provide us when applying, the faster we can get you approved and processing.

One of the main things our underwriters will look into is your chargeback history. The more chargebacks you have on a prior merchant account, the more difficult it is to get approved.

Billing policy is another thing processors will look at. Your billing policy can directly affect your chargebacks if you bill in advance frequently.

What To Look For In A High-Ticket Merchant Account?

The first thing you want to identify is your risk level as a merchant. By applying to multiple credit card processors, you will be able to figure out if you’re considered low or high-risk.

Once you are deemed one or the other, you can then start to narrow down your decision.

It is also important to note that all credit card processors specialize in different areas and services. For this reason, we always recommend reaching out to multiple processors before you ultimately decide.

Choosing a processor specializing in high-risk and high-volume will help you lower your chargebacks, provided they offer chargeback prevention services/solutions.

If you are considered high-risk, going with a low-risk processor such as Paypal or Stripe can prove problematic if your industry is against their terms of service or if you start to experience frequent chargebacks.

B2B VS B2C For High-Ticket Businesses

Generally speaking, B2C is considered high-risk as chargebacks are typically higher than B2B. With this being said, you will want to keep your chargeback ratio as low as possible, even if you’re selling B2B services/goods.

A high chargeback ratio can easily up your risk level in the eyes of a processor. The main reason for this is that higher chargebacks can directly reflect the business and what they are doing incorrectly.

The most significant difference between these two business models is that B2B sells goods/services to other businesses, whereas B2C sells to consumers.

Paypal For High-Ticket Merchants

Paypal can work for high-ticket merchants, depending on the type of services they offer and whether the business sells B2B or B2C as B2C is considered high-risk.

If you are selling services/goods that are B2C, then you should choose a high-risk processor. While Paypal is a great option and easy to set up, the problem can take months to surface.

The reason for this is that Paypal does all of their underwritings after the initial approval process. They expect you to review their terms of service and not violate them. What tends to happen is that merchants will break the terms of service, and Paypal will see this months down the line.

Once this happens, your merchant account will be frozen or even terminated, locking you out of your funds for up to 180 days or until they can do a full audit of your account.

If this has happened to your high-ticket business, the best thing you can do is apply for high-risk solutions immediately. However, you will have to wait until Paypal contacts you and gives you a reason for the freeze or termination.

Why High-Ticket Businesses Are High-Risk

High-ticket businesses vary significantly in terms of their business model. For example, a company that sells high-ticket items online will have higher chargebacks than a retail store.

Let’s take a look at the main reasons your business could be considered high-risk.

- Chargebacks

- Many Card-not-present transactions

- Industry is risky

- Security

High-Ticket Chargebacks

Chargebacks in any industry are costly for banks, processors, and ultimately, the business responsible for receiving the chargeback.

Many Card-Not-Present Transactions

CNP transactions usually always signal more chargebacks.

The Chosen Industry Is Deemed Risky

The industry that your business operates in can determine the overall risk of your business. For example, adult merchant accounts, CBD merchant accounts, vape merchant accounts, and skincare merchant accounts are all considered high-risk.

High-ticket items are typically sold via an online store, which most purchases will consist of CNP transactions, leading to high chargebacks.

Security

Many cyber-criminals attack eCommerce sites that specialize in high-ticket items. The way this is typically done is via a stolen credit/debit card. Additionally, the addresses the items are shipped are often used as ploys to receive the goods purchased. Typically, this is done by shipping items to other countries, making it extremely difficult to catch the criminals.

Proper site security can help merchants avoid as many of these fraudulent transactions as possible. At Corepay, we offer a PCI-Level 1 payment gateway, Solidgate, monitored around the clock to ensure safe transactions.

Your Success Is Our Goal

At Corepay, we take great pride in providing all of our clients with bespoke payment processing. By providing 24/7 customer service, industry-leading anti-chargeback solutions, and reliable payment processing.

If you are looking for payment processing for your high-ticket business, look no further than Corepay. To schedule a call or fill out an application, click the link below, and we will be in touch swiftly.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].