Forex Merchant Accounts – Tailored Payment Processing

Last Updated on July 7, 2023 by Corepay

With over $5 trillion traded daily, the foreign exchange market is one of the largest/most liquid financial markets currently in the world. Forex payment processing companies have faced scrutiny, which has made forex merchant account services a high-risk industry.

In turn, this makes it difficult to find payment processing for Forex trading platforms. This article will break down everything you need to know about forex merchant accounts and explain why we believe Corepay is an excellent choice for your forex business.

Since there isn’t a centralized foreign exchange market, all currency trading is done electronically 24/7, 5 days a week.

Corepay is proud to offer binary option and forex merchant accounts for the following FULLY LICENSED merchants:

- Trading Platforms: Corepay offers proficient payment processing for trading platforms through our extensive network of international acquiring banks. The one exception is in the U.S., the Commodity Futures Trading Commission (CFTC) has banned the use of credit cards to fund retail Forex trading accounts. This means U.S. customers can still use debit cards to fund their Forex trading accounts; U.S. Forex merchant accounts are not currently available. Trading platforms will need a merchant account that specializes in both high-risk and high-volume services.

- Informational & Educational: If you provide customers with Forex software, newsletters, courses, or seminars, you qualify for merchant accounts services for the U.S. and international acquiring banks. This is important to note with explosions of online courses via social media/blogs. If you run an online business that deals with transactions in this niche, look no further than Corepay.

Corepay Forex Payment Processing Solutions

- Highly Competitive Rates: Corepay offers high-quality high-risk credit card processing that is also affordable. We are confident in our rates as well as our experience and service.

- High Volume Processing: We offer the processing capacity that your business needs to manage and grow.

- Multicurrency Processing: Forex merchant accounts give you the ability to accept payments in all major currencies.

- Fraud Management Tools: We are confident that we can reduce your chargeback ratio through our partner product, CB-ALERT, ultimately resulting in lower fees for your business.

- Waived fees: In an effort to maintain 100% transparency with our Forex clients, we waive application, annual, and set up fees.

- Extensive Banking Network: We believe in diversifying credit card processing amongst different acquiring banks to mitigate risk and reducing dependency on one bank/processor.

- High Tickets: Should you be selling expensive courses/software, have no fear. We are able to accommodate VIP traders who are trading large sums with ease. We also have our proprietary gateway, Solidgate, explicitly built for high volumes and tickets.

- Many Payment Methods: You will be able to accept all major credit/debit card brands and add any alternative payment methods globally.

- Multi-Channel Payments: You will also receive via MOTO transactions/mobile payments outside of accepting payments online.

- Bespoke Customer Service: We understand the importance of customer service, especially when dealing with high volumes and tickets. At Corepay we offer 24/7 customer service that will be there to field any questions or concerns you may have.

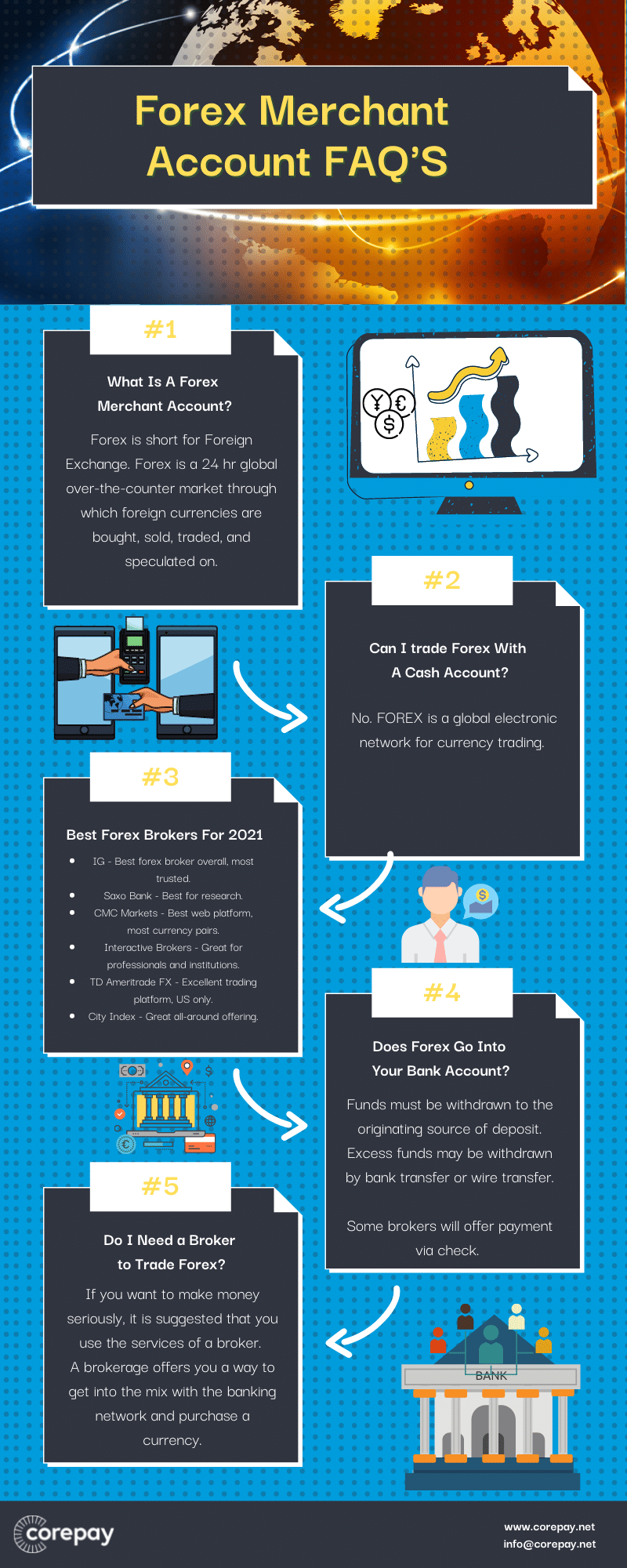

What Is A Forex Merchant Account, And Why Are They High-Risk?

Forex stands for foreign exchange, and it is the trading of one currency for another. An example is swapping a U.S. dollar for a Euro.

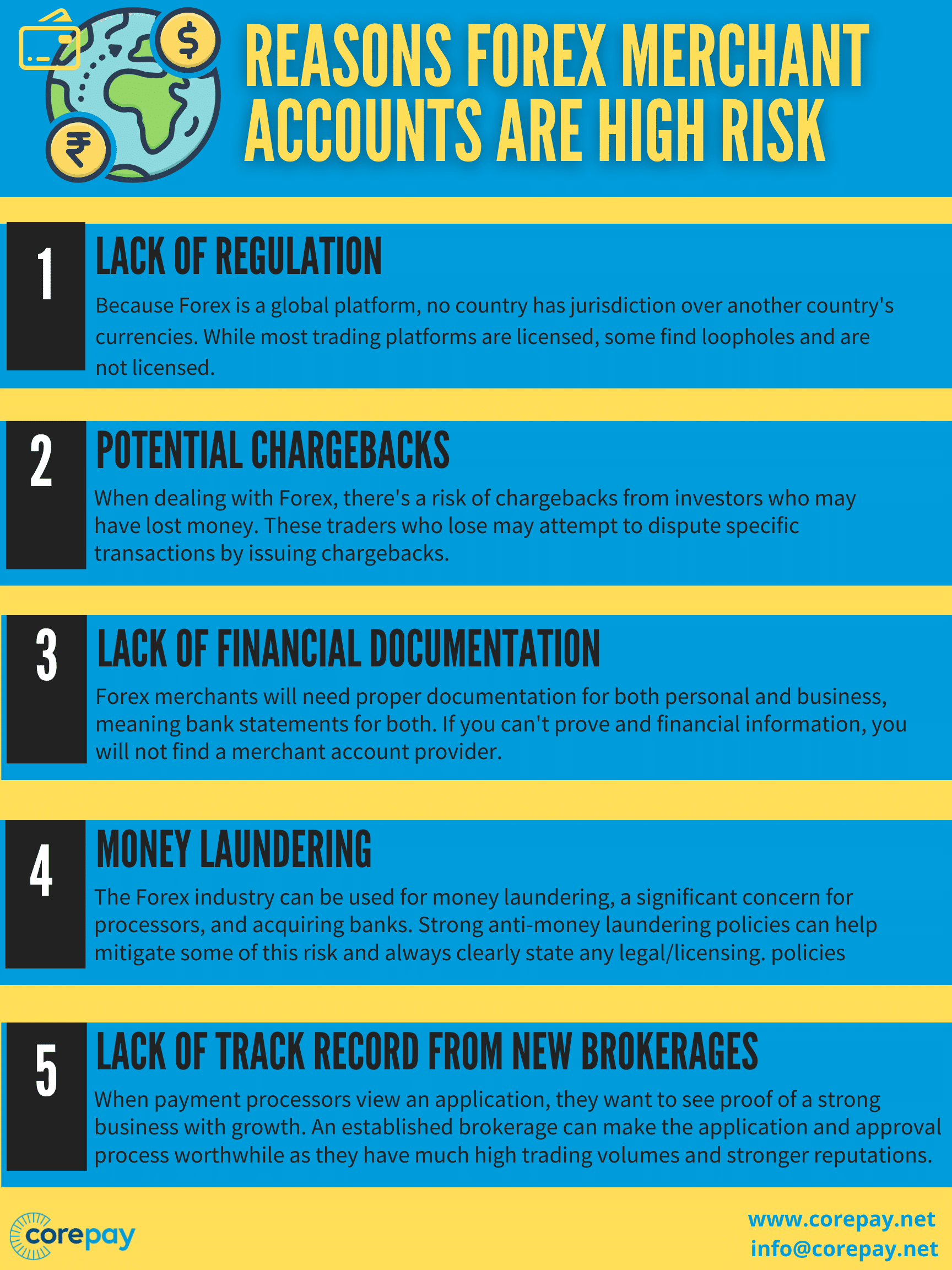

There are a few different reasons why Forex merchant accounts are deemed high-risk. One of the most common reasons is a lack of track record from new brokerages. When payment processors view an application, they want to see proof of a strong business with growth. An established brokerage is typically able to make the application and approval process worthwhile as they have much high trading volumes and stronger reputations.

Below are the main reasons that Forex payment processing is classified as high-risk:

- Lack of regulation: Because Forex is a global platform, no country has jurisdiction over another country’s currencies. While most trading platforms are licensed, some find loopholes and are not licensed. Banks/processors view the lack of regulation as a significant issue, yet they may risk it, as the industry can be highly profitable. Credit cards are used to fund accounts, and this is done quickly as time is money. Corepay only supports fully licensed and regulated Forex merchants based on where they are operating.

- Potential chargebacks: Chargebacks haunt most high-risk industries as they end costing not only the merchant but the banks/processors in the long run. When dealing with Forex, there’s a risk of chargebacks from investors who may have lost money. These traders who lose may attempt to dispute specific transactions by issuing chargebacks.

- Lack of financial documentation: The more information you can provide, the better your merchant account is applied. Forex merchants will need proper documentation for both personal and business, meaning bank statements for both. If you can’t prove and financial information, you will not find a merchant account provider.

- Money Laundering: The Forex industry can be used for money laundering, a significant concern for processors and acquiring banks. Strong anti-money laundering policies can help mitigate some of this risk, as well as always clearly stating any legal/licensing policies on your website/app.

Why Choose Corepay For Forex Payment Processing

At Corepay, we offer bespoke payment processing specializing in high-risk industries. We understand the forex market well and know how to get our clients approved, stay approved, and grow into the business they aspire.

Being able to accept as many forms of payments is essential for Forex traders. Below you will see why Corepay is perfect for your Forex platform.

- Level 1 PCI-DSS security to ensure PCI compliance

- Acquiring banks network

- Specialized in high-volume

- VIP payment processing

- Anti-chargeback solutions

- 24/7 customer service

- Free technical support

- Superb customer service

- Increase sales with localized alternative payment methods

What Not To Do When Choosing A Forex Merchant Account

When looking for payment processing for Forex, be sure that you choose a high-risk processor as choosing a low-risk solution such as Paypal could result in account termination.

Not educating yourself or having a team member educated in payment processing occurs all too often. Unfortunately, this can result in your business paying higher fees, especially if you’re unfamiliar with reading a credit card processing statement.

Choosing an option that offers instant account approvals can also result in a negative choice as instant approvals are usually not a good thing in payment processing outside of convenience.

Last but not least, be sure to check the payment processor’s website for signs of quality customer service. You should see something along the lines of 24/7 customer service. If you’re not able to find a contact email and phone number, that could be signs of a company you may not want to partner with.

To sum this up:

- Don’t choose a low-risk payment processor

- Compare rates/fees

- Compare services and what is provided

- Compare industry experience

- Always have a phone conversation to speak with the payment processor directly

Can Forex Merchants Use Paypal, Square, Or Stripe?

The simple answer to this frequently asked question is no. While Forex merchants/traders might get a quick account up with Paypal, it will not be long-lasted as Paypal only does processing for low-risk merchants.

The troubling part about this is that once Paypal decides to terminate your account, you risk having your funds in that account frozen for up to 180 days.

Paypal does their underwriting for merchants after the initial application, allowing merchants to start processing payments until up to six months later when your account is audited. At this time, you could find yourself with your funds frozen and your account terminated.

Getting set up with a high-risk processor during this process is crucial to keep the cash flow. Should you choose to wait it out, you could find yourself unable to access your funds as well as unable to process transactions.

Applying For A Forex Merchant Account

When applying for a Forex merchant account, you may find yourself with many questions regarding payment processing.

You must always compare rates, services, and experiences between payment processors. When applying for your account, the best thing you can do is provide the payment processing company with as much information as possible about your business. This gives payment processors the big picture of what your business is about and can result in faster approvals/lower fees at times.

When applying for your forex merchant account, you will need to present the following:

- Financial statements – both personal and business

- Articles of incorporation

- Principal’s driver’s license

- Company EIN document

- Business plan – Optional, but it helps show us the complete picture of your business

- Voided check

If you can show your payment processor the following, it may help reduce your fees:

- Chargeback information: Do you have a chargeback plan, and are you implementing effective customer service?

- Provide as much information about the nature of your Forex business. Where do most sales take place? Do you have a payment gateway?

- All return policies/refund policies

- Prove that your website is PCI compliant

When we perform our underwriting at Corepay, we will determine your level of risk based on the big picture of your business, the industry you operate in, as well as your chargebacks.

Forex Credit Card Processing Licensing

One of the most challenging tasks for most forex brokerages starting is dealing with licensing and regulation. Unfortunately, many jurisdictions make it cost-prohibitive to become properly licensed.

This is done intentionally with high fees and extensive vetting processes. The reason for this is to prevent money laundering and other types of fraud that could be using a forex exchange as a front.

Finding credit card processing becomes significantly easier when your business is properly licensed. Unfortunately, many banks or processors will refuse to work with your business unless you follow proper regulations and licensing protocols.

Forex Industry Overview

Below are the most wealthy brokerages in the world today:

- Pepperstone

- FP Markets

- Markets.com

- CMC Markets

- TD Ameritrade – Best for US Traders

- Forex.com

- IG

- Interactive Brokers

- FXTM

- ThinkMarkets

Security

At Corepay, we provide all of our Forex clients with an extensive list of protection tools. We can help you identify fraudulent transactions to help you reduce your chargebacks.

- PCI-Level 1 Payment Gateway: Our payment gateway, Solidgate, is PCI-compliant and built explicitly for the high-risk industry as we understand the risks of Forex.

- Blacklisting: You can easily blacklist fraudulent customers.

- Verification: Match credit card data with buyer’s addresses.

- Customize anti-fraud weapons: You are easily able to customize settings for any anti-fraud tools we help you implement, ultimately resulting in lower chargebacks.

- 3D Secure: 3DS is implemented to allow you to streamline any checkout process.

MCC For Forex

The MCC is 6211 for Forex, investments and, securities.

Wrapping Up

At Corepay, we know high-risk, and we have a deep understanding of the forex industry and what it takes to grow your business to the next level.

By implementing industry-leading credit card processing and anti-charge back solutions, we are confident that we will be an excellent fit for your business.

Whether you are already accepting credit/debit cards; are simply looking for another merchant account; or you are looking for a new provider altogether, we can help you.

Fill out an application below, and we will get back to you with what’s needed next.

We appreciate you following Corepay’s blog. Let’s collaborate, send us your article suggestions, questions, and/or feedback to: [email protected].