Nightclub Merchant Accounts: Get Yours Now

Last Updated on July 7, 2023 by Corepay

Reliable nightclub payment processing takes work to find. If you’re in the business, you likely have dealt with the frustrations of this. At Corepay, we specialize in payment processing for nightclubs, bars, and other high-risk verticals.

If you landed on this page searching for payment processing for your gentlemen’s club or nightclub, you’ve come to the right place.

Key Takeaways: A nightclub merchant account is a business account that accepts payments for merchants who sell alcoholic beverages/musical events.

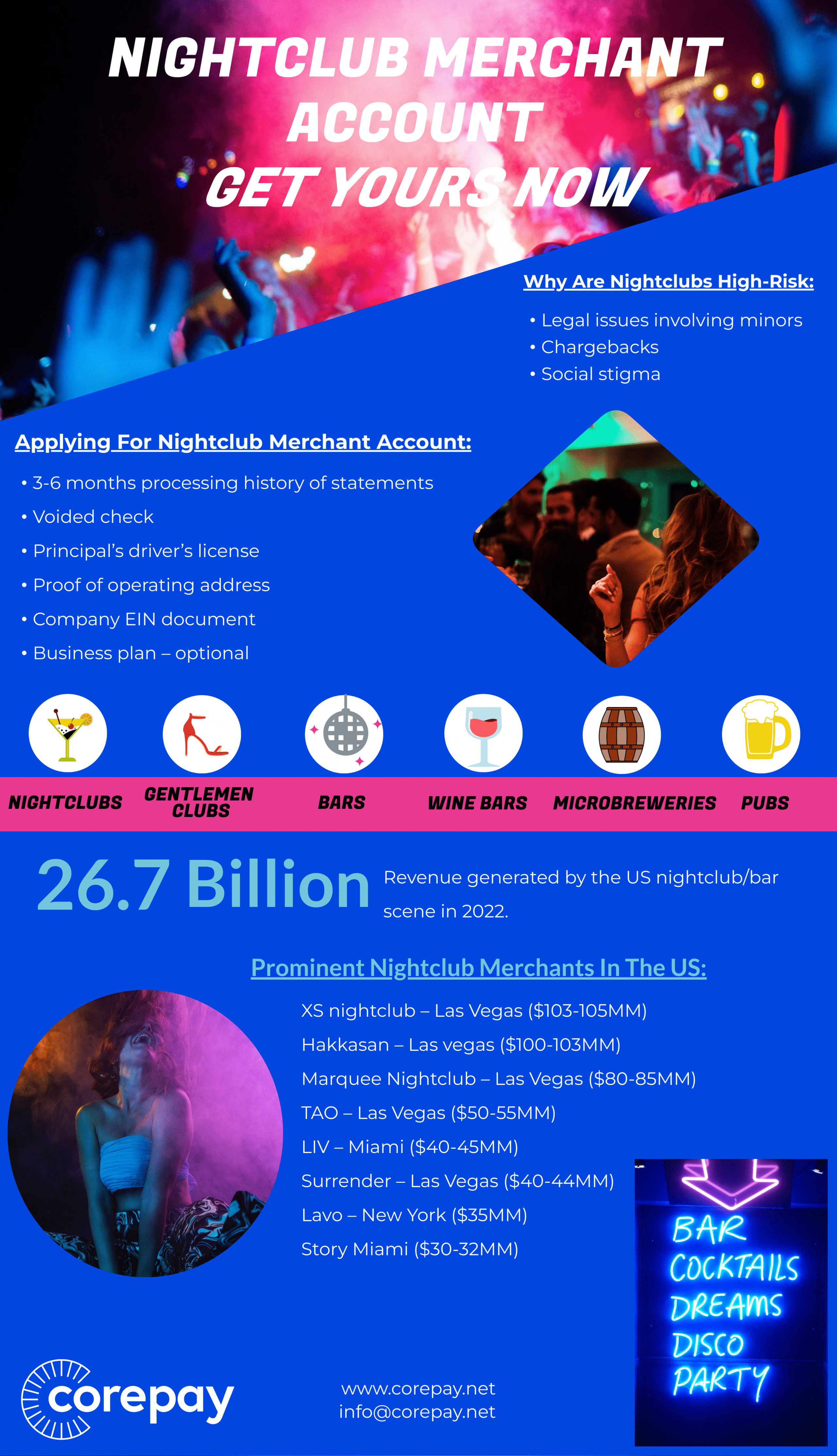

The following businesses are commonly classified as high-risk in this space:

- Nightclubs

- Gentlemen clubs

- Bars

- Wine bars

- Microbreweries

- Pubs

Nightclubs and bars have always fallen under the high-risk vertical for financial underwriting. Clubs and bars fall under the high-risk territory for reasons that differ from other high-risk verticals such as adult or CBD.

If you’ve already applied for payment processing with a low-risk solution such as Square or Stripe, you may want to rethink your decision, as you could be at risk of having your account terminated.

Getting Approval for Nightclub Merchant Accounts

Getting approval for nightclub payment processing takes a lot of work. Since you will be processing most payments as card-present, you will need equipment at your location.

You will also want a way to accept payments online for those looking to RSVP.

At Corepay, we can meet your every need and guide you should you need to become more familiar with this space.

Applying For Nightclub Merchant Account

Applying for a nightclub payment processing has never been easier than with Corepay. We understand the headaches of waiting to get approved, so we ensure a fast, streamlined process.

Please note: The more information you can give us about your products and business history, the faster we can get you approved. The information you provide may also give us even better rates.

You will need the following when applying:

- 3-6 months processing history of statements

- Voided check

- Principal’s driver’s license

- Proof of operating address

- Company EIN document

- Business plan – optional

Why Choose Corepay For Your Night Club Merchant Account

Nightclubs and bars are challenging when it comes to credit card processing. You need multiple ways to process and need to maximize approvals.

At Corepay, not only can we assist with POS, but we can also make sure that you can accept payments online.

When you choose Corepay, you also can use our partner product, which specializes in reducing your chargeback ratio, which is much needed for online gaming.

We also offer the following:

- Efficient bar/nightclub pre-approvals within 24-72 hours

- No application, set-up fees, or annual fees

- Risk mitigation with Order Insight and CB-ALERT

- Traditional chargeback alerts

- Fairly priced POS

- Low-risk rates, as low as $99 per month and $.05 per transaction

- Maximize approval ratios based on your target customer base

- High-risk rates as low as blended 2.95%

- 24/7 customer service

While we have our home base in Florida and pride ourselves on our Florida credit card processing, we can assist you in all of the United States and most places around the globe.

Payment Tracking

With our payment processing, every payment is tracked from the point of sale all the way through the checkout process.

Why Are Nightclubs High-Risk

Nightclubs are classified as high-risk for a few reasons. Below is a list:

- Legal issues involving minors

- Chargebacks

- Social stigma

Legality

Nightclubs are often the target of drugs/illegal underage drinking. Because of this, banks worry about risking their reputation.

Keeping your nightclub trustworthy and out of the news goes a long way when trying to find reliable credit card processing and maintaining it.

Chargebacks

Chargebacks are a pain for every industry, especially nightclubs. Since nightclubs often have additional and expensive charges, customers become enraged when they see their bill the following morning.

Having a full disclosure of your fees at the entrance of your nightclub and on your menus and checkout can help mitigate some chargebacks.

The same goes for adult payment processing/gentlemen’s clubs.

Social Stigma

The main reason for the social stigma is that nightclubs serve alcohol. Financial institutions are still hesitant to give payment processing to lounges because of the social stigma. This is similar to CBD, adult entertainment, etc.

Alcohol Merchant Solutions

While nightclubs generally serve alcohol, the payment processing varies because alcohol merchants are now incorporating more e-commerce instead of traditional brick-and-mortar. We love eCommerce merchants and can tailor your merchant account to your needs.

Nightclub Statistics

The US nightclub/bar scene market will come in at 26.7 billion in 2022 and is supposed to increase. Let’s look at the most prominent nightclub merchants in the US.

- XS nightclub – Las Vegas ($103-105MM)

- Hakkasan – Las vegas ($100-103MM)

- Marquee Nightclub – Las Vegas ($80-85MM)

- TAO – Las Vegas ($50-55MM)

- LIV – Miami ($40-45MM)

- Surrender – Las Vegas ($40-44MM)

- Lavo – New York ($35MM)

- Story Miami ($30-32MM)

*These stats are from edmmaniac.

As you can see, the nightclub induLet’scan be highly profitable when paired with a reliable high-risk credit card processor.

Make Corepay Your Nightclub Payment Processing Partner

Look no further if you need help getting placed as a bar merchant. We are confident that we can help save money on processing fees and help you keep chargeback to a minimum.

Fill out the application below if you’re looking to take your business to the next level.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].